| | Weekly business and foreign investment news roundup in Asia by Asia Briefing and Dezan Shira & Associates. |

| | |  |

|

|

|---|

|

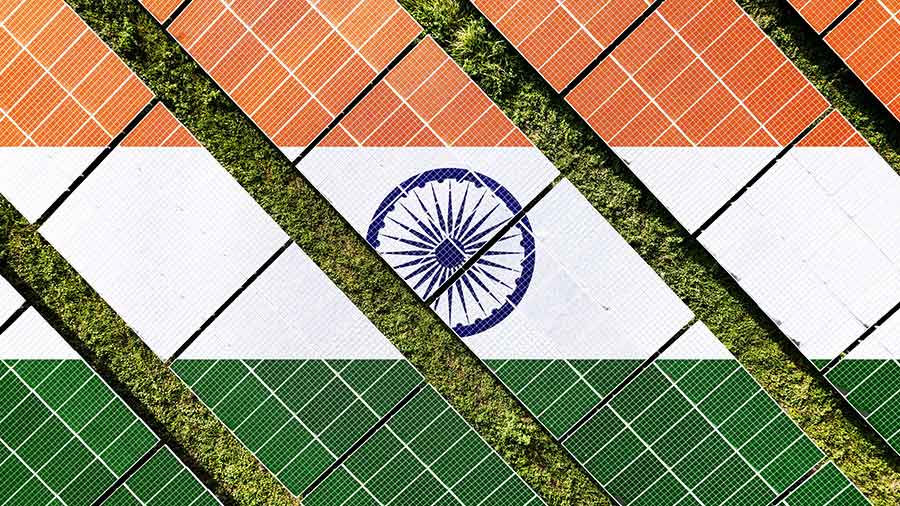

| | | | We explore India's 2025 economic outlook, which indicates moderate GDP growth, inflation challenges, and emerging opportunities in green energy, technology, and healthcare, along with the vital role of foreign investment in sustaining progress. | | | | | India's market securities regulatory body, the Securities and Exchange Board of India (SEBI), has announced a significant update to its Listing Obligations and Disclosure Requirements (LODR) regulations with the introduction of an integrated filing framework. This update will take effect from the quarter ending December 31, 2024. | | | | | We recap India’s top economic highlights of 2024, covering its GDP growth, FDI trends, and infrastructure projects. The country's projected GDP growth for FY2024-25 stands at 6.6% | | | | | Tax residency and the Place of Effective Management (PoEM) are crucial for determining tax obligations and avoiding issues like double taxation or tax evasion. We provide guidance on these concepts to help companies comply with Indian tax laws and avoid unintended tax liabilities. | | | | | India’s Union Ministry of Labor and Employment has set a target for all 36 states and Union Territories (UTs) to finalize and pre-publish the harmonized draft rules for the four labor codes by March 31, 2025. These labor codes are expected to come into effect this year. |

|

|

|---|

|

We hope you're enjoying this India Edition. To receive any of our other complimentary regional editions, including ASEAN, Vietnam, China, Middle East, or our Asia weekly round-up you can add or change subscriptions. Or newly subscribe a friend. |

|

|

|

|---|

|

COMPLIMENTARY BUSINESS RESOURCES: |  | | | | | Doing Business in China 2025 introduces the fundamentals of investing in China. Compiled by Dezan Shira & Associates in December 2024, this guide helps foreign investors navigate changes in China’s business landscape, mitigate risks, and seize new market opportunities. | | | | | This publication is designed to introduce the fundamentals of investing in all ten ASEAN countries and includes a guide to corporate establishment, tax advisory, and bookkeeping, in addition to HR and payroll, double tax agreements, and audit and compliance. | | | | | Guide to Corporate Taxation and Compliance in China 2025 provides an overview of key taxes and obligations for foreign businesses in China. Ideal for CFOs, compliance officers, and accounting leads, it helps navigate complex tax regulations to effectively manage and plan China-based operations. |

|

|

|---|

|

Do you have any feedback? Our teams would love to hear from you! |

|

|

|

|---|

|

UPCOMING EVENTS FOR ASIA: | | | Webinar | Wednesday, January 15, 2025 | 2:30 PM India / 4:00 PM Vietnam / 5:00 PM China | | | | | Webinar | Thursday, January 9, 2025 | 4:00 PM China / 9:00 AM CET / 8:00 AM UK | | | | | Webinar | Tuesday, January 14, 2025, 4:00 PM Vietnam, 5:00 PM China, 10:00 AM CET |

|

|

|---|

|

|

| | ©1992-2024 All Rights Reserved. |

| For daily alerts, follow us on social |

| | | | | This email was sent to minh.pham@dezshira.com |

| You've received it because you've subscribed to our newsletter. |

| | |

|

|

|---|

|

|

|