Overview of India’s Labor Code

Foreign companies looking to establish in India should understand the country’s multiple federal labor laws and regulations as well as locally enacted laws that are specific to the state, industry, and the size of the firm. Since labor is a concurrent subject in India, both the Centre as well as the states can make laws regulating labor.

| Category | Applicable Labour Codes |

|---|---|

| Conditions of Service / Occupational Safety | Occupational Safety, Health and Working Conditions Code, 2020 |

| Remuneration / Wages | Code on Wages, 2019 |

| Industrial Relations | Industrial Relations Code, 2020 |

| State-wise Establishments | Relevant State Rules under applicable Labour Codes |

| Social Security Benefits | Code on Social Security, 2020 |

Recent amendments in Labor Laws and Employment Regulations

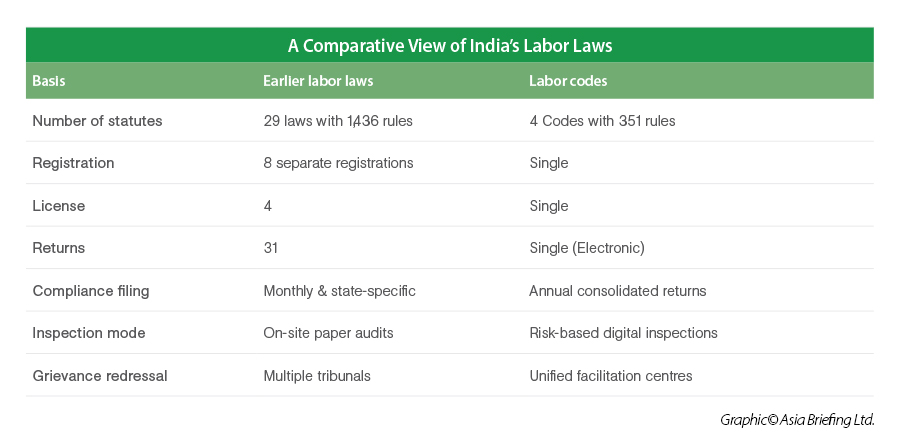

The Government of India has made all four Labor Codes – the Code on Wages (2019), Industrial Relations Code (2020), Code on Social Security (2020), and Occupational Safety, Health and Working Conditions (OSHWC) Code (2020)—effective from November 21, 2025.

The introduction of these codes is intended to reduce the compliance burden on businesses by merging multiple registrations, licenses, and returns into single, streamlined processes.

The new codes emphasize worker safety, fair wages, and social security. For instance, the Occupational Safety, Health, and Working Conditions Code mandates comprehensive health and safety standards and requires employers to ensure adequate working conditions.

|

New Labor Codes and Corresponding Laws It Subsumed |

|

|

New labor code |

Subsumed laws |

|

Code on Wages, 2019 |

|

|

Code on Social Security, 2020 |

|

|

Occupational Safety, Health, and Working Conditions Code Bill, 2020 |

|

|

Industrial Relations Code Bill, 2020 |

|

Businesses will find that the new codes make it easier for them to be flexible in their hiring and firing decisions as well as in shutting down operations in the country.

State-specific Labor Laws and Employment Regulations

The variation in labor laws across Indian states highlights the need for businesses to be acutely aware of the specific regulations in the states where they operate.

|

Aspect |

Maharashtra |

Karnataka |

Tamil Nadu |

|

Primary legislation |

Maharashtra Shops and Establishments Act |

Karnataka Shops and Commercial Establishments Act |

Tamil Nadu Shops and Establishments Act |

|

Industrial relations |

Maharashtra Industrial Relations Act (MIRA) |

Adaptations of the Industrial Disputes Act |

State-specific provisions in the Industrial Disputes Act |

|

Working hours |

Regulated under the Maharashtra Shops and Establishments Act |

Regulated under the Karnataka Shops and Commercial Establishments Act, with flexibility for IT sector |

Regulated under the Tamil Nadu Shops and Establishments Act |

|

Rest intervals |

Specified under the Maharashtra Shops and Establishments Act |

Specified under the Karnataka Shops and Commercial Establishments Act |

Specified under the Tamil Nadu Shops and Establishments Act |

|

Overtime |

Detailed in the Maharashtra Shops and Establishments Act |

Detailed in the Karnataka Shops and Commercial Establishments Act |

Detailed in the Tamil Nadu Shops and Establishments Act |

|

Weekly holidays |

Mandated under the Maharashtra Shops and Establishments Act |

Mandated under the Karnataka Shops and Commercial Establishments Act |

Mandated under the Tamil Nadu Shops and Establishments Act |

|

Paid leave |

Provisions in the Maharashtra Shops and Establishments Act |

Provisions in the Karnataka Shops and Commercial Establishments Act |

Provisions in the Tamil Nadu Shops and Establishments Act |

|

Labor welfare funds |

Mandatory welfare boards for specific sectors |

Labor Welfare Fund Act providing financial assistance for health, education, and housing |

Several welfare boards for unorganized sectors |

|

Sector-specific provisions |

Welfare measures for construction and domestic work sectors |

Special provisions for the IT sector with flexible working hours |

Welfare boards for sectors like handloom, beedi, and domestic work |

|

Dispute resolution |

Framework under MIRA for resolving industrial disputes |

Adaptations of the Industrial Disputes Act with state-specific mechanisms |

State-specific provisions in the Industrial Disputes Act to facilitate resolution |

|

Social security benefits |

Enforced through welfare boards for various sectors |

Enforced through the Labor Welfare Fund Act |

Enforced through welfare boards for unorganized sectors |

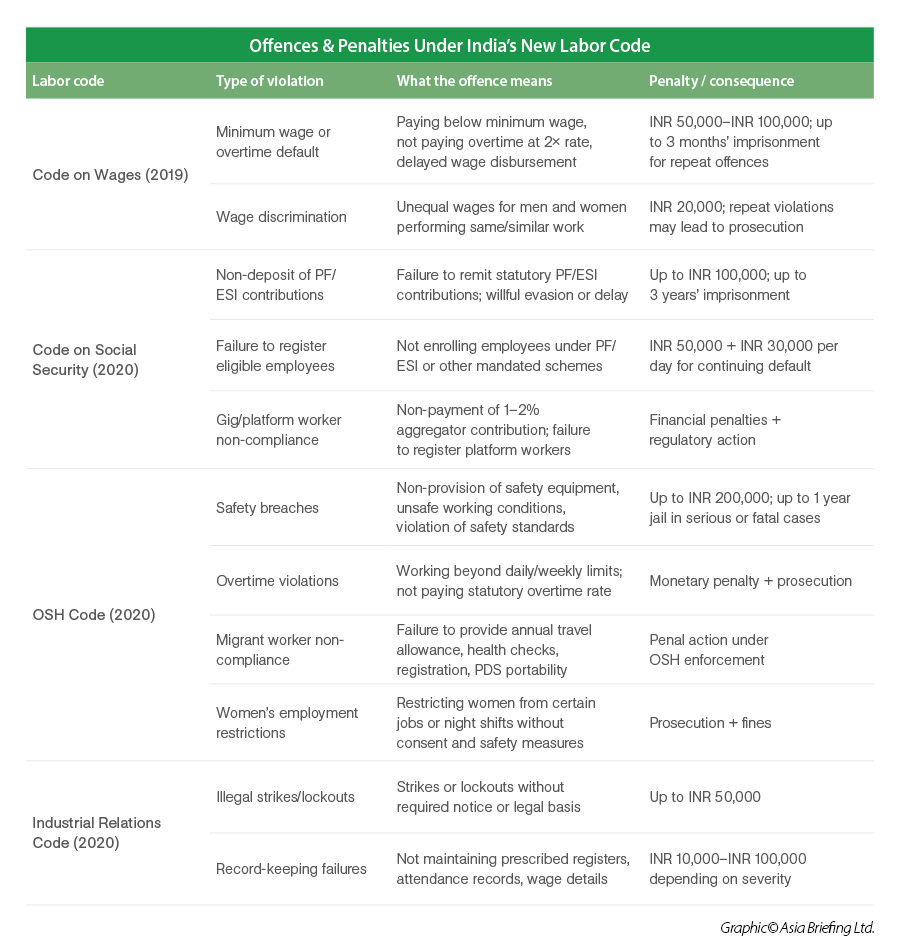

Compliance and penalties in Labor Laws and Regulations

Adherence to labor laws and regulations ensures fair treatment of employees and shields organizations from legal entanglements and financial penalties. Non-compliance can result in a cascade of negative outcomes:

- Businesses may face hefty fines, the extent of which varies depending on the nature and severity of the violation.

- Non-compliance can lead to protracted legal battles, potentially resulting in court-mandated compensation or corrective actions.

- In extreme cases, authorities may order temporary or permanent closure of non-compliant establishments.

- News of labor law violations can tarnish a company's image, affecting customer trust and business relationships.

- Some clients or partners may terminate agreements with businesses found to be in violation of labor laws.

Employment contracts and regulations

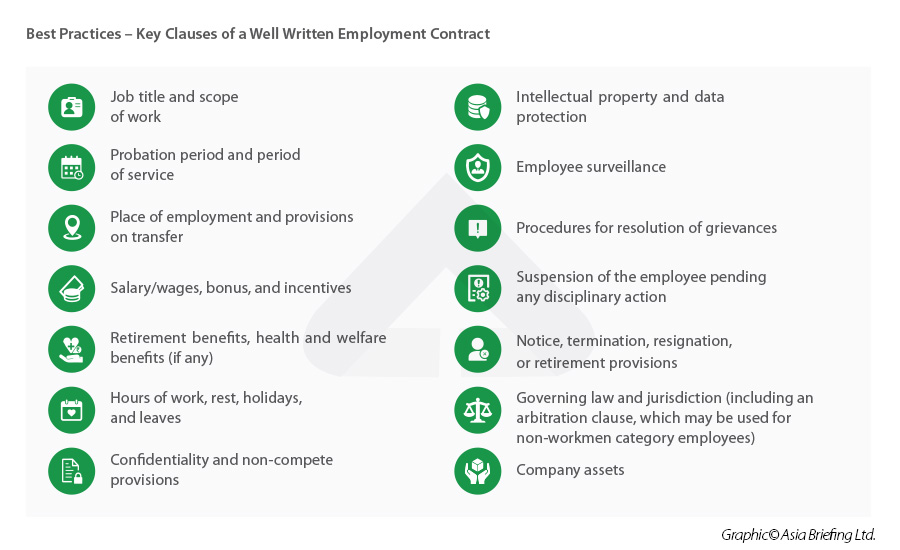

There is no provision in existing labor laws that requires an employer to provide a written statement of particulars to a newly hired employee. However, as a matter of best practice, written employment contracts are executed between the employer and the employee, or a detailed written appointment letter is issued to the employee, the terms of which are required to be duly accepted and acknowledged by the employee.

There are three types of employment contracts in India:

- Permanent (direct) contracts, typically offer a full range of benefits, which include a detailed job description, salary and benefits package, working hours and leave entitlements, and termination clauses (which can be quite stringent);

- Fixed contracts specify a predetermined duration of employment. They're commonly used for project-based work or to fill temporary vacancies. Key features include clear start and end dates, project-specific responsibilities, renewal conditions (if any), and limited benefits compared to permanent contracts; and,

- Temporary/probationary contracts typically last 3-6 months and allow both parties to assess the fit. The contract includes performance expectations, evaluation criteria, conditions for conversion to permanent employment, and a notice period for termination during probation (usually shorter than for permanent employees).

The employment contracts used in India contain the following information:

Working hours, overtime payments & leave policy

Working hours

Where an employee works beyond 8 hours in a day or exceeds 48 hours in a week, the additional hours qualify as overtime. Such overtime must be remunerated at a rate not less than twice the employee’s normal wages and paid within the applicable wage cycle.

The below table summarizes the hours worked in a day and week with rest intervals, including meals for four metropolitan cities of India, according to the respective state-specific S&E Acts.

|

State-Wise Working Hours Policy in India |

|||

|

State/region |

Normal working hours |

Maximum overtime hours |

Rate of overtime wages |

|

Andaman and Nicobar Islands |

Nine hours a day; 48 hours a week |

One hour a day; 50 hours a quarter |

Twice the rate of normal wages |

|

Andhra Pradesh |

Eight hours a day; 48 hours a week |

Six hours a week |

Twice the ordinary rate of normal wages |

|

Arunachal Pradesh |

– |

– |

– |

|

Assam |

Eight hours a day; 48 hours a week |

Two hours a day; 50 hours a quarter |

Twice the ordinary rate of wages |

|

Bihar |

Nine hours a day; 48 hours a week |

One hour a day and 54 hours a week; the aggregate hours of overtime work shall not exceed 150 hours in a year |

Twice the ordinary rate wages |

|

Chandigarh |

Nine hours a day; 48 hours a week |

50 hours a quarter |

Twice the rate of normal wages calculated by the hour |

|

Chhattisgarh |

48 hours a week and nine hours a day in a shop; 48 hours a week and 10 hours a day in a commercial establishment |

Six hours in any week |

Twice the ordinary rate of wages |

|

Dadra and Nagar Haveli |

Eight hours a day; 48 hours a week |

Six hours a week |

Twice the ordinary rate of wages |

|

Daman and Diu |

Eight hours a day; 48 hours a week |

Six hours a week |

Twice the ordinary rate of wages |

|

Delhi |

Nine hours a day; 48 hours a week |

Six hours in any week; 150 hours in a year |

Twice the rate of his normal remuneration, calculated by the hour |

|

Goa |

Eight hours a day; 48 hours a week |

Six hours a week |

Twice the ordinary rate of wages |

|

Gujarat |

Nine hours a day; 48 hours a week |

125 hours in a period of three months |

Twice the ordinary rate of wages |

|

Haryana |

Nine hours a day; 48 hours a week |

50 hours a quarter |

Twice the rate of normal wages calculated by the hour |

|

Himachal Pradesh |

Nine hours a day; 48 hours a week |

50 hours a quarter |

Twice the rate of normal wages calculated by the hour |

|

Jammu and Kashmir |

Nine hours a day; 48 hours a week |

Three hours a week |

Twice the ordinary rate of wages |

|

Jharkhand |

Nine hours a day; 48 hours a week |

Six hours in any week and 150 hours in a year |

Twice the ordinary rate of wages |

|

Karnataka |

Nine hours a day; 48 hours a week |

50 hours a quarter |

Twice the rate of normal wages |

|

Kerala |

Eight hours a day; 48 hours a week |

50 hours a quarter |

Twice the ordinary rate of wages |

|

Madhya Pradesh |

48 hours a week and nine hours a day in a shop; 48 hours a week and 10 hours a day in a commercial establishment |

Six hours in any week |

Twice the ordinary rate of wages |

|

Maharashtra |

Nine hours a day; 48 hours a week |

125 hours in a period of three months |

Twice the ordinary rate of wages |

|

Manipur |

Commercial establishments—seven hours a day; Shops—nine hours a day, and 48 hours a week |

Not applicable |

Twice the ordinary rate of wages |

|

Meghalaya |

Eight hours a day |

Two hours a day |

Twice the ordinary rate of wages |

|

Nagaland |

Eight hours a day; 48 hours a week |

Two hours a day; 50 hours a quarter |

Twice the ordinary rate of wages |

|

Odisha |

Nine hours a day; 48 hours a week |

One hour a day; 50 hours a quarter |

Twice the ordinary rate of wages |

|

Puducherry |

Eight hours a day; 48 hours a week |

Two hours a day; 54 hours a week |

Twice the ordinary rate of wages |

|

Punjab |

Nine hours a day; 48 hours a week |

50 hours a quarter |

Twice the rate of normal wages calculated by the hour |

|

Rajasthan |

Nine hours a day; 48 hours a week |

One hour a day; 50 hours a quarter |

One and a half times the ordinary rate of wages |

|

Sikkim |

Nine hours a day; 48 hours a week |

Three hours a week |

Twice the ordinary rate of wages |

|

Tamil Nadu |

8 hours a day; 48 hours a week |

Six hours in any week |

Twice the ordinary rate of wages |

|

Telangana |

10 hours a day; 48 hours a week |

48 hours per week; 144 hours per quarter |

Twice the ordinary rate of normal wages |

|

Tripura |

Eight hours a day; 48 hours a week |

One and a half hours a day; 120 hours a year |

Twice the ordinary rate of wages |

|

Uttar Pradesh |

Eight hours a day |

Two hours a day; 50 hours a quarter |

Twice the ordinary rate of wages |

|

Uttarakhand |

Nine hours a day |

125 hours in a period of three months |

Twice the ordinary rate of wages |

|

West Bengal |

Eight hours a day; 48 hours a week |

One and a half hours a day; 120 hours a year |

Twice the ordinary rate of wages |

Source: Working Hours in India, Simpliance.

An adult (over 18 years of age) cannot work for more than 48 hours in a week and not more than 8 hours in a day. Further, the spreadover should not exceed 10½ hours. Otherwise, the overtime rules are applicable.

Overtime

Before calculating overtime, the employer must determine the worker’s daily wage.

- For workers paid on a monthly basis, the daily wage is calculated by dividing the monthly wage by 26, as the OSH Code considers a month to consist of 26 working days.

- For workers paid on a daily basis, piece-rate basis, or any other earnings-linked arrangement, the worker’s actual daily wage or daily earnings are taken into account.

This daily wage serves as the basis for calculating overtime at twice the normal rate, and the actual implementation of overtime rules will continue to vary from state to state.

After determining the daily wage, overtime is calculated using the following formula:

Overtime pay = (daily wage ÷ 8 hours) × overtime hours × 2

Here, the factor of 2 denotes the statutory requirement to pay overtime at double the ordinary wage rate under the OSH Code.

The OSH Code standardizes the method for converting excess working time into payable overtime.

Any additional work lasting between 15 and 30 minutes is treated as 30 minutes of overtime, while excess time exceeding 30 minutes is counted as one full hour. This approach ensures uniformity and transparency in overtime calculations across all establishments.

For example, if an employee works an additional 38 minutes, the excess time is rounded up and paid as one hour of overtime.

Leave policy management

Formally employed workers are entitled to privileged leave, sick and casual leaves and other types of leaves as established by the company, such as marriage leave, private affairs leave, paternity leave, bereavement leave, exam leave, etc.

The number of leave days and holidays given by the organization to its employees working in its offices in different states should follow the prescribed numbers under all applicable state laws pertaining to the same.

Minimum wages

Both the central and state governments have control over fixing the minimum wages of employment. Wage rates of employment differ across occupations, skills, sectors, and regions. Given the extent of difference between various kinds of employable work, there is no set wage rate that can be set for each specific work across the country. Businesses are advised to track the periodically updated minimum wage amount across various categories of employment in their respective state/city/zone of operation, such as:

- Unskilled;

- Semi-skilled;

- Skilled; and

- Highly skilled workers.

Each state government has the power to fix the minimum wage rates for the following:

- Time work;

- Piecework; and

- Overtime work.

Minimum wages for an employee are based on the following parameters:

- Nature of employment;

- Industry;

- Geographic location;

- Employee’s age;

- Skill level (unskilled, semi-skilled, skilled, highly skilled); and,

- Arduousness and nature of work.

|

Minimum Wages for States Across India (per month) (in INR) |

|||

|

State |

Unskilled |

Skilled |

Highly skilled |

|

Andaman and Nicobar Islands Effective date: July 1, 2025 |

16,822 |

22,126 |

24,284 |

|

Andhra Pradesh Effective date: April 1, 2024 |

13,248.50 (Zone I) |

15,248.50 (Zone I) |

15,748 (Zone I) |

|

Arunachal Pradesh Effective date: April 1, 2023 |

6,600 |

7,200 |

NA |

|

Assam Effective date: June 1, 2023 |

9,800.50 |

14,239.35 |

18,307.05 |

|

Bihar Effective date: October 1, 2025 |

11,128 |

14,066 |

17,160 |

|

Chandigarh Effective date: April 1, 2025 |

14,394 |

15,069 (I) |

15,469 |

|

Chhattisgarh Effective date: October 1, 2025 |

10,656 (Zone C) 10,916 (Zone B) 11,176 (Zone A) |

12,086 (Zone C) 12,346 (Zone B) 12,606 (Zone A) |

12,866 (Zone C) 13,126 (Zone B) 13,386 (Zone A) |

|

Dadra and Nagar Haveli Effective date: April 1, 2025 |

12,649 |

13,195 |

NA |

|

Daman and Diu Effective date: April 1, 2025 |

12,649 |

13,195 |

NA |

|

Delhi Effective date: April 1, 2025 |

18,456; |

22,411 |

24,356 |

|

Goa Effective date: April 1, 2025 |

14,274 (Zone A) |

17,290(Zone A) |

NA |

|

Gujarat Effective date: October 1, 2025 |

13,013 (Zone I) |

13,585 (Zone I) |

NA |

|

Haryana Effective date: July 1, 2025 |

11,274.6 |

13,051.71 (Class A) |

14,389.52 |

|

Himachal Pradesh Effective date: April 1, 2025 |

12,750 (I) |

14,790 (I) |

15,390 (I) |

|

Jammu and Kashmir Effective date: October 17, 2022 |

8,086

|

12,558 |

14,352 |

|

Jharkhand Effective date: October 1, 2025 |

13,050 |

18,042 |

20,802 |

|

Karnataka Effective date: April 1, 2025 |

17,666.45 (Zone I) |

18,134.87 (Zone I) |

19,537 (Zone I) |

|

Madhya Pradesh Effective date: October 1, 2025 |

12,150 |

14,869 |

16,494 |

|

Maharashtra Effective date: July 1, 2025 |

13,635 (Zone I) |

15,246 (Zone I) |

NA |

|

Meghalaya Effective date: January 1, 2025 |

13,650; (semi-skilled) 14,690 |

15,730 |

16,770 |

|

Nagaland Effective date: June 14, 2019 |

5,280 |

7,050 |

NA |

|

Punjab Effective date: March 1, 2025 |

11,389.64

|

13,066.64 |

14,098.64 |

|

Rajasthan Effective date: January 1, 2023 |

7,410 |

8,034 |

9,334 |

|

Telangana Effective date: October 1, 2025 |

14,119.25 (Zone I) 13,369.25 (Zone II) 13,119.25 (Zone III) |

16,119.25 (Zone I) 15,119.25 (Zone II) 13,619.25 (Zone III) |

16,619.25 (Zone I) |

|

Tripura Effective date: October 1, 2025 |

8,010.34 |

9,827.65 |

NA |

|

Uttar Pradesh Effective date: October 1, 2025 |

11,021 |

13,580 |

NA |

|

Uttarakhand Effective date: April 1, 2024 |

12,391-12,539 |

13,838-14,023 |

NA |

|

West Bengal Effective date: July 1, 2025 |

10,329 (Zone A) |

12,499 (Zone A) |

13,748 (Zone A) |

|

Source: Simpliance Note: This is not a comprehensive table, and the respective state governments in India announce their minimum wage rates differently, that is, according to skill-level or other criteria. The criteria are either unskilled, semi-skilled, skilled, and/ highly skilled work categories or are occupation-based categories. For accurate and up-to-date information, companies are advised to consult local experts and official government sources in each state to ensure compliance with the latest minimum wage regulations. |

|||

Salary

India’s salary structure consists of basic salary, allowances, social security contributions, and reimbursements, which cumulatively is considered as the cost to the company (CTC). Employers have to deduct tax at source (TDS) from the employees’ salary income and deposit the same with the government treasury on a month-to-month basis.

Allowances and benefits

Allowance can be partially or fully taxable, depending upon the type of allowance. The allowances provided and their respective limits will differ from one company to another, as per their respective policies.

- Dearness allowance (DA);

- House rent allowance (HRA);

- Conveyance allowance;

- Leave travel allowance (LTA);

- Medical allowance; and

- Books and periodicals allowance.

Termination, severance, and payment

The different classifications of termination of employment as recognized under Indian labor law are:

- Voluntary Termination;

- Involuntary Termination;

- Layoffs and Downsizing

- Getting fired

- Illegal dismissal

- Termination under contract; and

- Termination by law.

Severance pay is offered to employees who retire, are laid off, or reach the end of the contractual agreements. Employers are advised to consult relevant legal provisions applicable to their industry, location, and type of establishment. Employees are entitled to gratuity payments after five years of continuous service.

Social security under Labor Laws and Employment Regulations

India’s social security system is composed of a number of schemes and programs spread throughout a variety of laws and regulations. India’s social security schemes cover the following types of social insurance:

- Employee provident fund,

- Health insurance and medical benefits under respective schemes;

- Disability benefit;

- Maternity benefit;

- Adoption and surrogacy benefits;

- WFH arrangement;

- Mandatory crèche facilities; and,

- Gratuity.

Hiring foreign employees

Labor laws in India are applicable to all establishments incorporated or doing business in the country, irrespective of the nationality of staff employed. However, the framework of labor legislation is only applicable to establishments, employers, and employees within India.

Prevention of sexual harassment of women in the workplace

The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 (the Act) prescribes a system for investigating and redressing complaints against sexual harassment of women in the workplace. It also provides safeguards against false or malicious charges. The major provisions of the Act lay down the following responsibilities for employers to ensure a safe working environment for women:

- Display penal consequences of sexual harassment;

- Organize workshops and sensitization programs;

- Formulate an internal policy, charter, resolution, declaration;

- Form an ‘Internal Complaints Committee’ (ICC) where the number of employees is more than 10;

- Provide necessary facilities to the committees;

- Secure attendance of witnesses/respondent;

- Monitor timely submission of committee reports;

- Assist the woman in pursuing a criminal case if she so chooses;

- Maintain confidentiality of the inquiry process. The Act lays down a penalty of INR 5,000 on the person who has breached confidentiality; and,

- With sexual harassment being a crime, employers are obligated to report offenses.

FAQs on India's Labor Law and Employment Regulations

What are the major federal labor laws in India?

The major federal labor laws in India include:

- The Code on Wages, 2019: Regulates wage payment and minimum wages.

- The Industrial Relations Code, 2020: Governs industrial relations and dispute resolution.

- The Occupational Safety, Health, and Working Conditions Code, 2020: Sets standards for workplace safety and health.

- The Code on Social Security, 2020: Provides social security benefits to workers.

How do state-specific labor laws impact businesses?

State-specific labor laws can significantly impact businesses by imposing additional requirements and standards that vary from state to state. Companies operating in multiple states must navigate these differences to ensure compliance. For example, the requirements for working hours, leave policies, and dispute resolution processes can vary, necessitating tailored HR policies for each state.

What are the new labor codes, and how do they differ from existing laws?

The new labor codes consolidate and simplify existing labor laws into four comprehensive codes:

- Code on Wages: Unifies wage-related laws.

- Industrial Relations Code: Streamlines industrial dispute resolution.

- Occupational Safety, Health, and Working Conditions Code: Consolidates health and safety regulations.

- Code on Social Security: Expands social security coverage. These codes aim to reduce regulatory complexity, improve compliance, and extend worker protections.

What should be included in an employment contract in India?

An employment contract in India should include:

- Job description and title

- Salary and benefits

- Working hours and leave policies

- Probation period details

- Termination clauses

- Confidentiality and non-compete clauses

- Dispute resolution mechanisms

How are working hours and overtime regulated in India?

Working hours and overtime in India are regulated by the Occupational Safety, Health and Working Conditions (OSH) Code 2020. The standard working hours are typically 8 hours per day and 48 hours per week. Overtime is generally compensated at twice the regular wage rate, but specific rules can vary by state.

What are the minimum wage rates in different states?

Minimum wage rates in India vary by state and are determined based on factors such as industry, type of employment, and cost of living.

How is social security structured in India?

Social security in India is structured through schemes like the Employees' Provident Fund (EPF), Employees' State Insurance (ESI), and the National Pension System (NPS). These schemes provide benefits such as retirement savings, health insurance, and pension.

What are the penalties for non-compliance with labor laws?

Penalties for non-compliance with labor laws in India can include fines, imprisonment, or both, depending on the severity of the violation. For instance, failing to pay minimum wages or not adhering to safety standards can result in significant penalties.

How can businesses ensure compliance with the Sexual Harassment Act?

Businesses can ensure compliance with the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013, by:

- Forming an Internal Complaints Committee (ICC)

- Conducting regular awareness and training programs

- Implementing a clear policy against sexual harassment

- Ensuring prompt and fair investigation of complaints

How much is the minimum wage in India?

Data tracked by the e-commerce platform Picodi.com indicates that India’s average minimum wage in 2021 stood at approximately US$95, significantly below comparable Southeast Asian economies such as Vietnam (US$160), Thailand (US$220), and Malaysia (US$258).

Media reports commonly note that wages for unskilled work in India range from about INR 2,250 (US$26.95) to as high as INR 70,000 (US$838.50) per month under the Minimum Wages Act. Despite this wide range, the median monthly income in India is estimated at only around INR 29,400 (US$352.17).

Further, figures published by World of Statistics on May 1, 2023 place India’s average monthly wage at INR 46,861 (US$561.33).

Wage levels vary substantially across sectors, with significantly higher compensation observed in skilled professional services such as software development and consulting, compared to industries like manufacturing and construction.

Can employees in India be forced to work overtime?

Employees in India cannot be forced to work overtime without their consent. Overtime work must be voluntary and compensated at the prescribed overtime rate, typically twice the regular wage.

Can employees in India be fired without notice?

Employees in India cannot be fired without notice unless specified in their employment contract. The notice period and conditions for termination must comply with labor laws and the terms agreed upon in the contract.

Are minors allowed to work in India?

The Child Labour (Prohibition and Regulation) Act, 1986, prohibits the employment of children under 14 years in any occupation. Adolescents (14-18 years) can work in non-hazardous occupations but with strict regulations on working hours and conditions.

How can employers in India comply with work-hour regulations?

Employers in India can comply with work-hour regulations by:

- Adhering to state-specific laws on working hours and overtime

- Maintaining accurate attendance records

- Ensuring employees receive adequate rest intervals and weekly holidays