We look specifically at India’s trade and investment prospects with Central Asian states Turkmenistan and Uzbekistan and the South Caucasian state, Azerbaijan.

The geographical location and resourcefulness of the Central Asian region and South Caucasus region have placed them at the crossroads of the economic, strategic, and political ambition of major stakeholders in the new multipolar world.

India, too, finds it important to build up its relationship with these regions in pursuit of its long-term goals, including energy security, trade, and infrastructure connectivity.

These further link up to India’s security and strategic calculus, linked to developments like the US-led NATO withdrawal from Afghanistan, actualization of China’s Belt and Road Initiative (BRI), and increasing Chinese influence in Central Asia with its recently launched “5+1” format.

In this article, we focus on India’s trade and investment prospects with the Central Asian states of Turkmenistan and Uzbekistan and South Caucasian state, Azerbaijan. Apart from being a reservoir of still untapped mineral resources, such as petroleum, natural gas, antimony, aluminum, gold, silver, coal, and uranium, these countries provide opportunities for Indian investment and cooperation in areas such as hydro-power sector, mining and metallurgical industries, construction industry, information technology, and tourism. Moreover, these states are key for sourcing the raw materials needed for India’s manufacturing ambitions.

Existing trade and connectivity challenges

India’s economic engagement with these countries has been limited – due in part to their landlocked location with no direct sea route as well as the lack of a direct overland route for trade owing to testy relations with neighboring Pakistan.

India’s trade with Central Asia remains less than 0.5 percent of India’s total trade, amounting to around US$2 billion, in stark contrast with China’s trade with the region at about US$100 billion. India’s engagement with the South Caucasus region has been dismal too, but that is soon expected to change with recent connectivity and economic agreements between India and the region.

India’s participation in connectivity initiatives with the region

However, recent connectivity initiatives like India’s Connect Central Asia Policy 2012, signing of the Ashgabat Agreement in 2018, India’s investments in the Chabahar port in Iran, pursuance of the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline, and operationalization of the International North South Transport Corridor (INSTC) are steps in the right direction.

Though Uzbekistan and Turkmenistan are not the members of INSTC, in 2012, they agreed to extend support to member countries to complete the missing links along the corridor. India is also mulling air corridor connectivity with the Central Asian region, similar to the India-Afghanistan air freight corridor, and talks to secure this are ongoing.

Along with physical connectivity, it is imperative that India also invests in the digital connectivity of the region to counter China’s own footprint.

India is now a party to multilateral initiatives like the Shanghai Cooperation Organization (SCO) and Conference on Interaction and Confidence-Building Measures in Asia (CICA), which will aid its engagement with the region.

In the second meeting of the India-Central Asia dialogue held in October, 2020, India announced a US$1 billion Line of Credit for priority developmental projects in diverse fields, such as connectivity, energy, info-tech, healthcare, education, agriculture, etc. India has also engaged in ‘vaccine diplomacy’ with its Vaccine Maitri Program, under which Uzbekistan received 0.6 million doses of vaccine from India.

India’s trade with Turkmenistan, Uzbekistan, and Azerbaijan

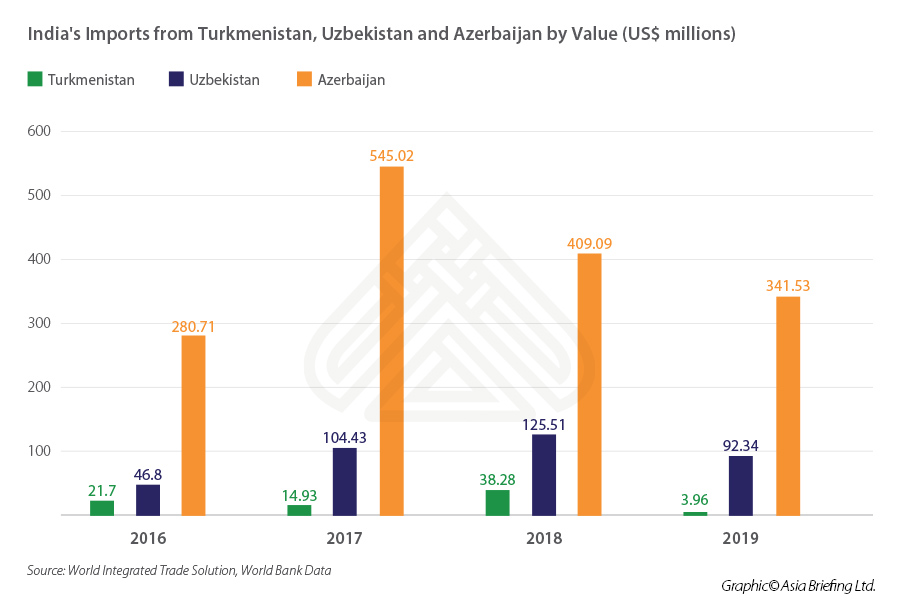

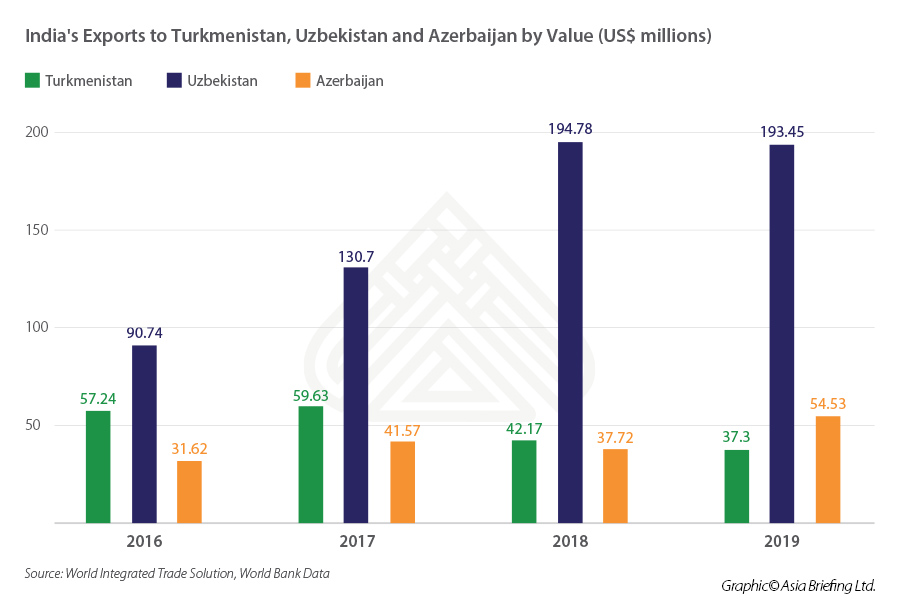

The chart below reveals that Uzbekistan’s trade with India gradually increased since 2016, with export value registering a significant rise from US$90.74 million in 2016 to US$193.45 million in 2019. Imports from Uzbekistan to India have more than doubled, from US$46.48 million in 2016 to US$92.34 million in 2019.

Azerbaijan, on the other hand, is a net exporter to India, with the trade balance clearly in its favor due to crude oil exports.

Comparatively, Turkmenistan’s engagement with India remains low. However, since the launch of Connect Central Asia dialogue in 2012, Turkmenistan’s share in India’s export and import basket has increased.

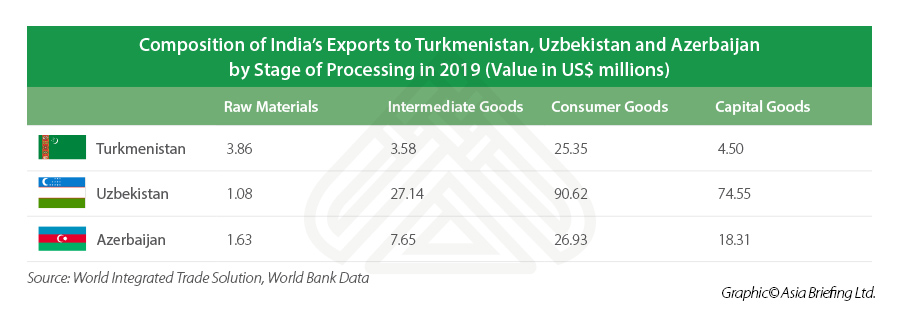

A look at the composition of India’s export basket to these countries reveals that India is primarily a supplier of consumer goods (for example, pharmaceuticals) and capital goods to these countries. Turkmenistan, too, has developed a market for Indian consumer goods.

Turkmenistan

According to data from WITS, the total trade between India and Turkmenistan stood at US$41.26 million, of which Indian exports were valued at US$37.30 million and Indian imports stood at US$3.96 million.

In 2020, Indian exports to Turkmenistan increased to US$44.3 million, according to the United Nations COMTRADE database.

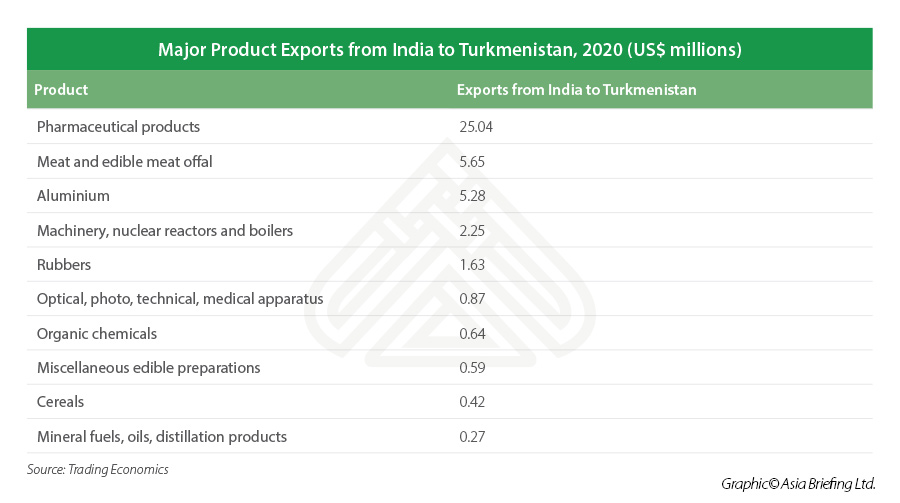

Major exports from India include pharmaceuticals, meat and edible offal, aluminum and machinery, nuclear reactors, and boilers, rubber, organic chemicals, etc. In 2020, India exported pharmaceutical products worth US$25.04 million to Turkmenistan. It was followed by meat products, valued at US$5.65 million.

Indian imports from Turkmenistan comprises of fertilizers, cotton, raw hides and inorganic chemicals.

Turkmenistan's is the world's fourth largest exporter of natural gas. The TAPI pipeline has been under negotiation for some time, and once operational, the proposed 1,800 km long pipeline would be able to export up to 33 billion cubic meters of natural gas per year.

India and Turkmenistan have signed a double taxation avoidance agreement (DTAA). However, energy experts have urged a wait and watch approach since the Taliban are currently making inroads to gain power in Afghanistan, whose position is key to the TAPI project moving forward.

Uzbekistan

Uzbekistan claims a 20 percent share in India’s exports to the Central Asian region. Its key mineral resources include petroleum, natural gas, coal, and uranium and now it is also looking at upgrading high-value-added food processing and textile industry sectors. India’s exports to Uzbekistan were US$260.76 million in 2020.

Major products exported from India to Uzbekistan include pharmaceutical products, machinery, nuclear reactors and boilers, tanning, dyeing extracts, tannins, derivatives, pigments, vehicles other than railway, tramway, coffee, tea, mate and spices, electrical, electronic equipment, organic chemicals, etc. In 2020, India’s export basket to the country was dominated by pharmaceuticals valued at US$167.74 million, followed by machinery, nuclear reactors, and boilers whose value stood at US$37.19. The surge in pharmaceutical exports can be attributed to the COVID-19 pandemic.

India’s imports from Uzbekistan consists largely of fruit and vegetable products, services, fertilizers, juice products and extracts, and lubricants. It is to be noted that while most Central Asian states export raw materials to India, Uzbekistan’s intermediate goods (for example, fertilizers) have also gained importance in India’s import basket.

Uzbekistan also offers lucrative opportunities for investors in the oil and gas industry and telecommunication and information technology industries. The country is seeking strategic partners to develop projects involving high-tech production in the petroleum, chemical, textile, pharmaceutical sectors, and road construction.

In December 2020, New Delhi and Tashkent signed an MoU where the India approved a US$ 448 million Line of Credit for road construction and development of the IT sector for digital connectivity.

In 2019, Uzbekistan also invited India to join its proposed Afghanistan-Uzbekistan rail link project.

On December 14, 2020, the Trilateral Working Group Meeting between India, Iran, and Uzbekistan agreed on the joint use of Chabahar Port. Both the countries have a DTAA with India.

Azerbaijan

Indian exports to Azerbaijan were valued at US$125.97 million during 2020. In contrast, Indian imports from the country were valued at US$456.80 million, of which US$452.73 million could be attributed to mineral fuels, oils, and distillation products, which claimed the majority share. The Indian import basket in 2020 also consisted of inorganic chemicals (iodine), jet fuel, and plant for perfumes.

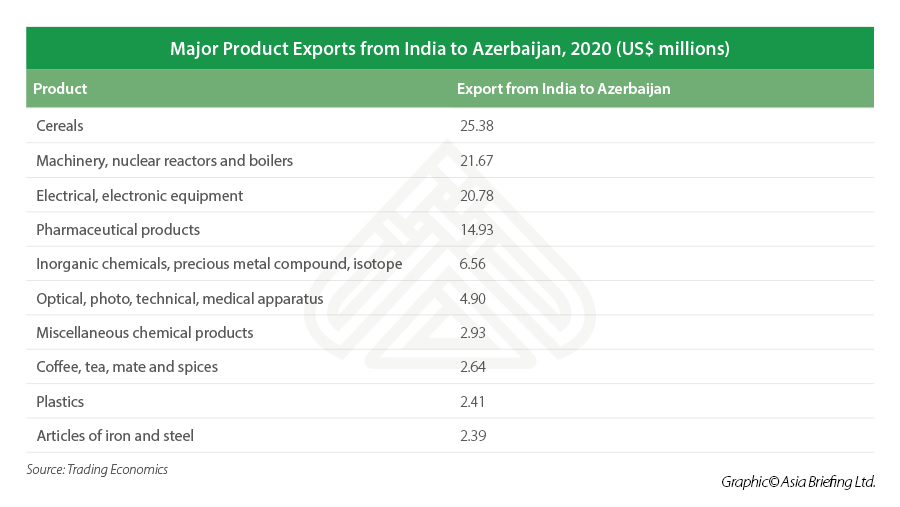

India’s exports to Azerbaijan comprise of cereals, rice, mobile phones, pharmaceuticals, organic chemicals, centrifugal liquid pumps, etc.

India’s trade with Azerbaijan has substantially increased since 2005 and it can be attributed to the opening of the Baku-Tbilisi-Ceyhan (BTC) oil pipeline to the Mediterranean port, from where Indian oil companies have been purchasing substantive quantities of crude oil.

Azerbaijan is an INSTC member along with India and is also a dialogue partner with the SCO.

Negotiations are underway for an India-Azerbaijan DTAA, and for cooperation in the areas of information and communication technology (ICT), health, agriculture, tourism, customs matters, youth and sports, and tourism between both countries.

Takeaways

Asserting geopolitical clout in the region, in form of providing an alternative to growing Chinese influence, addressing security and stability concerns through diplomatic channels and boosting economic and trade cooperation, and the need for energy security has sped up India’s desire to step up its role in Central Asia and the Caucasus regions.

Focusing on trade and developmental objectives have been traditionally favored by New Delhi. At the same time, reaching the position of influencer in these strategic regions will also aid India’s ambitions in the overall international order, such as on the UNSC.

To realize such ambitions, India needs to proactively bolster connectivity, not just physical but also digital. This means financing and on-the-ground investment as mere promises without funds will not hold the camaraderie.