Transfer pricing rules in India

The transfer pricing rules in India apply to both domestic and international transactions that fall above a threshold in terms of deal value.

According to the transfer pricing rules in India, income arising from international transactions or specified domestic transactions between Associated Enterprises (AE) should be computed using the arm’s-length price principle.

India’s transfer pricing rules provide a detailed statutory framework for the computation of reasonable, fair, and equitable profits.

International transactions’ refers to transactions between two (or more) AEs involving the sale, purchase, or lease of tangible or intangible property, the provision of services or cost-sharing agreements, the lending or borrowing of money, or any other transaction with a bearing on the profits, income, losses, or assets of such enterprises.

Relationships falling under the AE category include direct or indirect participation in the management, control, or capital of an enterprise by another enterprise. They also cover situations in which the same person participates in the management, control, or capital of both enterprises.

For tax purposes, companies are required to record the exchange of goods using the arm’s-length principle, which states that the prices charged by affiliated companies should be equivalent to the prices that would have been charged by an unrelated third party.

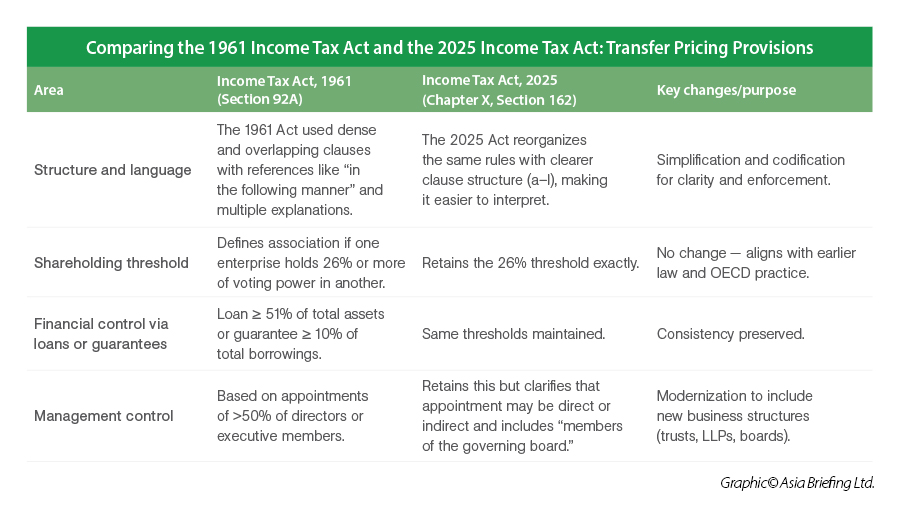

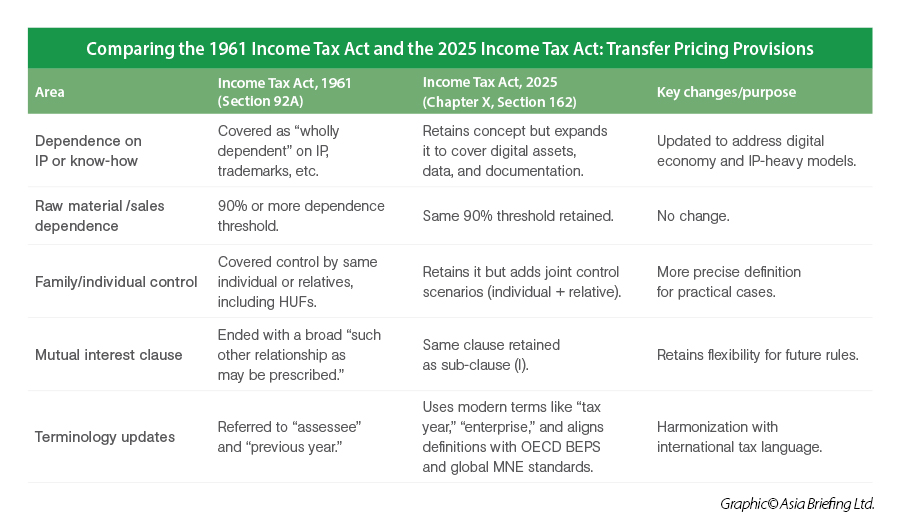

Transfer pricing provisions under India’s Income Tax Act

Currently governed by Sections 92A–92F of the Income-tax Act, 1961 and related rules, the TP framework will be reorganized under Chapter 10 of the Income Tax Act, 2025, effective April 1, 2025. While the definition of “associated enterprises” remains largely unchanged, the new law strengthens alignment with OECD principles and expands coverage to address modern business models, including digital assets, platform economies, and innovative financing structures.

Arm's length pricing

|

Methods for Determining Arm’s Length Price |

|

|

Comparable Uncontrolled Price (CUP) Method |

The price charged or paid for property transferred or services provided in a comparable uncontrolled transaction + adjustments |

|

Re-sale Price Method (RPM) |

Resale Price charged by the tested party for the goods or services obtained from the AE to the unrelated party minus the normal uncontrolled gross profit and the expenses incurred by the assessee + Adjustments |

|

Cost Plus Method (CPM) |

A sum of direct and indirect costs incurred and [normal uncontrolled gross profit + Adjustments] |

|

Profit Split Method (PSM) |

Employed in transactions involving the transfer of unique intangibles. The combined net profit of the AEs in a transaction is compared to their relative contribution to arrive at an apportioned transfer price profit |

|

Transaction Net Margin Method (TNMM) |

The net profit of the tested party is determined against costs incurred, sales affected assets employed or any other relevant base, and the same is compared against the net profit of comparable determined against the same base + Adjustment. |

|

Other Method |

The other method can be any method that considers the price that has been charged or paid or would have been charged or paid for the same or similar uncontrolled transaction with or between unrelated parties under similar circumstances, considering all the relevant facts. |

|

Under the earlier transfer pricing regime, when multiple prices were determined using the most appropriate method (typically six or fewer comparables), the arithmetic mean of those prices was considered the arm's length price. A tolerance margin of ±3% (or ±1% in the case of wholesale trading) was allowed—if the difference between the actual transaction price and the arm's length price fell within this range, the transaction value was accepted as the arm's length price. Any excess beyond the permitted margin was fully added to the assessee’s income.

However, the Finance Act, 2025 has omitted explicit reference to the arithmetic mean, indicating a possible transition toward methods such as the interquartile range (IQR) or a single arm's length price with an applicable margin. Final implementation details are awaited, but businesses should prepare for a potential move away from mean-based pricing toward a “precise value plus tolerance” model. |

|

- Specified domestic transactions (SDT): Transfer pricing regulations are applicable to domestic transactions that fall under domestic pricing only if the aggregate value is more than the threshold limit of INR 200 million (US$2.7 million). Transactions with related domestic parties that qualify as SDT include:

- Two or more enterprises are associated enterprises if:

- ⇒ One of them participates in the management, control, or capital of another; or

- ⇒ There is common management, control, or capital exercised by some persons.

- Transactions relating to the transfer of goods or services, such as profit-linked deductions for enterprises engaged in infrastructure development or industrial undertakings, producers and distributors of power, or telecommunication service providers.

- Transactions between the entity located in a tax holiday area and the one which is situated in a non-tax holiday area in case both are under the same management structure.

- Introduction of multi-year ALP determination for similar SDTs over a block of three years, starting from April 1, 2026.

- Two or more enterprises are associated enterprises if:

- All international transactions with associated enterprises (AEs) must comply with transfer pricing regulations, maintain documentation, and file Form 3CEB, certified by a chartered accountant with no minimum threshold.

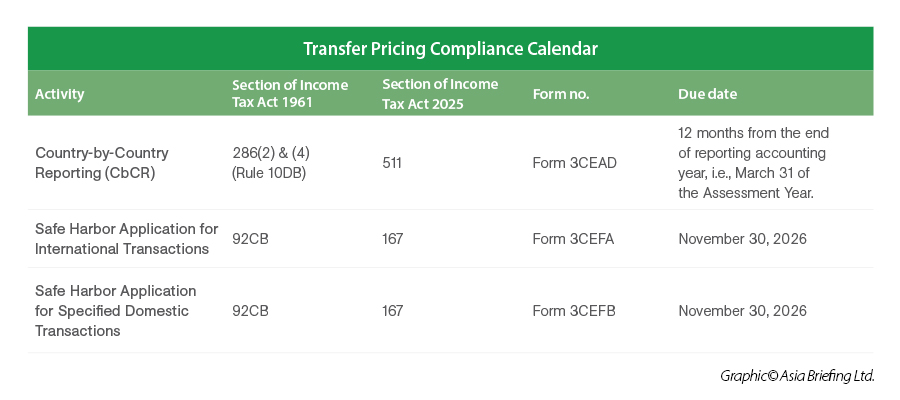

Introduction of a master file and country-by-country reporting (CbCR)

The efforts by OECD’s BEPS project have led to the formulation of proposals to implement the “minimum standards,” including Country-by-Country Reporting (CbCR). Globally, CbCR applies to MNCs with a combined revenue of US$837 million at a maximum. Under the CbCR requirement, large MNCs have to provide local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities.

Please make a note that a master file threshold limit and country-by-country reporting limits are different.

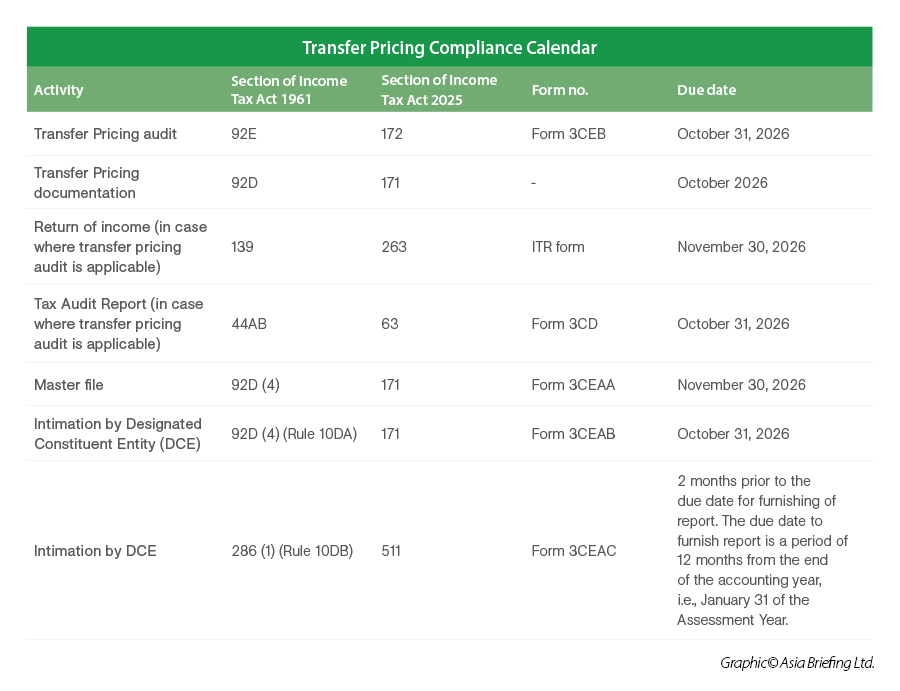

Transfer pricing compliance

All income acquired by a company or associated enterprise by means of any international transaction is calculated at the arm’s-length price.

The respective methods to calculate the arm’s-length price are applied depending on the nature and type of the transaction, the nature of the group or the association involved, or any other features of the transactions involved. If there are two or more appropriate prices assumed for a certain transaction, the arm’s-length price will be calculated as the average of the prices.

The group or person who does not adhere to these rules is liable to pay the penalties as imposed by the CBDT.

Maintaining TP documentation

Taxpayers are required to maintain information related to international transactions undertaken with AEs. The rules prescribe detailed information and documentation that must be maintained by the taxpayer.

Such requirements can broadly be divided into two parts:

- Information on the ownership structure of the taxpayer, a group profile, and a business overview of the taxpayer and AEs, including prescribed details such as the nature, terms, quantity, and value of international transactions. The rules also require the taxpayer to document a comprehensive transfer pricing study.

- Adequate documentation must be maintained to substantiate the information, analysis, and studies documented under the first part of the rule. It also contains a recommended list of such supporting documents, including:

- Government publications;

- Reports, studies, technical publications, and market research studies undertaken by reputable institutions;

- Price publications;

- Relevant agreements,

- Contracts, and

- Correspondence.

Taxpayers having aggregate international transactions below the prescribed threshold of INR 10 million and specified domestic transactions below the threshold of INR 200 million are relieved from maintaining the prescribed documentation.

It is essential that the documentation maintained should be adequate to substantiate the arm’s-length price of the international transactions or specified domestic transactions.

Companies to which transfer pricing regulations are currently applicable are required to file their tax returns on or before November 30, following the close of the relevant tax year.

The prescribed documents must be maintained for a period of eight years from the end of the relevant tax year and must be updated annually on an ongoing basis.

The categories of documentation required are:

- Documentation regarding the ownership hierarchy and structure of the group.

- Overview of the business activities and operations of the multinational group.

- Details of international transactions, including their nature, terms, and pricing.

- Explanation of the roles, assets, and risks involved in the transactions.

- Documentation of any financial projections or estimates used in relation to the transactions.

- Information on comparable transactions between the group and independent third parties.

- Assessment comparing the international transaction with similar uncontrolled transactions.

- Explanation of the various transfer pricing methods considered.

- Justification for dismissing alternative transfer pricing methods.

- Information on any adjustments made to align with the arm's-length principle.

- Any additional data or documents related to the associated enterprise relevant to determining the arm’s-length price.

- Certificate from a licensed Chartered Accountant (3CEB) confirming the maintenance of required documentation.

It is also imperative to obtain an independent accountant’s report with respect to all international transactions between AEs, and the same must be submitted by the due date of the tax return filing, on or before November 30.

Transfer Pricing Compliance Calendar 2026

|

Transfer Pricing Related Penalties |

|

|

Nature of default and relevant sections under the Income Tax Act, 1961 |

Nature of penalty |

|

Section 270A: Under-reporting or misreporting of income |

|

|

Section 271AA: Failure to maintain transfer pricing documentation, failure to report the transaction, maintenance or furnishing of incorrect information/document |

|

|

Section 271BA: Failure to furnish accountant’s report |

|

|

Section 271G: Failure to furnish documents/report transaction |

|

|

271GB: Failure to furnish the documents prescribed under Section 286. |

|

Safe Harbor Rules

Safe Harbour Rules (SHRs) are an integral part of India’s transfer pricing regulations, designed to streamline compliance and reduce the administrative burden for taxpayers engaged in transactions between Associated Enterprises (AEs). These rules establish predefined profit margins or pricing benchmarks for specific categories of transactions.

These rules, under Section 92CB of the Income Tax Act, 1961, minimize scrutiny by tax authorities.

The Central Board of Direct Taxes (CBDT) has issued Notification No. 21/2025 on March 25, 2025, introducing key changes to India’s Safe Harbour Rules under the Income Tax Act. These changes aim to expand the scope of applicability, promote ease of doing business, and encourage investment. The amendments are in effect.

Thresholds for international transactions increased

The value limit for specified international transactions (like service provisions) has been raised from INR 2 billion to INR 3 billion. This change enables more taxpayers to benefit from the Safe Harbour provisions.

|

Transaction type |

Up to INR 1 billion |

INR 1 billion – 3 billion |

|

Software Development Services |

17% |

18% |

|

IT-enabled Services (ITeS) |

17% |

18% |

|

Knowledge Process Outsourcing (KPO) |

— |

18% to 24% |

|

Contract R&D – Software Development |

— |

24% |

|

Contract R&D – Pharma (Generic Drugs) |

— |

24% |

|

Note: Rates remain unchanged; only the transaction limit is revised. On operating expenses. ^ The outer limit increased from INR 2 billion to INR 3 billion without changing any safe harbour rates. |

||

Safe Harbour Rules apply to various categories, including:

- IT/ITES services: Minimum margin of 18 percent for IT-enabled or software development services.

- R&D services: Margin of 24 percent for R&D in software or pharmaceuticals.

- Intra-group loans: Interest within prescribed rates, like LIBOR plus a fixed margin.

- Corporate guarantees: Minimum commission rate of 1 percent.

- Contract manufacturing: Defined profit margins for manufacturing exports.

- Low-risk distribution: Industry-specific margins for resellers.

- Financial services: Predefined terms for low-risk activities.

- Raw diamond trading: 4 percent margin on gross receipts for foreign miners in SNZs.

Lithium-ion batteries now covered under ‘core auto components’

The definition of core auto components now includes lithium-ion batteries used in electric and hybrid vehicles. This allows such manufacturers to claim the 12 percent safe harbour rate (on operating expenses), previously limited to traditional components like engines, steering, and suspension parts.

Previously, lithium-ion batteries were treated as non-core components (eligible for only 8.5%). While this promotes e-mobility and local battery manufacturing, some capital-intensive businesses may find the 12 percent rate relatively high and less competitive.

Applicability of Safe Harbour Rules Extended to AY 2025–26 and AY 2026–27

The applicability of Safe Harbour Rules, which was earlier extended one year at a time, is now confirmed for two consecutive assessment years – AY 2025–26 and AY 2026–27 (i.e., FY 2024–25 and FY 2025–26).

This two-year extension restores the earlier practice and offers greater certainty and planning stability for taxpayers using the Safe Harbour route.

While Rule 10TE(2) allows the Safe Harbour option to remain valid for up to three years (as per Form 3CEFA), the new rules clarify that this is not applicable when the option is exercised under Rule 10TD(3B).

Taxpayers will now need to file Form 3CEFA every year to opt for Safe Harbour treatment under the new conditions.

In FY 2024-25, India’s Central Board of Direct Taxes (CBDT) signed a record 174 APAs, including Unilateral APAs (UAPAs) and 64 Bilateral APAs (BAPAs). The Board has said this was the "highest number" of APAs signed in a single financial year since the programme's launch.

Of the 174 APAs, 65 were BAPAs, which is again the "highest" number of such agreements finalised in any year so far. These APAs are a result of mutual agreements with India's treaty partners, including Australia, Japan, South Korea, The Netherlands, New Zealand, Singapore, the UK, and the US. The total number of APAs, across all the years, now stands at 815, comprising 615 UAPAs, 199 BAPAs and 1 MAPA.

Industry-specific Transfer Pricing issues

Transfer pricing poses unique challenges and opportunities across different industries. In India, industries such as IT services, manufacturing, and pharmaceuticals encounter distinct transfer pricing issues that require tailored strategies for compliance and optimization.

IT Services

The IT services industry in India is characterized by significant cross-border transactions, especially with parent companies and subsidiaries in the United States and Europe. The primary transfer pricing challenge here is the valuation of software development and IT-enabled services. Key issues include, accurately valuing intangibles like software and proprietary algorithms, ensuring that service agreements between related entities are at arm's length, and properly allocating costs between different geographical locations and ensuring these allocations reflect the actual economic activity.

Manufacturing

The manufacturing sector in India faces transfer pricing issues related to the pricing of goods, raw materials, and intercompany services. This industry often deals with complex supply chains that span multiple countries. Key issues include, pricing transactions for raw materials and finished goods between related entities, conducting value chain analysis to allocate profits, and ensuring that the transfer of tangible goods complies with the arm's length principle.

Pharmaceuticals

The pharmaceutical industry is heavily regulated and involves significant R&D activities, making transfer pricing particularly complex. Key issues include, the valuation of intellectual property, the allocation of profits from drug sales, and allocating R&D costs among entities in different jurisdictions.

Impact of the digital economy on transfer pricing

The rise of the digital economy has fundamentally altered traditional business models, bringing new challenges to the realm of transfer pricing. The proliferation of digital business models and intangible assets, such as software, patents, and trademarks, complicates the application of conventional transfer pricing methods.

Digital business models, characterized by high reliance on intangible assets and the ability to operate across borders with minimal physical presence, pose unique transfer pricing issues. These models often involve complex value chains where intangible assets play a pivotal role in value creation.

The OECD has acknowledged these issues and provided guidance through its Base Erosion and Profit Shifting (BEPS) project. The BEPS Action 1 report specifically addresses the tax challenges of the digital economy. Key recommendations include adopting new nexus rules based on significant economic presence and ensuring that profits are taxed where economic activities and value creation occur.

The OECD also emphasizes the importance of transparency and information sharing among tax authorities to combat base erosion and profit shifting.

India’s response to digital economy challenges

India has implemented several measures to ensure that digital businesses contribute their fair share of taxes.

Introduced in 2016, the Equalization Levy initially targeted online advertisement services and was later expanded to cover a broader range of digital services. This levy is designed to tax digital transactions involving foreign companies that derive significant income from Indian users but lack a physical presence in India.

The 2 percent equalization levy (EL) on non-resident digital companies was abolished in India as of August 1, 2024, as part of the Union Budget 2024. This change was made in recognition of the progress being made on the OECD Pillar 1 negotiations on how to tax foreign earnings from digital service providers.

In 2018, India introduced the concept of Significant Economic Presence as part of its domestic tax law. This concept expands the scope of taxable presence to include digital businesses that engage significantly with Indian users.

SEP criteria are based on factors such as revenue generated from Indian users and the number of users, aiming to capture value created through digital interactions.

Dispute resolution mechanisms

Transfer pricing disputes can arise due to the complex nature of cross-border transactions and differing interpretations of transfer pricing regulations. To address these challenges, India offers several dispute resolution mechanisms, including Advance Pricing Agreements (APAs), Mutual Agreement Procedures (MAP), and Safe Harbour Rules. This section provides a detailed explanation of these mechanisms and their effectiveness, supported by relevant case studies.

Advance Pricing Agreements (APAs)

An APA is a pre-emptive agreement between a taxpayer and the tax authority determining the transfer pricing methodology for transactions over a specified period. APAs aim to provide certainty and reduce disputes.

Types of APAs:

- Unilateral APA: Agreement between the taxpayer and the tax authority of one country.

- Bilateral APA: Agreement involving the tax authorities of two countries.

- Multilateral APA: Agreement involving the tax authorities of more than two countries.

Process:

- An informal meeting to discuss the potential APA application.

- Submission of a detailed application, including transaction descriptions, proposed transfer pricing methods, and supporting documentation.

- Discussion between the taxpayer and tax authorities to finalize the terms of the APA.

Mutual Agreement Procedure (MAP)

MAP is a dispute resolution mechanism under tax treaties, allowing competent authorities of the involved countries to resolve issues related to double taxation and transfer pricing adjustments.

The MAP process in India is governed by Article 25 of the OECD Model Convention, corresponding DTAA articles, and CBDT’s MAP Guidance.

- The taxpayer initiates the MAP by submitting a request to the competent authority in their home country.

- Competent authorities from the involved countries negotiate to resolve the dispute, aiming to eliminate double taxation and ensure a consistent transfer pricing approach.

- The agreed resolution is implemented, typically through corresponding adjustments in the tax assessments of the involved countries.

Transfer Pricing: Frequently Asked Questions

What is the meaning of arm's length price?

The arm's length price refers to the price that would be charged in a transaction between unrelated parties in uncontrolled conditions. This principle ensures that transactions between associated enterprises (AEs) are conducted as if they were between independent entities, ensuring fairness and compliance with tax regulations.

What are Associated Enterprises (AEs)?

Associated Enterprises (AEs) are entities that are related to each other through direct or indirect participation in the management, control, or capital of the other enterprise”. This relationship can be established through shareholding, voting power, or management control. Transactions between AEs are subject to transfer pricing regulations to prevent tax avoidance.

What are the different types of methods which can be applied for computing arm's length price?

The methods for computing the arm's length price include:

- Comparable Uncontrolled Price (CUP) Method

- Resale Price Method (RPM)

- Cost Plus Method (CPM)

- Profit Split Method (PSM)

- Transactional Net Margin Method (TNMM)

- Other methods prescribed by the Central Board of Direct Taxes (CBDT)

When are the taxpayers required to prepare Transfer Pricing (TP) Documentation as per Rule 10D of the Income-tax Rules, 1962?

Taxpayers must prepare Transfer Pricing (TP) Documentation if their aggregate value of international transactions exceeds INR 1 crore in a financial year. The documentation should be prepared contemporaneously and maintained to justify the arm's length nature of their transactions.

When are the taxpayers required to file an accountant's report specified in Section 92E of the Income-tax Act, 1961?

Taxpayers engaging in international or specified domestic transactions must file an accountant's report in Form 3CEB under Section 92E of the Income-tax Act, 1961. This report must be filed by the due date of filing the income tax return, which is generally on or before November 30th of the assessment year.

Which transaction is classified as “international transaction”?

An "international transaction" involves the transfer of goods, services, or intangible property between associated enterprises (AEs) where either or both of the enterprises are non-residents. This also includes capital financing, business restructuring, cost-sharing arrangements, including know-how, patents, trademarks or brand rights as defined in under section 92(B)(1) and (2) of the IT Act. and other intercompany transactions that may impact the taxable income of the entities involved.

When do the transfer pricing regulations apply to an enterprise?

Transfer pricing regulations apply to enterprises that engage in international transactions or specified domestic transactions with associated enterprises. The regulations ensure that these transactions are conducted at arm's length prices to prevent profit shifting and tax avoidance.

Is a Liaison Office (LO) in India of a foreign corporation subject to TP Provisions?

A Liaison Office (LO) in India generally engages in limited activities such as communication and liaison, without earning income in India. As such, an LO is typically not subject to transfer pricing provisions. However, if the LO is found to be engaged in income-generating activities, it will be equivalent to the creation of a Permanent Establishment (PE) in India and thus, transfer pricing regulations will apply.

Do the transfer pricing rules apply in respect of transactions between head office (HO) and a branch office/project office?

Yes, transfer pricing rules apply to transactions between a head office (HO) and its branch office or project office if they involve cross-border transactions. These transactions must comply with arm's length principles to ensure accurate reporting and taxation.

What are the documents required to be maintained by a company while executing an international transaction?

Companies must maintain comprehensive documentation for international transactions, including:

- Description of the transaction and the entities involved

- Pricing methodologies and economic analyses

- Comparability analyses

- Agreements and contracts

- Financial data and relevant documentation supporting the arm's length nature of the transactions

Does transfer pricing documentation have to be prepared annually?

Yes, transfer pricing documentation must be prepared and maintained annually for each financial year in which the international or specified domestic transactions occur. This ensures that the documentation is current and reflects the actual business activities and financial conditions.

What is the materiality limit/threshold for preparing and maintaining transfer pricing (TP) documentation?

The materiality threshold for preparing and maintaining transfer pricing documentation in India is INR 1 crore of an aggregate value of international transactions in a financial year. Transactions below this threshold may not require comprehensive documentation but must still comply with transfer pricing regulations. However, specified domestic transactions exceeding INR 20 crore require transfer pricing documentation.

What are the different methods to calculate arm’s length price?

The methods to calculate the arm's length price are:

- Comparable Uncontrolled Price (CUP) Method

- Resale Price Method (RPM)

- Cost Plus Method (CPM)

- Profit Split Method (PSM)

- Transactional Net Margin Method (TNMM)

- Other methods prescribed by the Central Board of Direct Taxes (CBDT)

Is there a requirement for a fresh benchmarking analysis every year vs roll-forward/update of the financials?

A fresh benchmarking search needs to be conducted every year. Rule 10D(4) says, “The information and documents specified under sub-rules (1), (2) and (2A) shall, as far as possible, be contemporaneous and existing latest by the specified date referred to in clause (iv) of section 92F.”

Is there a statutory deadline for submission of transfer pricing documentation?

There is no statutory deadline for the submission of transfer pricing documentation itself, but the documentation must be prepared and maintained contemporaneously. The accountant's report in Form 3CEB, which relies on this documentation, must be filed by the due date for filing the income tax return, typically November 30th of the assessment year.

What are safe harbor rules under the Indian transfer pricing regulations?

Safe harbor rules provide predefined margins or criteria for certain transactions, deeming them to be at arm's length if they meet these conditions. These rules simplify compliance and reduce the likelihood of transfer pricing disputes for eligible taxpayers.

Does Indian transfer pricing law have an Advance Pricing Agreement (APA) program?

Yes, India has an Advance Pricing Agreement (APA) program that allows taxpayers to enter into agreements with the tax authorities to determine the transfer pricing methodology for specified transactions over a period of time. This provides certainty and reduces litigation risks.

What are the scenarios under which Form FC-TRS is required to be filed?

Form FC-TRS must be filed in cases involving the transfer of shares or convertible debentures of an Indian company from a resident to a non-resident, or vice versa. This form ensures compliance with the Foreign Exchange Management Act (FEMA) regulations.

What are the penal consequences for under-reporting or misreporting of income?

Penalties for under-reporting or misreporting income can be substantial, including:

- Penalty of 50 percent of the amount of tax payable on the under-reported income

- Penalty of 200 percent of the tax payable in cases of misreporting

What are the penal consequences for non-compliance with the Indian Transfer Pricing regulations?

Non-compliance with transfer pricing regulations can result in:

- Penalty of 2 percent of the value of each international transaction for failure to maintain documentation, furnish information, or comply with the accountant's report requirement

- Penalty of up to 100 percent to 300 percent of the tax amount on transfer pricing adjustments if deemed to be concealment of income.

- For failure to furnish an accountant’s report: INR 100,000 (US$1,194).