The GST is a single, value-added tax levied on the manufacture, sale, and consumption of both goods and services at the national level. The GST subsumes most indirect taxes previously levied at the federal and state level.

It is a consolidated tax based on a uniform tax rate fixed for both goods and services across India, and is payable at the final point of consumption. At each stage of sale or purchase in the supply chain, the tax is collected on value-added goods and services, through a tax credit mechanism.

GST is levied on the supply of all goods and services except the supply of liquor for human consumption which is still liable to state excise duties and the VAT.

GST is not being levied on petroleum crude, high-speed diesel, motor spirit (commonly known as petrol), natural gas and aviation turbine fuel, however, central excise duty and VAT would be levied on these products.

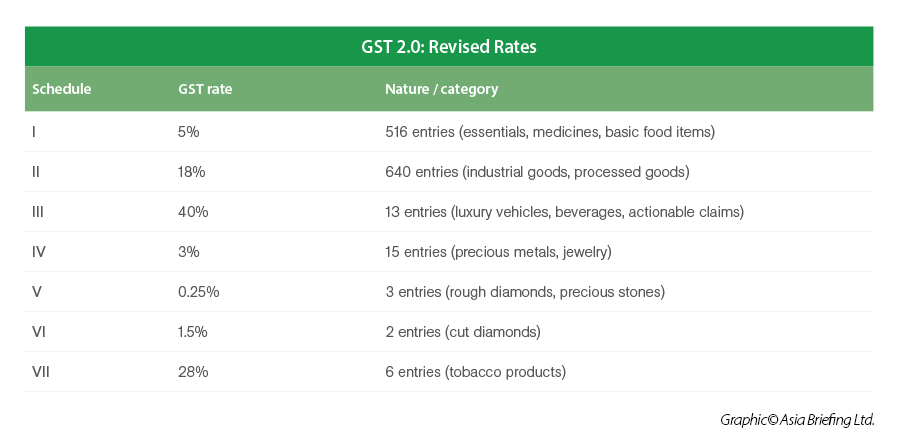

GST rate

Different categories of goods and services are taxed differently under GST. The GST council has provided a different tax structure:

The elimination of the 12 percent tax slab addresses one of the most enduring areas of interpretive ambiguity in the GST regime. Historically, the fine distinctions in tariff classification created persistent challenges for businesses in determining whether goods fell under the 12 percent or 18 percent rate.

The elimination of the 12 percent tax slab addresses one of the most enduring areas of interpretive ambiguity in the GST regime. Historically, the fine distinctions in tariff classification created persistent challenges for businesses in determining whether goods fell under the 12 percent or 18 percent rate.

GST rates for services

India’s GST Council has implemented a substantial overhaul of the services tax structure effective 2025, transitioning to a simplified two-rate model: 5 percent with limited or no input tax credit (ITC) and 18 percent with full ITC eligibility. This marks the most significant reform of service taxation since the introduction of GST in 2017, aimed at easing compliance for consumer-facing sectors while maintaining seamless credit availability for business-to-business industries.

Under the revised framework, tax rates on essential and household-focused services have been lowered, while levies on petroleum-related services, outsourcing, and transportation activities have increased.

| Service Category | Earlier GST Rate | Revised GST Rate (GST 2.0) | Sectoral Impact |

|---|---|---|---|

| Life insurance | 18% | 0% (exempt) | Major reduction in long-term financial protection costs; improves affordability and penetration. |

| Health insurance | 18% | 0% (exempt) | Significant relief for households and corporates; boosts demand for medical coverage. |

| Education services (select learning materials & supplies) | 5% / 12% | 0% (exempt) | Reduced cost of educational operations; benefits students and institutions. |

| Healthcare diagnostics (e.g., kits, thermometers) | 12% / 18% | 5% (merit rate) | Lowers cost of essential healthcare services; supports hospitals and diagnostic centers. |

| Hospitality & restaurants | 12% / 18% | 5% (merit rate) | Cheaper dining and travel-related services stimulate consumption in hospitality. |

| Wellness & personal care services | 18% | 5% (merit rate) | Lower costs for grooming, wellness therapies, and related services. |

| Agricultural support services | 12% / 18% | 5% (merit rate) | Reduces operational expenditure for farmers; improves rural productivity. |

| Transport of goods & passengers (select services) | 12% / 18% | 5% (merit rate) | Lower operating costs across logistics and mobility sectors. |

| Construction-related service inputs | 18% | 18% (revised standard rate) | Slight cost reduction due to recalibrated standard slab; supports housing and infrastructure demand. |

| Premium lifestyle & luxury services | 28% + cess | 40% (de-merit rate) | High-end hospitality, luxury club memberships, and premium service bundles become costlier. |

| Services linked to premium automobiles / yachts | 28% + cess | 40% (de-merit rate) | Luxury mobility services become more expensive despite cess removal. |

| Aerated / caffeinated beverage services | 28% + cess | 40% (de-merit rate) | Higher costs for beverage services; aligns with health-based taxation. |

_1.jpg)

_2.jpg)

Indirect tax structure under GST

|

Indirect Tax Structure under GST

|

||

|

Indirect taxes subsumed under GST |

Indirect taxes not subsumed under GST |

|

|

Federal level |

State level |

|

|

|

|

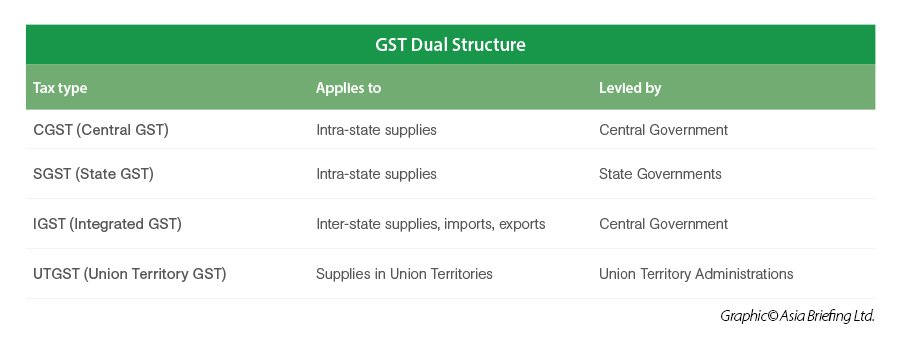

Components of GST

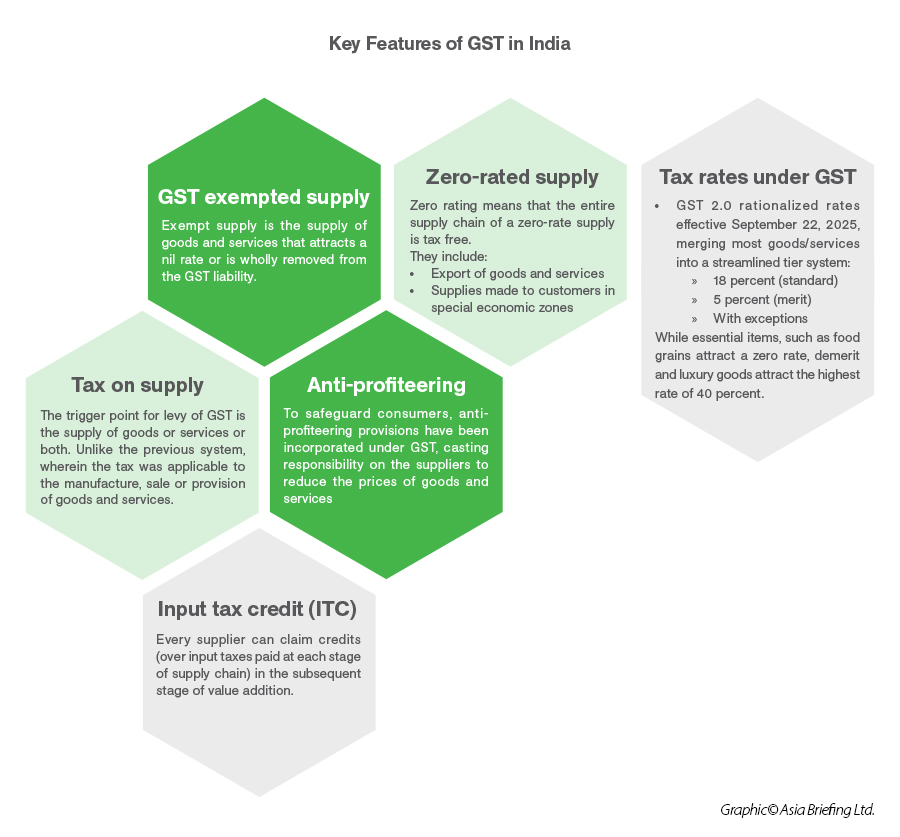

Key features of GST

Dual tax

The GST is a dual levy, which means that both the federal and State government levy tax on supply of goods and services based on the nature of transaction (Inter-State or Intra-State). Accordingly, GST has two concurrent components:

- State/Union Territory GST (SGST/UTGST): It is levied and collected by the state or union territory (UT).

- Central GST (CGST): It is levied and collected by the federal government.

Integrated Goods and Services Tax (IGST)

Under GST, inter–State supplies between any two States and imports to the country are subject to the IGST, which is levied and collected by the federal government. The IGST is the aggregate of the CGST and SGST; it is appropriated from the State where the supplies are consumed.

Tax on supply

The GST is applicable on the “supply” of all goods and service. Under GST, the liability to pay CGST or SGST arises at the time of supply. Depending on whether the transaction is ‘inter-state’ or ‘intra-state’ separate GST provisions are applicable to help a business determine the place of supply for goods and services. GST is a destination-based tax, levied only at the final destination of consumption.

Input tax credit (ITC) mechanism

The ITC forms the backbone of the GST regime in India. The ITC mechanism helps in the seamless flow of tax-credits throughout the value-chain, and across boundaries of States.

The GST is essentially a tax on value addition at each stage of the supply chain; every supplier, who is the person supplying the goods and/ or services or an agent acting as such on behalf of such a supplier, can claim credits (over input taxes paid at each stage of supply chain) in the subsequent stage of value addition. Thus, a continuous chain of set off is established from the original producer’s or service provider’s level up to the retailer’s level, thus, eliminating the burden of double taxation.

Suppliers at each stage are permitted to set off the GST paid on the purchase of input goods and services against GST to be paid on the supply of goods and services.

It is important for dealers to note that no cross utilization of the ITC is permitted between the state and federal levy. This means that the credit of CGST paid on inputs may be used only for paying CGST on the output, while the credit of SGST on inputs may be used only for paying SGST, except in the case of inter-State supply of goods.

|

Utilization of Input Tax Credit |

|

|

Input Tax Credit |

Set off Against |

|

CGST |

IGST and CGST (in that order) |

|

SGST |

IGST and SGST(in that order) |

|

IGST |

IGST, CGST, SGST (in that order) |

To avail input tax credit, following conditions must be met:

- The dealer holds a tax Invoice, a debit note issued by the registered supplier or any such tax paying documents as may be prescribed;

- The details of such tax invoice or debit note must have been furnished by the supplier in GSTR-1;

- The said goods or services have been received;

- Returns (Form GSTR-3B) have been filed; and

- The supplier has paid the due tax to the government, either in cash or via claiming ITC.

Reverse charge concept:

- Unregistered dealer selling to a registered dealer: In such a case, the registered dealer has to pay GST on the supply.

- Services through an e-commerce operator: If an e-commerce operator supplies services, then reverse charge will apply on the e-commerce operator. He will be liable to pay GST.

- Supply of certain goods and services specified by CBEC: CBEC has specified a list of certain goods and services on which reverse charge is applicable.

- Input tax credit on reverse charge: Tax paid on reverse charge basis will be available for ITC if such goods and/or services are used, or will be used, for business. The service recipient (i.e., who pays reverse tax) can avail ITC.

- Businesses must ensure that RCM invoices are prepared, taxes are discharged, and corresponding ITC is availed in compliance with GST regulations.

When a business purchases goods, or services under RCM, it must:

- Issue a self-invoice (since the supplier does not charge GST).

- Mention RCM applicability on the invoice.

- Disclose RCM transactions separately in GSTR-3B.

- Pay GST on RCM through cash ledger (not ITC).

- Claim ITC on the same in the following month.

Invoice matching system

The GST allows for a seamless flow of ITC across the supply chain. One of the essential features of the GST is to check ITC claims by the taxpayer to prevent any leakages. For this purpose, an invoice matching system has been developed under GSTN to match the purchase and sale invoices of taxpayers. Accordingly, every registered taxable person under GST is required to issue a tax invoice, which will be uploaded on the invoice matching system. After the sale and purchase invoices of a taxpayer have been matched, the ITC will be conferred.

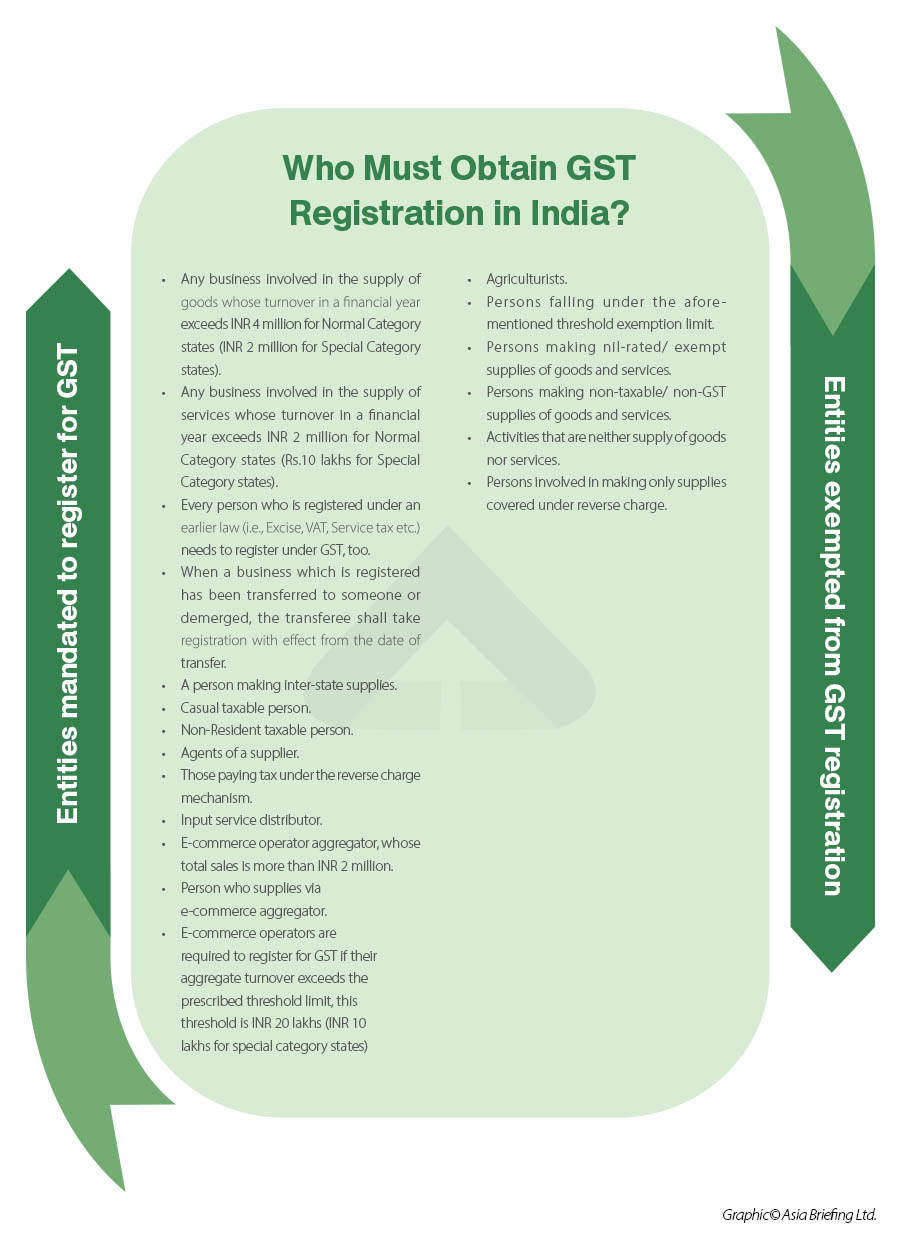

Who must obtain GST Registration in India?

Do foreign companies require GST registration in India ?

Yes, any foreign company that supplies goods and/or services to recipients in India, but operates without a fixed place of business or residence in India should mandatorily obtain GST registration.

GST compliance

Businesses in India will need to reassess their aggregate turnover, adopt a new invoice series, and align their operation with updated reconciliation and reverse charge mechanism (RCM) regulations. The followings are the steps businesses need to take to remain compliant and avoid penalties.

- Mandatory Multi-Factor Authentication (MFA)

- Stricter E-Way Bill (EWB) regulations

- Mandatory ISD registration under GST framework

- Lowered e-invoicing threshold

- Implementation of new invoice series

- Reassessment of aggregate turnover

- Quarterly Return Monthly Payment (QRMP) scheme selection

- Reconciliation of Input Tax Credit (ITC)

- Reverse Charge Mechanism (RCM) compliance

- E-Way Bill Two-Factor authentication

- Letter of Undertaking (LUT) submission

- Credit Note: E-invoicing requirement effective

All taxpayers, regardless of turnover, must enable MFA to access the GST portal. This security measure adds an extra layer of protection against unauthorized access starting April 1, 2025.

ISD registration is mandatory from April 1, 2025, for businesses receiving common input service invoices for multiple branches.

- It applies to all sectors, including services.

- It does not apply to goods or capital goods.

- Businesses with multiple locations must assess if ISD registration is required to ensure ITC is properly allocated.

From April 1, 2025, businesses with an Annual Aggregate Turnover (AATO) of Rs. 10 crore+ must upload e-invoices to the Invoice Registration Portal (IRP) within 30 days, a rule once limited to those with Rs. 100 crore+.

Registering for GST in India

Eligibility for GST registration

If a business engages in buying and selling goods or services, they must register for GST if they meet the eligibility criteria. Those businesses with an annual turnover of more than INR 2 million (US$24,390) for service supply or INR 4 million (US$48,780) for goods supply are required to register for GST in India.

|

GST Registration Threshold in Indian Jurisdictions |

||

|

Category |

Region |

Aggregate annual turnover (INR) |

|

Services |

Special Category States- Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Uttarakhand and Himachal Pradesh. |

INR 1 million |

|

Rest of India |

INR 2 million |

|

|

Goods |

Special Category States- Assam, Arunachal Pradesh, Manipur, Mizoram, Meghalaya, Nagaland, Tripura, Sikkim, Uttarakhand and Himachal Pradesh |

INR 2 million |

|

Rest of India |

INR 4 million |

|

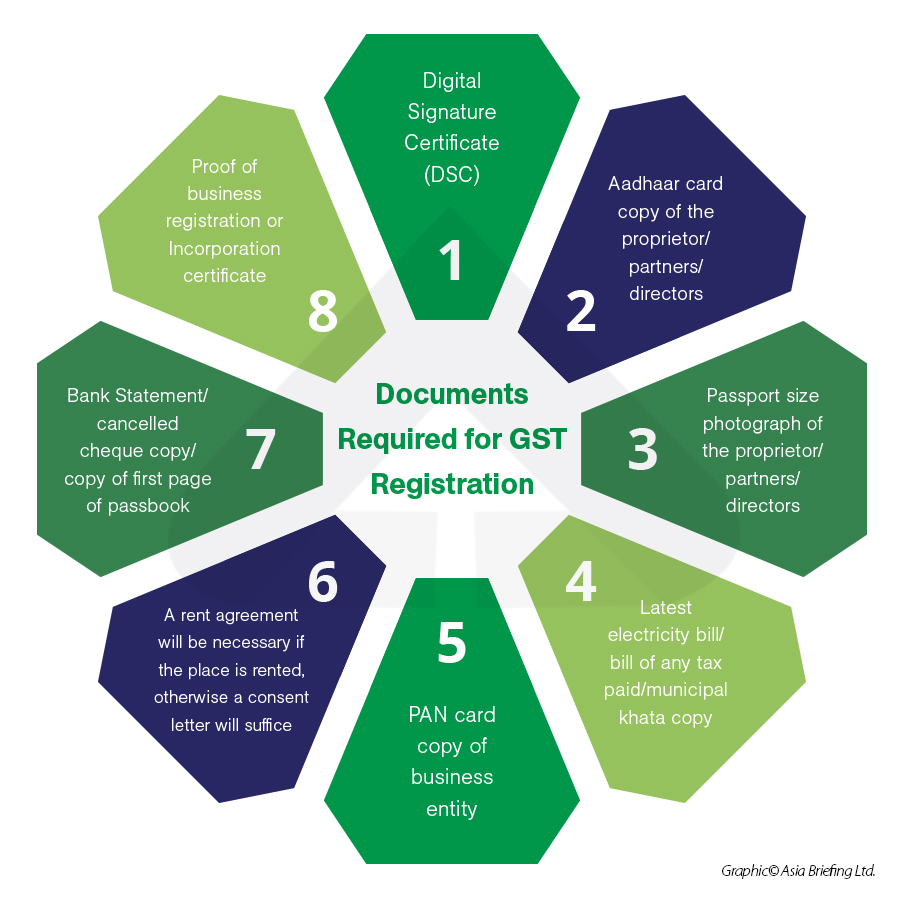

Documents required for GST registration

Procedure for GST registration

Validity of GST registration

A normal GST registration certificate issued to a regular taxpayer does not have a validity period and does not expire unless it is cancelled. However, in the case of GST registration for casual taxable persons and non-resident taxable persons, the GST certificate is issued temporarily with an expiry date.

Filing GST returns in India

A GST return is a document containing details of all income/sales and/or expenses/purchases that a GST-registered taxpayer (every GSTIN) is required to file with the tax administrative authorities. Tax authorities use this to calculate net tax liability.

GST return filing is a mandatory compliance even if there are no sales and purchases carried out by a business during the return period. Such taxpayers must file a ‘nil’ return. Failure to file returns in time may attract penalty, and in case of non-compliance, a notice from the tax authorities.

Under the GST regime, regular businesses having more than INR 50 million as annual aggregate turnover (and taxpayers who have not opted for the Quarterly Returns with Monthly Payment (QRMP) scheme) have to file two monthly returns and one annual return. This amounts to 25 returns each year.

Taxpayers with a turnover of up to INR 50 million have the option to file returns under the QRMP scheme. The number of GSTR filings for QRMP filers is nine each year, which include four GSTR-1 and GSTR-3B returns each and an annual return. Businesses must note that QRMP filers have to pay tax on a monthly basis even though they are filing returns quarterly.

QRMP Scheme is for eligible taxpayers to file their Form GSTR-1 and Form GSTR-3B returns on quarterly basis, while paying their tax dues on monthly basis through a challan. The QRMP scheme can be availed only by those taxpayers who are liable to file Form GSTR-1 and Form GSTR-3B returns and can be opted by:

- Registered taxpayer (Normal taxpayer, Special economic Zone (SEZ) developer, SEZ unit);

- Taxpayers who have opted out of composition scheme; and

- Persons applying for a fresh registration as Normal taxpayer.

The scheme is not available for taxpayers whose annual aggregate turnover is more than INR 50 million.

There are also separate statements/returns required to be filed in special cases such as composition dealers where the number of GSTR filings is five each year (four statement-cum-challans in CMP-08 and one annual return GSTR-4).

What is composition scheme?

Small businesses and taxpayers with a turnover below INR 15 million (INR 7.5 million for special category states) have the option to choose the composition scheme. This scheme levies taxes at a nominal rate of 0.5 percent or one percent (for manufacturers) for CGST and SGST each. However, this option is only available to small businesses dealing in goods, and not available to interstate sellers, e-commerce traders and operators, and service providers.

Types of GST returns

The period for filing GST returns and types of returns vary among different categories of taxpayers. Below is a brief description of the types of returns to be filed under the GST.

|

GST Returns |

||||

|

Form |

Particulars |

Frequency |

Deadline |

|

|

GSTR - 1 |

Outward supplies return. |

Monthly (large taxpayer) |

11th of next month. |

|

|

Quarterly (small taxpayer whose turnover is up to 50 million under QRMP scheme) |

13th of the month succeeding the quarter

|

|||

|

GSTR-1A |

The CBIC released Notification No.12/2024 dated 10th July 2024, adding a proviso to Rule 59(1) re-introducing a new Form GSTR-1A for allowing amendments in the GSTR-1 before filing GSTR-3B. |

GSTR-1A would be available for filing after filing GSTR-1 for the given tax period but before filing GSTR-3B |

deadline is before filing GSTR-3B. |

|

|

IFF (Optional by taxpayers under the QRMP scheme) |

Details of B2B (business-to-business) supplies of taxable goods and/or services affected. |

Monthly (for the first two months of the quarter) |

13th of the next month. |

|

|

GSTR - 2A |

GSTR 2A is a purchase-related tax return that is automatically generated for each business by the GST portal. It is a read only return and no action can be taken. |

Monthly |

Auto-populated. |

|

|

GSTR – 2B |

GSTR-2B is an automatically populated statement that allows taxpayers to conveniently reconcile ITC with their own books of accounts and record. |

Monthly |

Auto-populated. Can be generated by recipient taxpayers once a month on the 12th of the month next to the tax period.

|

|

|

GSTR - 3B |

Inward and outward supply summary |

Monthly |

For annual turnover less than or equal to INR 50 million |

22nd or 24th of each month (state-wise) |

|

For annual turnover more than INR 50 million |

20th of each month |

|||

|

CMP-08 |

Special statement-cum-receipt to declare the details or summary of their self-assessed tax payable for a given quarter. It is meant for composition taxpayers.

|

Quarterly |

On or before the 18th of the month succeeding the quarter of any fiscal year.

|

|

|

GSTR - 4 |

A taxpayer opting for the composition scheme is required to file GSTR-4.

|

Annual |

April 30th |

|

|

GSTR - 5 |

Return for non-resident taxable person. |

Monthly |

20th of next month |

|

|

GSTR - 5A |

Return to be filed by non-resident OIDAR service providers. |

Monthly |

20th of next month |

|

|

GSTR - 6 |

Return for input service distributor. |

Monthly |

13th of next month |

|

|

GSTR - 7 |

Return for taxpayers that are required to deduct TDS. |

Monthly |

10th of next month |

|

|

GSTR - 8 |

Return to be furnished by the e-commerce platform that is required to collect TCS. |

Monthly |

10th of next month |

|

|

GSTR - 9 |

Annual return for normal registered taxpayers. |

Annual |

December 31st |

|

|

GSTR - 9B |

Annual return for e-commerce platforms that are required to collect TCS. |

Annual |

December 31st |

|

|

GSTR – 9C |

Self-certified reconciliation statement. |

Annual |

December 31st of the next financial year |

|

|

GSTR - 10 |

Annual return for the registered taxpayer whose GST registration is cancelled. |

Once, after the registration of GST is cancelled or surrendered. |

Within three months from the date of cancellation or date of cancellation order, whichever is later.

|

|

|

GSTR - 11 |

Return for Unique Identification Number holders. |

Monthly (as per applicability) |

28th of following month |

|

|

ITC-04 |

Statement to be filed by a principal/job-worker about details of goods sent to/received from a job-worker |

Annual, for annual aggregate turnover up to INR 50 million |

April 25th where annual aggregate turnover is up to INR 50 million |

|

FAQ: GST registration in India

Compulsory registration

The following categories of suppliers are mandatorily required to be registered irrespective of turnover:

- Taxable person carrying on interstate supply;

- Casual taxpayer / Non-resident taxable person;

- Businesses liable to pay tax under reverse charge;

- Agents supplying on behalf of taxable person;

- Input service distributor;

- Sellers on e-commerce platforms;

- E-commerce operators and aggregators liable to collect tax at source;

- Authorities responsible to withhold tax or deduct tax deducted at source (TDS); and

- Person supplying online information and database access or retrieval (OIDAR) services from a place outside India to a person in India, other than a registered taxable person.

Exemption from registration

The following shall not be required to obtain registration and will be allotted a UIN (Unique Identification Number) instead. They can receive refund of taxes on notified supplies of goods/services received by them:

- Any specialized agency of UNO (United Nations Organization) or any multilateral financial institution and organization notified under the United Nations Act, 1947;

- Consulate or embassy of foreign countries;

- Any other person notified by the Board/Commissioner; and

- The central government or state government may, on the recommendation of the GST council, notify exemption from registration to specific persons.

Voluntary registration

A person may opt for voluntary registration under GST even if he is not liable to be registered. All the provisions of GST applicable to a registered taxable person will similarly apply to such a voluntarily registered person also, that is, he will be treated as a normal taxable person.

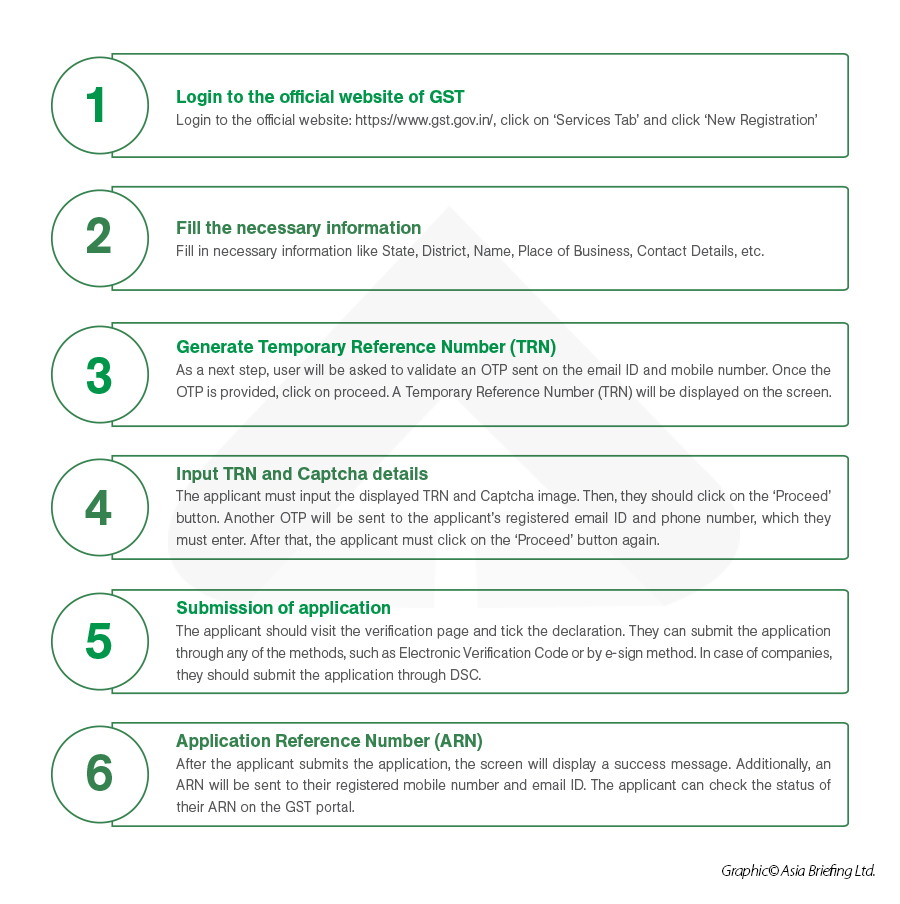

What is the process of registration for new businesses under GST?

Entities supplying taxable products and services to different states in India need to be registered in all the states from which the supplies are made. An entity already registered in a state under any existing law must migrate to the GST regime within the stipulated period.

What is the mode of payment of tax?

The payment of tax is in an electronic mode with a common ‘challan’ for all the taxes under three different modes of payment:

- Internet banking;

- Payments through RTGS/NEFT; and

- Over the counter payments (for payments up to INR 10,000 (US$135.60) per tax period) in cash, cheque or demand draft.

What is an E-Way Bill?

An E-Way Bill is a document required for the movement of goods valued over ₹50,000 (single invoice/bill/delivery challan) within or between states in India.

When is it required?

You need to generate an E-Way Bill when:

- Goods worth more than ₹50,000 are being transported.

- The movement is inter-state or intra-state (as notified by states).

- Even if the value is below ₹50,000, E-Way Bill is mandatory in these cases:

- Inter-state transfer of goods by a principal to a job worker.

- Inter-state transport of handicraft goods by a person exempt from GST registration.

Who should generate it?

|

Person Involved in Transport |

Responsibility to Generate |

|

Registered Supplier |

Must generate the E-Way Bill |

|

Registered Recipient |

If supplier doesn’t |

|

Transporter |

If neither party generates it and goods are handed over for transport |

What details are required?

- GSTIN of supplier and recipient

- Invoice/challan number and date

- HSN code and description of goods

- Quantity and value

- Transport details: vehicle number, transporter ID

Stricter e-way bill (EWB) regulations:

- Document Age Restriction for E-Way Bill (EWB) Generation means that when generating an E-Way Bill, the base document (such as an invoice, bill of supply, delivery challan, or credit note) used for the transportation of goods must not be older than 180 days from the date of EWB generation.

- Extension Limit: The total extension period for EWBs is capped at 360 days from the original generation date, preventing indefinite transit periods.

Validity of E-Way Bill

An e-way bill is valid for periods as listed below, which is based on the distance travelled by the goods. Validity is calculated from the date and time of generation of e-way bill-

|

Type of conveyance |

Distance |

Validity of EWB |

|

Other than over-dimensional cargo |

Less Than 200 Kms |

1 Day |

|

For every additional 200 Kms or part thereof |

additional 1 Day |

|

|

For Over dimensional cargo |

Less Than 20 Kms |

1 Day |

|

For every additional 20 Kms or part thereof |

additional 1 Day |

Validity of Eway bill can also be extended by the generator of such Eway bill either eight hours before expiry or within eight hours after its expiry.

Penalty for non-compliance

If goods are moved without an E-Way Bill when required:

- Goods and vehicle may be seized

- Penalty of ₹10,000 or tax sought to be evaded (whichever is higher)

To enhance security, all registered persons are required to comply with Two-Factor Authentication for the e-Way Bill/e-Invoice System starting April 1, 2025.