Top reasons to invest in India

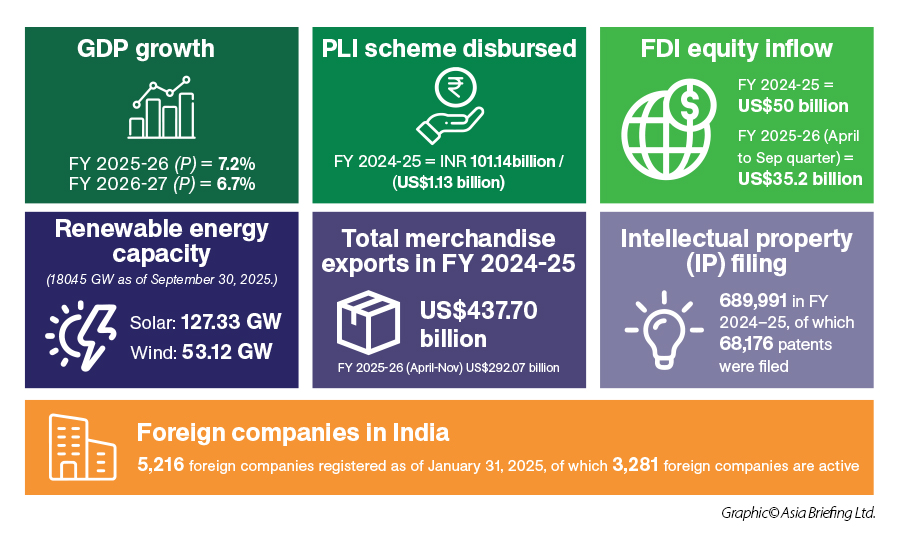

According to the Reserve Bank of India (RBI), India’s GDP growth for FY 2024–25 is estimated at 6.5 percent in constant price terms. On December 10, 2025, the Asian Development Bank (ADB) raised its growth projection for FY 2025–26 to 7.2 percent from the earlier estimate of 6.5 percent, largely supported by strong domestic consumption following recent tax reductions. This upward revision of 0.7 percentage points is expected to contribute to faster economic expansion across Asia, with regional growth now projected at 5.1 percent instead of the earlier forecast of 4.8 percent for 2025.

India’s GDP accelerated to 8.2 percent in the second quarter of FY 2025–26, compared with 5.6 percent during the same period in the previous year. Real GDP growth for the April–June quarter of FY 2025–26 is estimated at 7.8 percent, marking the fastest expansion in five quarters.

As per the Ministry of Corporate Affairs (MCA) Annual Report, as of January 31, 2025, India had approximately 2.8 million registered companies, of which 1.81 million were active. Additionally, there were 5,216 registered foreign companies operating in the country, with 3,281 (about 63 percent) classified as active.

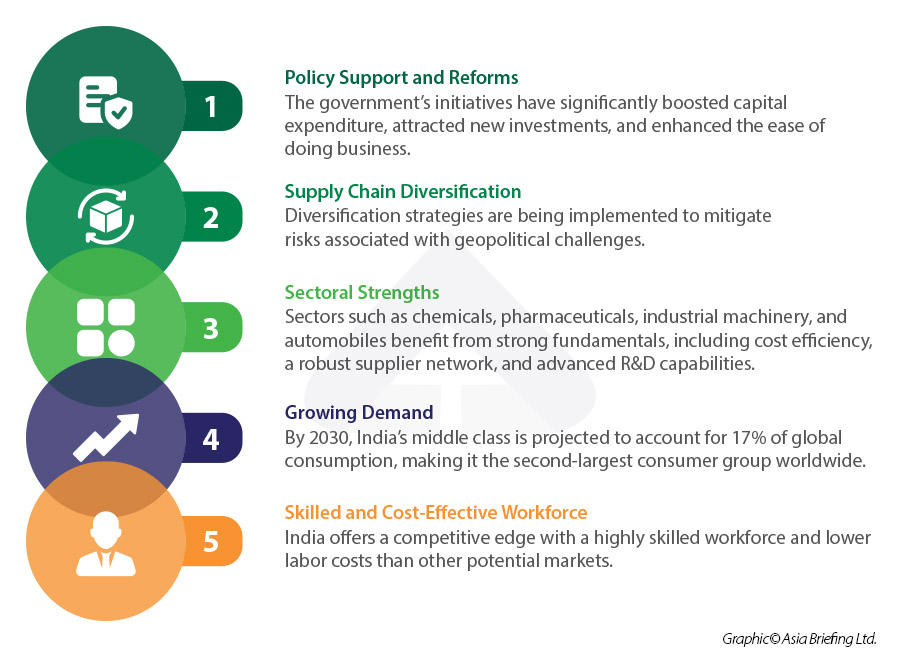

India’s steady rise in global rankings reflects a combination of factors, including technological advancements, policy interventions, and increasing private sector participation, all of which have contributed to its expanding economic footprint. By 2027, India is anticipated to overtake Germany, securing the third spot in the global rankings.

The country’s robust economic trajectory is underpinned by resilient growth and favorable demographics. After all, India is the most populous country in the world, with a median age of 28.2 years. After a prolonged pandemic, recovery in domestic demand, particularly in private consumption and household spending, should facilitate business expansion plans. India’s large consumer base, rising urban incomes, and the aspirations of the world’s largest young population are feeding into this. A recent World Bank report titled “Navigating the Storm” underlines that the Indian economy has proved remarkably resilient to the ongoing impacts of the deteriorating external environment, growing faster than most major emerging market economies (EMEs).

With the banking system in good health to support the nation’s economic recovery, private-sector investment is anticipated to rise in the forthcoming year, making India the bright spot in the Asian business and investment landscape.

Amidst these conditions, specific trends are also driving further increases in the country’s inbound investment and making India a hotbed for companies from around the world that are seeking to:

- Diversify their Asia presence;

- Access the Indian and South Asian markets;

- Supplement their China operations; and

Leverage highly attractive free trade agreements, production, and market advantages.

Ease of doing business

According to the IMD World Competitiveness Yearbook 2025, India ranks 41st out of 69 economies in overall competitiveness, reflecting moderate but steady improvement in several business-enabling dimensions. Performance indicators show relative strengths in economic performance and government efficiency, while business efficiency and infrastructure continue to present structural bottlenecks.

From a regulatory and institutional perspective, India demonstrates mixed outcomes. Areas such as business legislation, tax policy, and the institutional framework show incremental progress, improving transparency and predictability for investors.

Infrastructure quality remains a critical determinant of ease of doing business. While technological and basic infrastructure have improved, gaps persist in logistics efficiency, urban connectivity, and scientific infrastructure, affecting supply chain reliability and innovation capacity. Financial management practices and access to capital continue to strengthen, supported by rising inward direct investment stocks of approximately US$ 536.9 billion in 2023, signaling sustained investor confidence.

Economic outlook

India’s manufacturing performance

Manufacturing output rebounded in FY 2024–25, growing 4.26 percent versus 1.4 percent the previous year, supported by higher capacity utilization, increased investment, and the continued rollout of Production-Linked Incentive (PLI) schemes across 14 priority sectors, including electronics, automotive, pharmaceuticals, and advanced materials. Manufacturing accounts for about 14 percent of GDP, with the industrial sector contributing over 27 percent. With real GDP growth projected at 7.2 percent in FY 2025–26, manufacturing is expected to remain a key driver of economic expansion and exports.

Industrial output showed steady, moderate growth through 2025, with monthly IIP gains ranging from 1.5 to 5 percent and manufacturing leading overall expansion. Strong performance was recorded in electrical equipment, basic metals, transport equipment, machinery, and non-metallic minerals, underscoring the strength of capital goods, automotive, and infrastructure-linked industries. Temporary disruptions, including early monsoon impacts, moderated activity in some months, but domestic demand and capacity additions sustained overall resilience.

India’s innovation ecosystem continues to strengthen. Four cities now rank among the world’s top 100 science and technology clusters, led by Bengaluru and Delhi, and India improved its Global Innovation Index ranking to 38th in 2025, maintaining its leadership position in Central and South Asia.

.jpg)

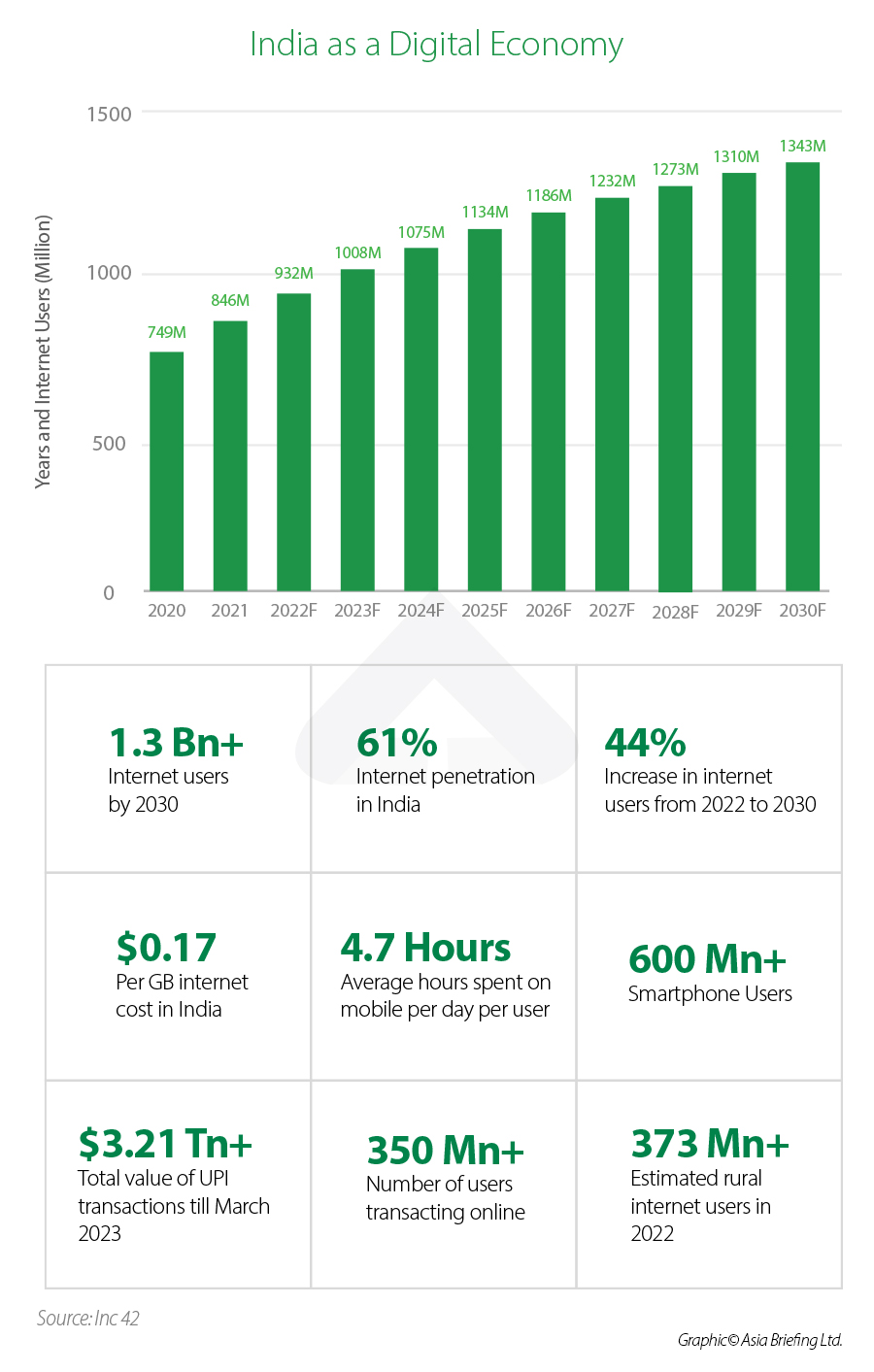

India as a Digital Economy

India’s International Free Trade and Tax Agreements

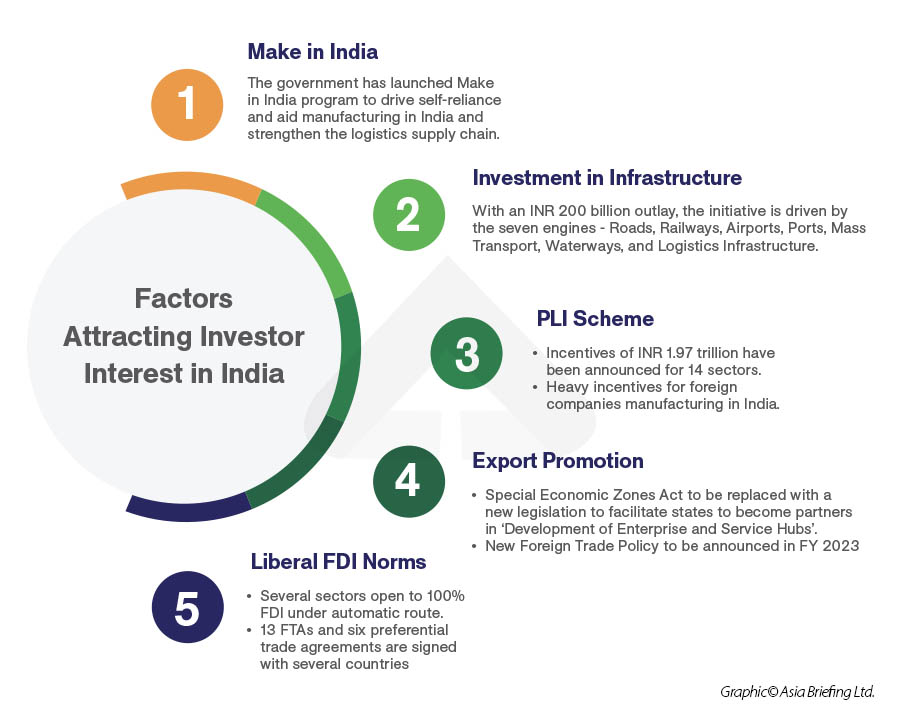

India has been proactively engaging in free trade agreements (FTAs) to strengthen its export-driven manufacturing sector. The country initially set an ambitious export target of US$450–500 billion for FY2023 and aims to reach US$2 trillion by 2030. Export performance has shown consistent growth, with significant increases in both merchandise and services exports.

Over the past five years, India has successfully concluded trade agreements with several partners, including Mauritius, the UAE, and Australia. Notably, the India-UAE Comprehensive Economic Cooperation and Partnership Agreement (CEPA) has been in effect since May 2022, while the India-Australia Economic Cooperation and Trade Agreement (ECTA) was implemented on December 29, 2022.

India’s trade agreements span five categories:

- Free Trade Agreements (FTAs): Tariff reduction/elimination with partners such as Japan,

South Korea, ASEAN, UAE, and Australia. - Preferential Trade Agreements (PTAs): Limited tariff preferences (e.g., India–MERCOSUR,

India–Chile). - Comprehensive Economic Partnerships/Cooperation Agreements (CEPAs/CECAs): Inclusive

of goods, services, investment, and regulatory alignment (e.g., Singapore, South Korea). - Bilateral Investment Treaties (BITs): Investment protection frameworks (e.g., UAE, Uzbekistan,

Kyrgyzstan). - Regional Trade Agreements (RTAs): Multilateral arrangements such as SAFTA and APTA.

Double Tax Avoidance Agreements

Double Tax Avoidance Agreements treaties effectively eliminate double taxation by identifying exemptions or reducing the amount of taxes payable in India.

India has one of the largest networks of tax treaties for the avoidance of double taxation and prevention of tax evasion. India has established over 94 comprehensive DTAAs and eight limited DTAAs, compared with China’s 114 and Vietnam’s 80. The purpose of such tax treaties is to develop a fair and equitable system for the allocation of the right to tax several types of income between the ‘source’ and ‘residence’ countries

It is, therefore, extremely worthwhile for foreign investors to be aware of which double taxation avoidance agreements (DTAAs) between India and other countries might be applicable to their situation, as well as understand how these agreements are applied.

Why do businesses relocate to India?

To size up India, or any country, as a potential destination for relocation, it is vital that foreign investors diligently research their options across many factors that are relevant to their situation. Such factors may include infrastructure, locations, talent availability, access to raw materials, incentives, supply chain partners and logistics, and others.

The country has doubled down on efforts to diversify its economy, resulting in the prominence of its services sectors, boosted by information and communication technologies capabilities and English as the lingua franca.

Here are some top reasons (to add to the reasons listed above) why companies choose to relocate to India:

- India is a prime location for foreign multinationals - a major investment hub in South Asia and well-connected to central, west, southeast, and east Asian countries.

- The country has doubled down on efforts to diversify its economy, resulting in the prominence of its services sectors, boosted by information and communication technologies capabilities and the labor forces' English language skills.

- Numerous industrial zones, workforce and labor availability, lower labor costs, and a relatively open environment for foreign direct investments.

- India’s large labor and consumer base, low operating costs, and linkages to important international markets.

- Well-established Judiciary and prevalence of the rule of law.

- India is a democratic, secular republic with a stable political environment and broad consensus across the political spectrum on the direction of the economy.

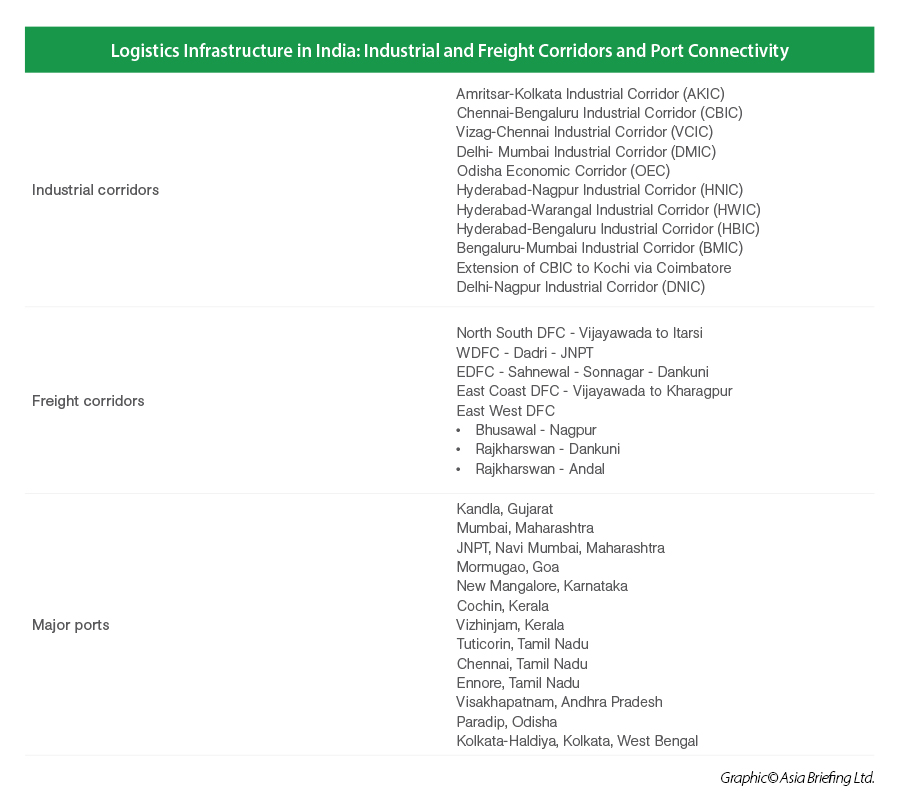

- Massive investment in infrastructure to improve last mile connectivity, speed up and reduce the cost of carrying goods:

- East and west dedicated rail freight corridors;

- National Infrastructure pipeline;

- Gatishakti; and

- Sagarmala.

India’s advantage as a China +1 destination

As of March 2025, new tariffs imposed by the U.S. on Chinese imports have further complicated this situation, with tariffs rising from 10 percent to 20 percent, prompting China to retaliate with tariffs on American agricultural products. This has pressured foreign-invested businesses that had been reliant on China sourcing or production to diversify or seek alternative destinations.

China’s costs have been rising for more than two decades, in and around its tier 1 and tier 2 cities, and are significantly higher in terms of operating costs than India’s. There is very high competition in China for skilled labor, and coupled with China’s aging population, has resulted in labor shortages in certain manufacturing, high-tech, and other specialized sectors.

On the other hand, in addition to a population of 1.4 billion people, India has a large, young population. More than half of India’s total population is under the age of 25, and two-thirds are less than 35 years of age. By 2027, India is likely to have the world’s largest workforce, with a billion people aged between 15 and 64. Analysts expect this large, young workforce to make a significant contribution to India’s growing consumer base.

India has some of the lowest labor costs in Asia: an hourly labor cost in India is roughly one-third the cost of the same hour in China.

India’s infrastructure development

India introduced the National Infrastructure Pipeline (NIP) covering FY 2019 to FY 2025 to create a broad pipeline of projects focused on building, modernizing, and expanding essential infrastructure. The program encompasses key sectors including roads, housing, urban development, railways, conventional and renewable energy, and irrigation. Highways and rail networks remain central priorities, underscoring the government’s objective to improve logistics efficiency and facilitate industrial expansion.

The Industrial Corridor Projects under the National Industrial Corridor Program reflect this strategy in practice. By developing advanced industrial cities and strengthening inter-city connectivity, these corridors aim to enhance the integration of domestic manufacturing hubs into global value chains and improve India’s competitiveness as an investment destination.

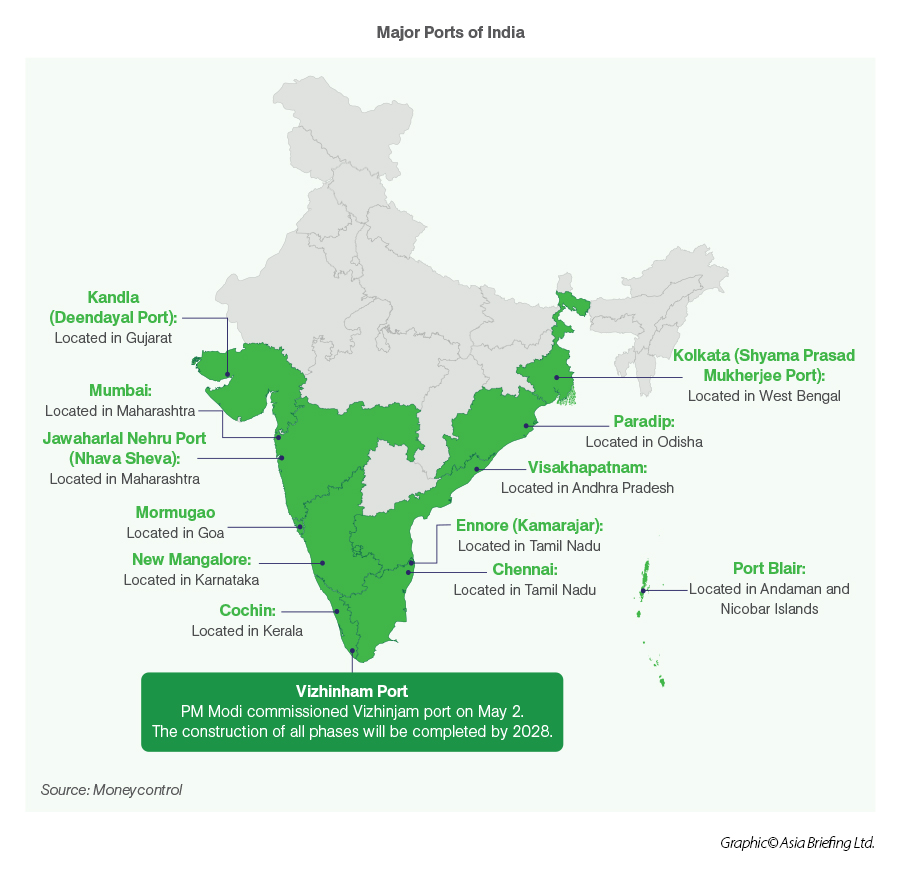

Vizhinjam International Seaport Ltd. (VISL), a Government of Kerala special purpose entity, is developing India’s first deep-water, all-weather container transshipment port at Vizhinjam under a PPP model, with operations managed by Adani Vizhinjam Port Pvt. Ltd. Located 10 nautical miles from the main east–west shipping corridor, the port offers an initial capacity of about 1 million TEUs, scalable to over 6.2 million TEUs, strengthening India’s transshipment competitiveness.

Vizhinjam International Seaport Ltd. (VISL), a Government of Kerala special purpose entity, is developing India’s first deep-water, all-weather container transshipment port at Vizhinjam under a PPP model, with operations managed by Adani Vizhinjam Port Pvt. Ltd. Located 10 nautical miles from the main east–west shipping corridor, the port offers an initial capacity of about 1 million TEUs, scalable to over 6.2 million TEUs, strengthening India’s transshipment competitiveness.

Between July 2024 and July 2025, it handled 393 vessels and approximately 830,000 containers, including 23 ultra-large container ships. EXIM operations will commence once road connectivity is completed, with rail links targeted within three years. The port is expected to reduce transit times and logistics costs for southern and western India, while catalyzing port-led development through logistics parks, warehousing, FTZs, and multimodal connectivity, with future berth expansion and full hinterland integration critical to realizing its long-term hub potential.

Incentives, workforce, and economic zones

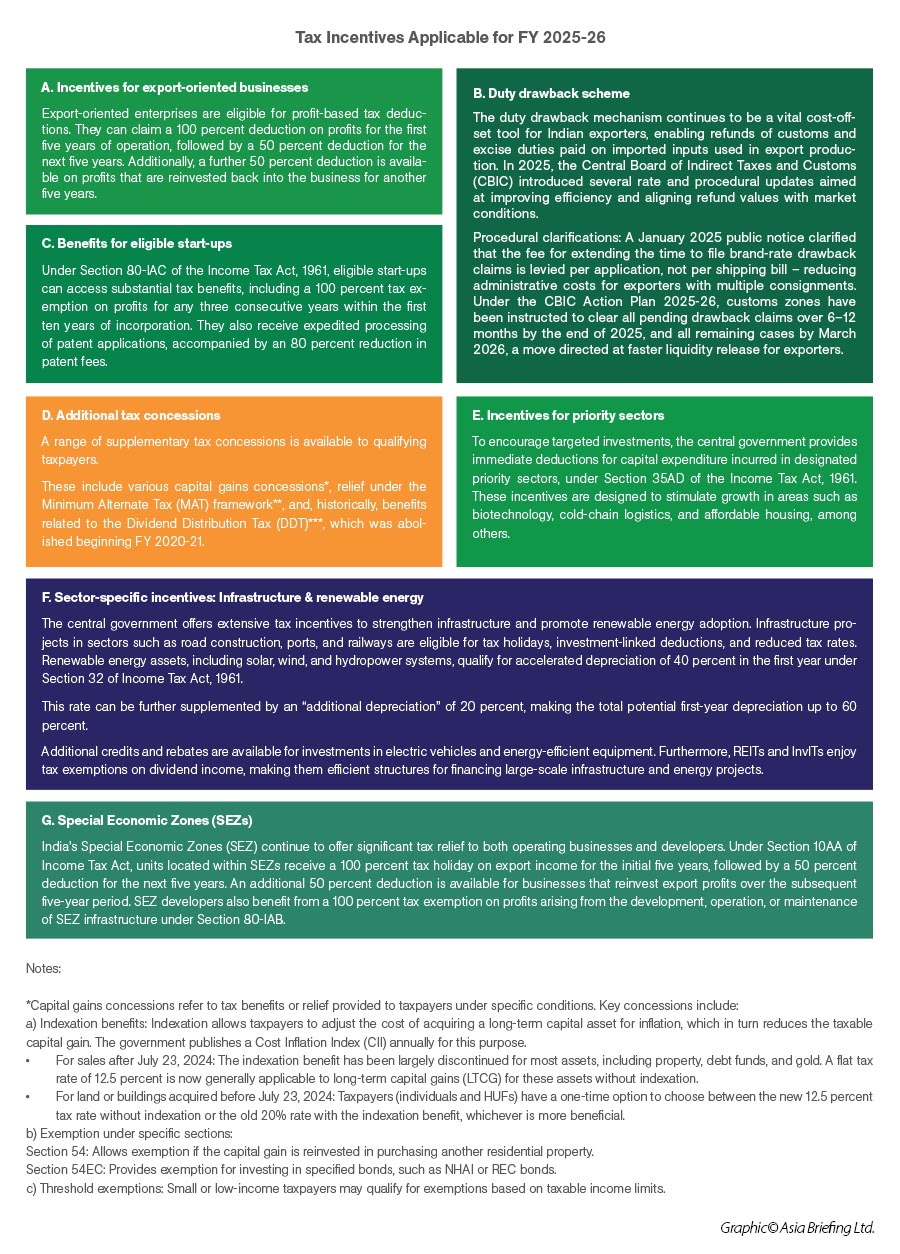

Incentives for doing business in India

There are various incentives available to businesses depending on the economic activity, industry, location, and size of the firm.

India offers tax relief at both the central and state level. Additional incentives are available to investors in specific sectors, while India’s special economic zones (SEZs) offer their own comprehensive tax relief. However, not all tax benefits offered are mutually inclusive.

Corporate tax incentives for eligible companies

- Tax on domestic companies engaged in manufacturing, set up after April 1, 2016, shall be a 25 percent rate provided such companies do not avail specific tax incentives or deductions.

- With effect from April 1, 2020 the corporate income tax rate for domestic companies is 22 percent rate, provided such companies do not avail of specific tax incentives or deductions.

- Tax on new domestic manufacturing companies set up after October 1, 2019, is 15 percent, provided such new manufacturing company is set up before March 31, 2024.

The concessional tax regime (22 percent) for domestic enterprises is applicable only if they do not avail of specific tax incentives or deductions. (The effective tax rate for these domestic companies is around 25.17 percent inclusive of surcharge and cess.)

Those companies opting for the concessional corporate tax rate do not have to pay minimum alternate tax. India’s current effective tax rate brings it at par, on average, with leading Asian investment destinations and manufacturing hubs like China, Vietnam, Malaysia, Singapore, and South Korea.

Other incentive types

Several other types of incentives are offered by the Indian government in qualifying, special circumstances. These are explained in our incentives guide.

Foreign companies choosing where to set up in any of India’s states should note that each region has its own set of policies and incentive schemes. The applicability of incentives usually varies based on:

- The state’s location;

- The products that will be manufactured;

- The scale of investment; and

- The creation of jobs.

India’s promising workforce

India possesses a large labor pool, with approximately 64.4 percent of its 1.4 billion population in the working-age group, a figure expected to rise further by 2031. Naturally, the structure of India’s labor market is diverse, and foreign companies must understand this complexity to benefit from the country’s demographic dividend.

A significant portion of the working population is engaged in the informal sector, working for small businesses or manufacturing units that employ fewer than ten individuals. For businesses that do not require highly skilled labor, sourcing workers remains relatively accessible due to this wide labor base.

While the expansion of higher education and vocational training has improved access to skilled talent, formally skilled workers still represent only about 4.7 percent of the labor force. Additionally, only around 12 percent of the workforce holds university-level qualifications. Companies seeking skilled labor must be prepared to compete aggressively for talent within this comparatively limited pool.

Labor costs in India

Firms considering entry into the Indian market often evaluate labor costs as a critical decision factor. India continues to offer a competitive edge due to its low wage structure and expansive labor supply. For instance, minimum wages are not fixed nationally but vary by state and job category. The lowest daily wage rate starts at INR 176 (US$2.11), while in high-cost regions like Delhi, it can go up to INR 423 (US$5.08) per day.

Employers should note that these rates represent floor-level benchmarks, commonly used for unskilled and semi-skilled labor, especially in the manufacturing sector.

Labor costs also differ significantly by region. In tier-2 and tier-3 cities, wages can be up to 25 percent lower than in tier-1 cities due to reduced costs of living and benefits. For instance, the average annual salary of a software engineer in New Delhi is around US$9,600–10,800, while in Mysore, it may range from US$6,500–8,000, depending on experience and role. These disparities make regional site selection a strategic factor in workforce planning.

Special Economic Zones

Special economic zones (SEZs) in India are areas that offer incentives to resident businesses. SEZs typically offer competitive infrastructure, duty-free exports, tax incentives, and other measures designed to make it easier to conduct business. Accordingly, SEZs in India are a popular investment destination for many multinationals, particularly exporters.

While India’s SEZs are similar to those found in other parts of Asia, business leaders who are considering setting up a SEZ should seek to understand how SEZs work in India. Each SEZ is unique. Many business leaders conduct market entry studies that compare sites, resources, tax incentives, and costs before making site visits.

Summary: Top 10 reasons to invest in India

|

1. |

Strategic Location |

Strategic destination for manufacturing and China +1, a major investment hub in South Asia, and well connected to central, west, southeast, and east Asian countries |

|

2. |

Growing Economy |

Strong economic GDP growth, including continuing annual GDP growth, competing consistently with global and regional peers. |

|

3. |

Network of SEZs |

Multiple SEZs offer competitive infrastructure, duty-free exports, tax incentives, and other measures designed to make it easier to conduct business. |

|

4. |

Ease of Doing Business |

Improving ease of doing business for foreign investors. |

|

5. |

Large, young labor force |

By 2027, India is likely to have the world’s largest workforce, with a billion people aged between 15 and 64. |

|

6. |

Incentives for Doing Business |

There are various incentives available to businesses depending on the economic activity, industry, location, and size of the firm. |

|

7. |

Strong FDI Environment |

Most sectors are open to FDI.

|

|

8. |

Progress in Infrastructure Development |

Major infrastructure schemes like Bharatmala (roads), Sagarmala (ports), UDAN (airports), and Gati Shakti (multi-modal logistics) are bridging India’s infrastructure gap, enhancing business efficiency and logistics. |

|

9. |

Network of FTA's and DTAs |

India has over 13 active FTAs (e.g., with UAE, Japan, ASEAN, Australia, Mauritius) and more than 90+ Double Taxation Avoidance Agreements (DTAAs), easing trade and tax burdens for foreign investors. |

|

10. |

Integration with Legal Frameworks |

India is a WTO member and party to global IP, patent, and trade protection treaties (TRIPS, Berne Convention, WIPO, etc.), providing strong legal backing for cross-border investments and IP rights. |