This article highlights India’s current trade trends as well as long-term projections that peg India’s export valuation at US$1 trillion by 2030. While discussing recent trade agreements and the opportunities to boost trade, we provide a detailed explainer of export-import procedures in India and the process of setting up a trading company. It must be noted that the current procedures are governed by the Foreign Trade Policy 2015-20, which has been extended till March 30, 2023.

India’s trade statistics have amplified exponentially in the recent years, with financial year 2021-22 (FY 2022) recording the highest ever value of merchandise exports. The government is buoyant about hitting the US$500 billion export target in FY 2023 through rupee-denominated trade and various recent bilateral free trade agreements (FTAs), such as those signed with the United Arab Emirates (UAE) and Australia.

To make Indian exports globally more competitive, India also recently released National Logistics Policy, which provides for seamless integration of multiple modes of transportation by leveraging technology, processes, and skilled manpower. The policy, which is in line with PM GatiShakti National Master Plan, will give a massive boost to India's US$200 billion logistics sector, thereby enabling smooth movement of goods both domestically and internationally.

India’s trade trends and outlook

India’s aggressive policy push, coupled with large scale infrastructural augmentation, has resulted in increased volume of exports and imports in the last few years. Some of India's top trading partners include the United States (US), which surpassed China in the previous fiscal to emerge as India's largest trading partner. UAE, too, has emerged as one of India's top trading partners on the back of increasing oil trade.

In FY 2022, merchandise exports from India reached a new high at US$417.81 billion, marking a surge of 43.18 percent over the US$291.18 billion recorded in FY 2021. During the same period, India’s merchandise imports soared to US$610.22 billion, an increase of 54.71 percent over the U$394.44 billion registered during FY 2021.

|

India’s Top Trading Partners in FY 2021-22 (in US$ Million) |

||||

|

Country |

Export |

Import |

Total trade |

Trade balance |

|

US |

76,167.01 |

43,314.07 |

119,481.08 |

32,852.94 |

|

China |

21,259.79 |

94,570.57 |

115,830.36 |

-73,310.78 |

|

UAE |

28,044.88 |

44,833.48 |

72,878.36 |

-16,788.60 |

|

Saudi Arabia |

8,758.94 |

34,100.58 |

42,859.52 |

-25,341.64 |

|

Iraq |

2,403.27 |

31,927.05 |

34,330.33 |

-29,523.78 |

|

Singapore |

11,150.61 |

18,962.19 |

30,112.80 |

-7,811.58 |

|

Hong Kong |

10,984.80 |

19,096.61 |

30,081.41 |

-8,111.81 |

|

Indonesia |

8,471.51 |

17,702.83 |

26,174.34 |

-9,231.31 |

|

Korea Rp |

8,085.03 |

17,477.20 |

25,562.24 |

-9,392.17 |

|

Australia |

8,283.13 |

16,756.17 |

25,039.30 |

-8,473.04 |

|

Germany |

9,883.34 |

14,968.10 |

24,851.43 |

-5,084.76 |

|

Switzerland |

1,348.57 |

23,392.32 |

24,740.89 |

-22,043.76 |

|

Japan |

6,176.77 |

14,399.77 |

20,576.54 |

-8,222.99 |

|

Belgium |

10,084.37 |

9,951.65 |

20,036.02 |

132.72 |

|

Malaysia |

6,995.04 |

12,424.20 |

19,419.24 |

-5,429.16 |

|

Bangladesh |

16,156.37 |

1,977.93 |

18,134.30 |

14,178.44 |

|

UK |

10,461.29 |

7,017.78 |

17,479.07 |

3,443.51 |

|

South Africa |

6,085.29 |

10,965.81 |

17,051.10 |

-4,880.52 |

|

Netherland |

12,543.69 |

4,478.10 |

17,021.79 |

8,065.59 |

|

Thailand |

5,751.30 |

9,332.59 |

15,083.88 |

-3,581.29 |

|

Qatar |

1,837.75 |

13,193.70 |

15,031.45 |

-11,355.95 |

|

Nigeria |

4,663.17 |

10,291.58 |

14,954.75 |

-5,628.40 |

|

Vietnam |

6,702.67 |

7,438.52 |

14,141.19 |

-735.85 |

|

Italy |

8,180.76 |

5,048.47 |

13,229.22 |

3,132.29 |

|

Russia |

3,254.68 |

9,869.99 |

13,124.68 |

-6,615.31 |

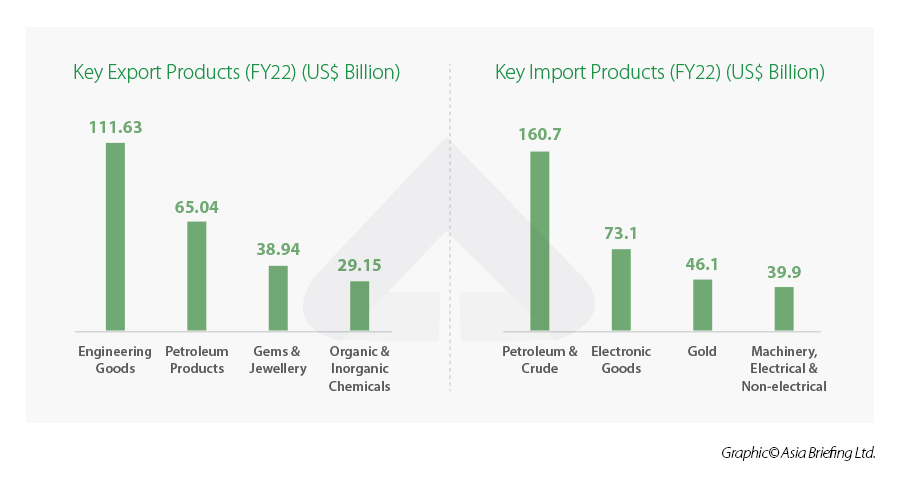

India’s top exports

The top exports of India are engineering goods, gems and jewelry, petroleum products, drugs and pharmaceuticals, organic chemicals, electronic goods, etc.

India’s import basket primarily comprises petroleum and crude products, electronic goods, gold, machinery and electrical appliances, pearls, stones and semi-precious metals, transport equipment, etc.

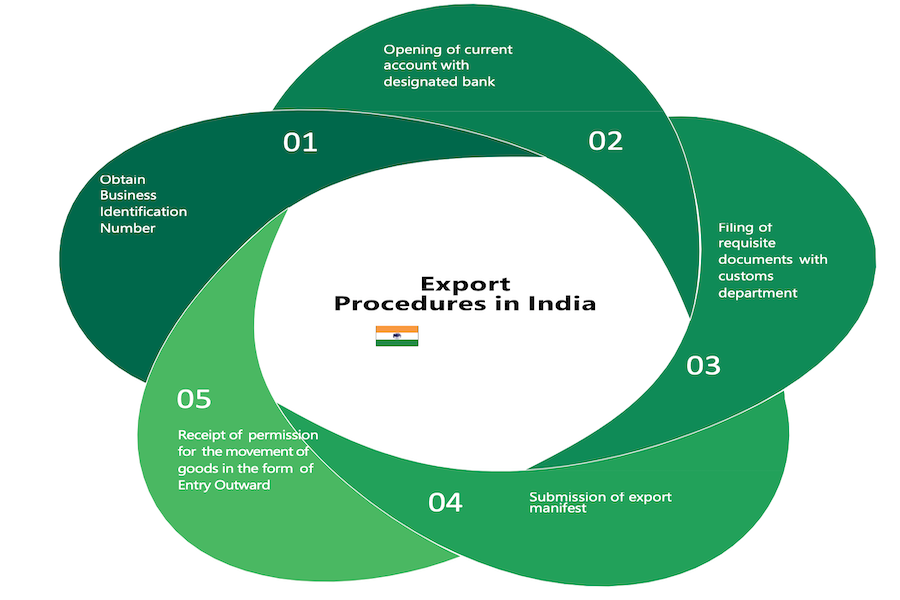

Export-import procedures in India

Foreign trade in India is promoted and facilitated by the Directorate General of Foreign Trade (DGFT), under the Ministry of Commerce and Industry.

The DGFT issues the authorization to exporters and monitors their corresponding obligations through a network of 38 regional offices. The DGFT also implements the Foreign Trade Policy (FTP), which is notified by Foreign Trade (Development & Regulation) Act, 1992.

Presently, the Foreign Trade Policy 2015-2020 has been effective since April 1, 2015 – having now been extended till March 30, 2023.

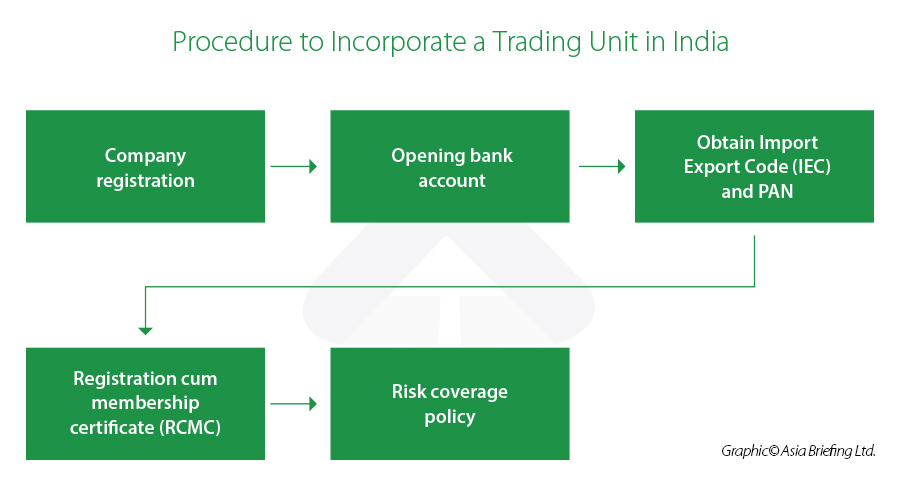

Procedure to set up an export-import unit in India

- Establishing a unit: To start the export business, first a sole proprietary concern, partnership firm, or a company has to be set up as per procedure.

- Opening a bank account: A current account with a bank authorized to deal in foreign exchange should be opened.

- Obtaining permanent account number (PAN): It is necessary for every exporter and importer to obtain a PAN from the Income Tax (IT) Department.

- Obtaining importer-exporter code (IEC) number: As per the FTP, it is mandatory to obtain the IEC for export and import from India. An application for IEC is filed online with the DGFT as per ANF 2A, and an online payment of application fee of INR 500 through net banking or credit/debit card must be made along with submission of requisite documents as mentioned in the application form.

- Registration cum membership certificate (RCMC): Exporters are required to obtain RCMC granted by the concerned Export Promotion Councils (EPCs), Federation of Indian Export Organization (FIEO), Commodity Boards, or authorities in order to avail authorization to export-import or any other benefit or concession under FTP 2015-2020. RCMC is also required to avail the services and guidance from EPCs.

- Covering risks through ECGC: Risks involved in international trade owing to buyer or country insolvency can be covered by an appropriate policy from the Export Credit Guarantee Corporation Ltd (ECGC). Where the buyer is placing order without making advance payment or opening Letter of Credit, it is advisable to procure credit limit on the foreign buyer from ECGC to protect against risk of non-payment.

Export-import documentation in India

All the export or import applications must be filed with the DGFT. As per the Foreign Trade Policy 2015-20, following are the mandatory documents needed for an EXIM unit to export or import from India:

|

Mandatory documents for export and import in India |

|

|

Export |

Import |

|

Bill of Lading, Airway Bill, Lorry Receipt, Railway Receipt, Postal Receipt |

Bill of Lading, Airway Bill, Lorry Receipt, Railway Receipt, Postal Receipt in Form CN-22 or CN-23 |

|

Commercial Invoice cum Packing list |

Commercial Invoice cum Packing list |

|

Shipping Bill, Bill of Export, Postal Bill of Export |

Bill of Entry |

Apart from the above-mentioned mandatory documents, additional documents like certificate of origin and inspection certificate may be required on case-to-case basis.

Other important export import procedures and documentation include the following:

- GST Return Forms (GSTR 1 and GSTR 2) and GSTR Refund Form

- Exchange Control Declaration

- Bank Realization Certificate

- RCMC

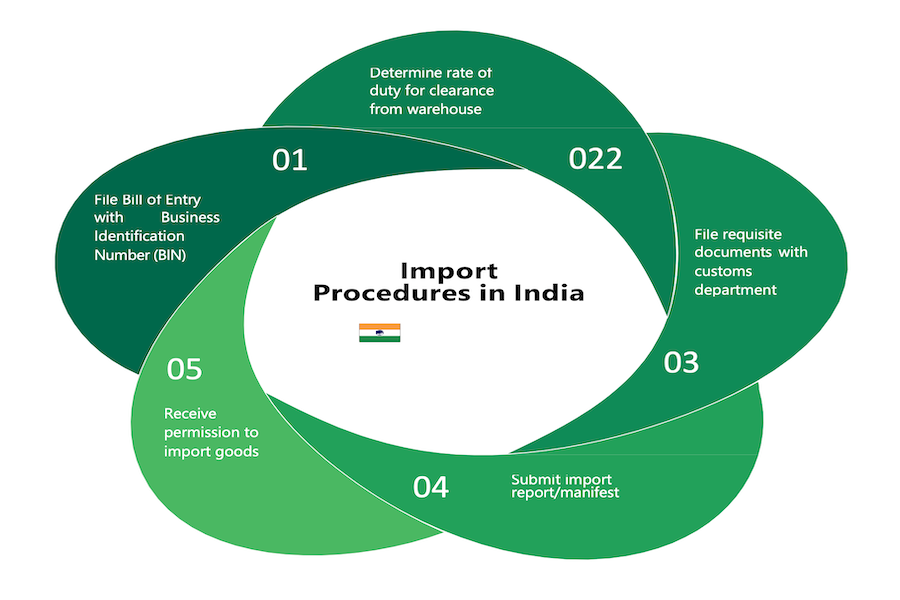

How to import goods in India?

Obtaining import license and quota

The importer must attach the following documents to their application form:

- Receipt which shows that import license fee has been paid.

- Certificate from a Chartered Accountant (CA) showing the total value of goods to be imported.

- Verification certificate for income tax

The Indian Trade Classification – Harmonized System (ITC-HS) allows for the free import of most goods without a special import license. Most items fall within the scope of India’s export-import policy regulation of Open General License. This means that products can be freely importable without restrictions and without a license unless they are regulated by the provisions of the policy or applicable laws.

However, certain goods that fall under the following categories require special permission or licensing.

Imports of items not covered by Open General License are regulated and fall into three categories:

- Banned or prohibited items: These goods are strictly prohibited from import and include tallow fat, animal rennet, wild animals, and unprocessed ivory.

- Restricted items requiring an import license

- Canalized items: Canalized items can only be imported via specific transportation channels and methods or through government agencies such as the State Trading Corporation (STC). These include petroleum products, bulk agricultural products, such as grains and vegetable oils, and some pharmaceutical products.

Following authorities are responsible for issuing import license for respective commodities:

- Department of Electronics for computer and computer-related systems

- Department for the Promotion of Industry and Internal Trade (DPIIIT - Technical Support Wing) for organized sector units registered under it, except for computers and computer-based systems

- Ministry of Defense for defense-related items

- DGFT for small-scale industries not covered above

Obtaining foreign exchange

Before placing any order, the importer must apply to the Exchange Control Department (ECD) of Reserve Bank of India (RBI) for the release of requisite foreign exchange. The importer should forward the application through their bank. The ECD verifies the application of the importer, and if found valid, sanctions the foreign exchange for the particular transaction.

Placing an order

The importer may either place the order directly or through an agent. In case of canalized items, they must obtain the imports through the canalizing agency. The importer cannot directly import such canalized items. They have to place an order with the canalizing agency who shall import and supply the same.

Dispatching Letter of Credit

After getting the confirmation from the supplier regarding the supply of goods, the importer requests their bank to issue a Letter of Credit in favor of the supplier.

Appointing clearing and forwarding agents

The importer must make arrangements to appoint clearing and forwarding agents to clear the goods from the customs.

Receipt of shipment device

At this stage, the importer receives the shipment advice from the exporter, which states the date on which the goods are loaded on the ship. This shipment advice helps the importer to make arrangements for clearance of goods.

Receipts of documents

The importer’s bank receives the documents from the exporter’s bank. These documents include bill of exchange, a copy of Bill of Lading, certificate of origin, commercial invoice, consular invoice, packing list, and other relevant documents. The importer makes payment to the bank (if not paid earlier) and collects the documents.

Bill of Entry

Every importer is required to begin by submitting a Bill of Entry under Section 46 of the customs Act, 1962. This document certifies the description and value of goods entering the country. The Bill of Entry should be submitted as follows:

- The original and duplicate for customs

- A copy for the bank

- A copy for the importer

- A copy for making remittances

Under the Electronic Data Interchange (EDI), no formal Bill of Entry is required (as it is recorded electronically) but the importer is required to file a cargo declaration after prescribing particulars required for the processing of the entry for customs clearance. Bills of entry can be one of three types:

- Bill of Entry for home consumption: This form is used when the imported goods are to be cleared on payment of full duty. Home consumption means use within India. It is white colored and hence often called the ‘white Bill of Entry’.

- Bill of Entry for warehousing: If the imported goods are not required immediately on arrival at port, importers may store the goods in a warehouse without the payment of duty under a bond and clear them from the warehouse when required on payment of duty. This enables the deferment of payment of the customs duty until goods are actually required. This Bill of Entry is printed on yellow paper and is thus often called the ‘yellow Bill of Entry’. It is also called the ‘into bond Bill of Entry’ as the bond is executed for the transfer of goods in a warehouse without paying duty.

- Bill of Entry for ex-bond clearance: The third type is for ex-bond clearance. This is used for clearance from the warehouse on payment of duty and is printed on green paper.

Extra documentation may be required if a Bill of Entry is filed without using the Electronic Data Interchange system. These are:

- Signed invoice

- Packing list

- Bill of Lading or delivery order/air waybill

- GATT declaration form

- Importer/CHA declaration

- Import license wherever necessary

- Letter of Credit/bank draft

- Insurance document

- Industrial license, if required

- Test report, in case of chemicals

- Ad hoc exemption order

- Duty Exemption Entitlement Certificate (DEEC) / Duty Entitlement Pass Book (DEPB) in original, where applicable

- Catalogue, technical write up, literature in case of machineries

- Spares or chemicals as may be applicable

- Separately split up value of spares, components, and machinery

- Certificate of Origin, if preferential rate of duty is claimed

Delivery order

The clearing agents obtain the delivery order from the office of the shipping company. Once the payment of freight, if any, is completed.

Clearing of goods

The clearing agents are required to pay the necessary dock or port trust dues and obtains the Port Trust Receipt in two copies. Thereafter, the clearing agent approach the Customs House and presents one copy of Port Trust Receipt, and two copies of Bill of Entry to the customs authorities. The customs officer endorses the Bill of Entry Forms and one copy of Bill of Entry is handed back to the importer. The importer then pays the customs duty and clears the goods. In case, the customs duty is not paid, then the goods are stored in the bonded warehouses. As and when the duty is paid, the goods are cleared from the docks.

Payment to clearing and forwarding agent

Once the goods have been cleared from the docks, the importer makes the necessary payment to the clearing agent for his various expenses and fees.

Payment to exporter

The importer is obligated to make payment to the exporter who usually draws a bill of exchange. The importer has to accept the bill and make payment.

How to export goods from India?

Once an exporting unit has been incorporated and an IEC and RCMC has been obtained, exporters must also get inspection certifications.

According to the Export (Quality and Inspection) Act of 1963, it is critical to ensure the effective functioning of India's export trade. The Indian Export Inspection Council will assist in obtaining inspection certificates.

The following steps must be followed to successfully export products from India.

Authorised Dealer (AD) Code registration

AD code must be registered with any scheduled commercial bank in India before filing any export bill. The scheduled bank will generate the AD code using the IEC code. In addition, the exporter must register their IEC and AD codes with customs officials. The AD code is used to determine whether or not export proceeds have been realized.

Goods and Services Tax (GST) registration

Every exporter can register with their GSTIN in Part A of Form GST REG-01 on the shared platform, regardless of their turnover. Exports of goods and services are classified as zero-rated supplies under GST. If GST is paid at any point of supply against exports from India, a trader may either export without the payment of IGST under bond or letter of undertaking, or may pay the IGST and claim refund later.

Product and market selection

Apart from a few goods on the restricted or prohibited list, the rest of the products can be freely exported. Following a thorough examination of the trends in the export of various items from India, a proper selection of the product(s) to be exported can be made.

Furthermore, after researching market size, competition, quality criteria, payment arrangements, etc., the overseas market should be chosen.

Identifying buyers and providing sample products

Participation in trade fairs, buyer-seller meetings, exhibitions, business-to-business (B2B) portals, and web browsing are efficient mechanisms to locate buyers. Export Promotion Councils (EPCs), and overseas chambers of commerce can also assist in securing potential target buyers. Once they have been identified, providing customized samples to meet the needs of foreign buyers can assist in the gaining of export orders. FTP 2015-2020 provides for unlimited exports of genuine trade and technical specimens of freely exportable commodities.

Obtain the services of a freight forwarder

The goods can be transported by sea, land, or air. The following three factors determine the freight rates:

- Mode of transport

- Port of arrival

- Quantity of shipment

Proforma invoice (PI)

Following the initial discussion with the customer, the exporter should send the buyer a proforma invoice with details such as quality, goods description, payment method, mode of shipping, packing material etc. When the buyer receives the proforma invoice, they must approve it before moving on to the next phase.

Shipping instructions (SI)

Depending on the nature of the goods, they must be shipped according to specified guidelines. Items which are hazardous, perishable, etc. must be shipped following various international treaties. The freight forwarder provides shipping instructions after learning about the many aspects of the shipment.

Commercial invoice (CI)

A commercial invoice is similar to a standard sales invoice and should be prepared when the buyer has confirmed the export order.

Labelling, packing, and marking

Export items must be labelled, wrapped, and packed following the buyer's precise instructions. Address, package number, port and place of destination, weight, handling instructions, and other markings offer identification and information about the cargo packed.

Certificate of origin

While clearing customs, the customs authority seeks the certificate of origin, which establishes the product's origin. The name and address of the exporter, characteristics of the goods, package number or shipping marks, and quantity, if applicable, are generally included on a certificate of origin.

Shipping bill

A shipping bill is generated when the commercial bill, PI, or other documents are submitted. The shipping bill must then be lodged with the appropriate port. The shipment bill can be submitted via the ICE gate website. Following receipt of the shipping bill, the assessing officer must verify the accuracy of the information supplied and the exportability of the products as per procedure.

Let export order (LEO)

Once the evaluating officer is satisfied, a Let Export Order will be issued.

Loading of goods in container

The shipping bill and LEO must be provided to the shipping agent, who will then contact the Proper Officer to request shipping permission. Customs officials supervise the loading of commodities onto the ship.

Bill of Lading (BL)

After the items have been loaded, the carrier vessel issues a BL. It specifies the items' name, means of transportation, mode of payment, and packing content, among other things. BL will be given to the buyer of the products to claim the items when they arrive in their country.

Insurance

A marine insurance policy covers the danger of loss or damage to the products while they are in transit. Exporters generally arrange insurance for CIF contracts, whereas buyers obtain insurance for cost and freight (C&F) and Free On Board (FOB) contracts.

Export general manifest (EGM)

Within a week of the cargo sailing, shipping lines or agents submit the EGM to customs. The EGM contains a list of all goods loaded or present on the ship as it sailed away from the port and serves as the final confirmation of the goods' physical export. This also aids in the approval of duty exemptions.

Submission of documents to bank

Following shipment, the paperwork must be presented to the bank within 21 days for forwarding to the foreign bank for payment arrangements.

The following documents should be submitted:

- Invoice

- Packing List

- Airway Bill/Bill of Lading

- Bill of exchange

- Certificate of origin

- Declaration under Foreign Exchange

- Letter of Credit

Document transmission from bank to bank

The negotiating bank will examine the shipping documents and forward them to the importer's banker so that they can clear the consignment. It is expected of such authorised dealers to assure receipt of export proceeds, which must be communicated to the RBI by quarterly returns.

Receipt of bank certificate

Once payment is received, authorised dealers will issue bank certificates to the exporter, and only with the issuance of the bank certificate will the export transaction be completed. Exporters are required to negotiate shipping documentation exclusively through approved Reserve Bank dealers. Only through this system can the RBI secure receipt of export revenues for products transported out of the country.

This article was first published on October 3, 2022 and last updated on October 19, 2022.