India's retail industry is rapidly growing due to the entry of new players. With a large population, a growing middle class, and an emerging luxury spending cohort, foreign retailers have excellent prospects for business expansion in the Indian market.

India's retail sector is experiencing robust growth driven by several factors. The country is experiencing a steady increase in national wages, rapid urbanization, and the emergence of the digital economy. Lower-tier cities no longer have to rely solely on physical stores, as an expanding network of last-mile logistics suppliers enables access to preferred brands through online platforms.

The retail landscape in India offers a wide array of choices, including global e-commerce platforms, single-brand shopping websites, multi-retail apps, and social media sellers. Furthermore, discretionary spending power is on the rise, with the average per capita income in India surpassing US$2000 and projected to exceed US$12,000 by 2047.

The substantial middle class and underserved consumer base in non-metropolitan cities have attracted the interest of several international retail giants seeking expansion into new markets. Branded products, such as apparel, cosmetics, jewelry, footwear, watches, food and beverage (F&B), and furnishings, are gaining popularity and becoming essential lifestyle items for both business and leisure purposes.

The era of social media and internet commerce has further accelerated two significant trends: product premiumization and a growing emphasis on health and sustainability. Indian consumers are increasingly making aspirational choices driven by their desired image.

Key growth drivers for the Indian retail industry

As India continues to evolve into a thriving consumer-driven economy, its retail industry is experiencing remarkable growth, making it one of the most attractive markets for businesses around the world.

Below we breakdown some of the factors driving greater investments into the consumer retail space in India.

Fourth largest retail destination

India has established itself as the fourth largest retail destination worldwide, providing a promising opportunity for businesses to expand their global sales networks. During FY 2022-23, a significant surge in demand for discretionary and lifestyle products resulted in the rapid expansion of nearly a dozen listed retailers and quick-service restaurant chains across the country. Collectively, they added almost 4,700 stores to their network, averaging around 13 new stores per day. This expansion rate marked their most substantial growth in at least five years. India is projected to witness the opening of approximately 60 shopping malls, totaling 23.25 million square feet, in FY 2023-24.

The fast-moving consumer goods (FMCG), apparel and footwear, and consumer electronics segments are the largest segments in the Indian retail market, comprising 65 percent, 10 percent, and nine percent, respectively.

A Deloitte study titled "Future of Retail" predicts that India’s online market will jump to US$325 billion in 2030 from US$70 billion in 2022. The organized retail market will grow to US$230 billion in 2030 from US$110 billion in 2022. However, the total value of the offline retail market will be U$1,605 billion in 2030, up from US$860 billion in 2022.

Second largest internet market

India currently ranks as the second largest internet market globally, with over 800 million internet users. The surge in smartphone users has propelled the growth of e-commerce platforms in the country. Online retail is projected to contribute 10.7 percent to the total retail market by 2024, a substantial increase from 4.7 percent in 2019. This provides businesses with the opportunity to reach a wide consumer base without the need for extensive physical stores, harnessing the potential of the digital economy to enhance their retail brand.

In 2021 alone, there were 1.2 million daily e-commerce transactions in India, and this number is expected to skyrocket, reaching 500 million online shoppers by 2030, up from 150 million in 2020. Consequently, the e-commerce market's gross merchandise value (GMV) is projected to reach US$350 billion by 2030. This presents a significant opportunity for businesses seeking to expand their presence and tap into India's thriving retail sector.

The majority of internet usage is reportedly increasingly dedicated to consuming short videos, and social media and short video content heavily influence the purchasing decisions of the youth demographic. Consequently, global retailers are also investing in social commerce channels and influencer marketing.

Multiple modes of payment

With improved internet access, the digital payment ecosystem in India is flourishing. Users and businesses have a wide range of options, including virtual cards, wire transfers, prepaid instruments (prepaid cards and digital wallets like Paytm, Google Pay, PhonePe, Apple Pay), as well as bank debit and credit cards.

Cashless transactions are gaining popularity among Indians for their daily expenses. The growth of digital payments in the past five years has been driven by the Unified Payments Interface (UPI), enabling real-time inter-bank transactions, and the Bharat Interface for Money (BHIM) app, simplifying the digital transaction process.

According to a report by Worldline India, as of Q2 2022, there were over 1 billion debit and credit cards in circulation in India, and UPI recorded more than 6 billion transactions per month. UPI is the dominant payment method, while credit cards are preferred for high-value transactions. Maharashtra, Tamil Nadu, Karnataka, Andhra Pradesh, and Kerala were the top five states with the highest transactions at physical merchant stores, while Hyderabad, Bengaluru, Chennai, Mumbai, and Pune were the top five cities.

In terms of digital transactions in 2022, Bengaluru led with 29 million transactions worth INR 65 billion, followed by Delhi with 19.6 million transactions worth INR 50 billion, Mumbai with 18.7 million transactions worth INR 49.50 billion, Pune with 15 million transactions worth INR 32.80 billion, and Chennai with 14.3 million transactions worth INR 35.50 billion.

In terms of consumer spending through electronic payment modes, grocery stores, restaurants, clothing and apparel, pharmacies, hotels, jewelry retail, specialty retail, household appliances, and departmental stores are the prominent categories. In the online space, e-commerce, gaming, utility, and financial services account for the majority of transactions.

However, despite the growing adoption of electronic payments in India, more than 75 percent of transactions still involve cash, especially for significant purchases like property transactions. As of October 21, 2022, the currency in circulation in India amounted to INR 30.89 trillion.

Growing consumer spending

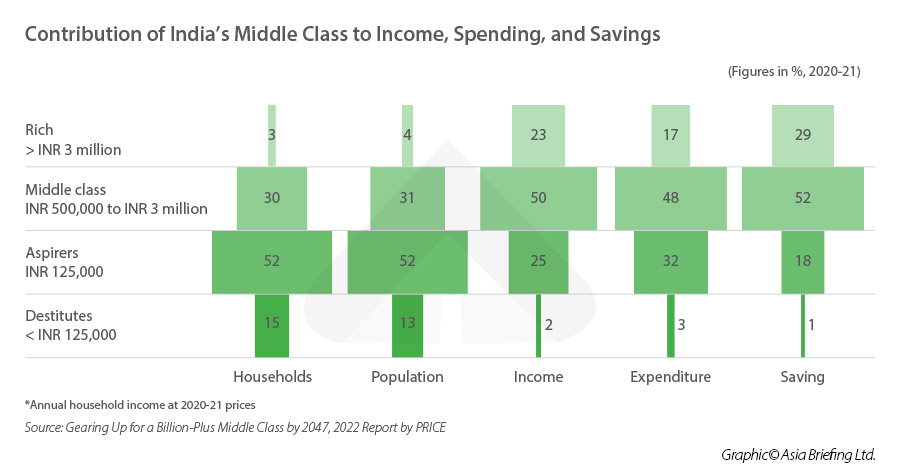

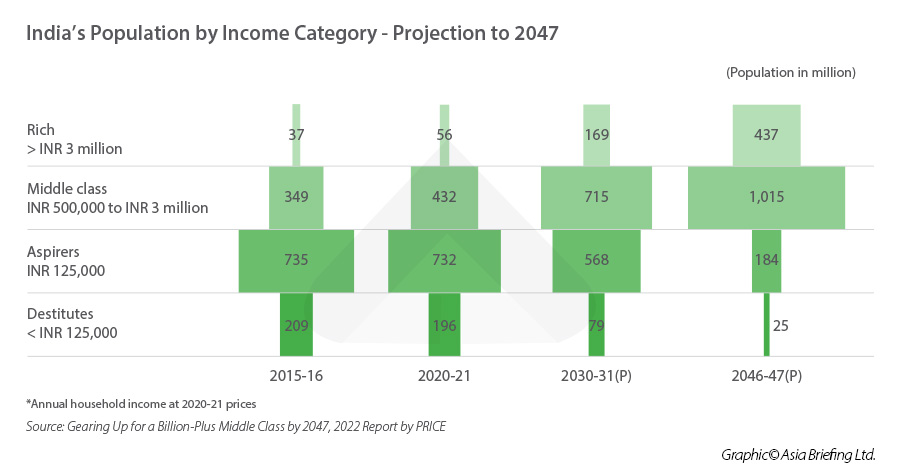

India's expanding middle class is set to drive consumer spending, projected to increase from US$1.5 trillion in 2021 to nearly US$6 trillion by 2030. This shift presents significant business opportunities to meet the growing demand and capture a larger market share.

In 2023, consumer spending is expected to grow at a rate of 7.1 percent annually. While inflationary pressures have impacted post-pandemic spending recovery, discretionary purchases and non-essential spending are predicted to bounce back in 2024.

Per the Retailers Association of India (RAI), the organized retail sector witnessed a significant growth of 34 percent in FY 2022-23, surpassing pre-pandemic sales figures from 2019-20.

According to a report from ING, personal loan growth in India, which serves as an indicator of consumer spending, rose by 23.7 percent year-on-year in January 2023. Notably, loans for major purchases, such as vehicles and consumer durables, have demonstrated strong growth.

Premium is better

The trend of "premiumization" is impacting various product segments, ranging from chocolates and alcoholic beverages to electronics, clothing, and cosmetics. In certain categories like automobiles, the demand for premium products is surpassing the demand for entry-level options. For instance, in FY2021-22, premium car sales witnessed a 38 percent year-on-year increase, while lower-priced car sales only grew by 7 percent. This shift is attributed to the evolving preferences of consumers, who now prioritize value and customization.

Previously, premium segments were predominantly targeted at high-net-worth individuals (HNWI), but they are now expanding to include millennials and consumers from non-metropolitan areas. Moreover, the customer base for luxury housing has also expanded beyond the typical high-net-worth and non-resident customers to encompass affluent middle-class individuals, largely due to the rise of remote and hybrid working models.

Post-pandemic revival of the luxury segment

Per data from McKinsey and the 2021 Knight Frank Wealth Report, the number of HNWI in India will grow 63 percent to 11,198 by 2025 from 6,884 in 2020. The number of US dollar billionaires are expected to increase from 113 in 2020 to 162 by 2025. Further, 20 percent of luxury sales in India will be transacted online. Euromonitor International forecasts that the projected value of US$8.5 billion in 2023, an increase of US$2.5 billion compared to 2021.

Luxury brands are seeking more real estate in India and are retailing at luxury brands-focused malls, concept and pop-up stores in metropolises like Mumbai and Bengaluru, as well as curated e-commerce platforms.

Booming retail market

According to a recent report by Anarock and Retailers Association of India (RAI), the organized retail sector in India is projected to grow at a 25 percent compound annual growth rate (CAGR). The Indian retail market is expected to reach US$1.1 trillion by 2027 and US$2 trillion by 2032, driven by a growing middle class. As such, the sector offers significant opportunities for businesses to thrive.

Despite the impact of the COVID-19 pandemic, the sector attracted US$1.47 billion in private equity (PE) investments between 2019 and 2022. However, the contribution of PE capital invested in retail real estate decreased from 16 percent in 2019 to 6 percent in 2022.

While India is primarily an offline market, the pandemic has influenced shopping and consumption preferences, leading to an increase in online commerce. Retail investors should consider both traditional and online channels. By 2024, offline retail is expected to hold approximately 89.3 percent of the total Indian retail market, down from 95.3 percent in 2019, according to the RAI report. The online retail market is expected to reach a value of US$120-140 billion by FY 2025-26, with an annual growth rate of 25-30 percent over the next five years. In FY22, the sales volume of the overall organized retail segment was estimated to be US$52 billion and projected to grow to US$136 billion by 2028 at a 17 percent CAGR.

Retail leasing in India

Retail leasing in India experienced a significant 21 percent growth in 2022, primarily driven by the expansion plans of fashion retailers, hypermarkets, and restaurants, as stated in CBRE's report 'India Market Monitor 2022'. The report emphasizes optimistic growth prospects, supported by a strong supply pipeline and robust domestic demand. International brands, particularly in the F&B sector, are capitalizing on these opportunities, while domestic brands are witnessing increased demand for expansion. However, global challenges have resulted in temporary fluctuations.

Key sectors contributing to the leasing activity in 2022 include fashion and apparel, F&B, hypermarkets, homeware, and department stores. Bangalore and the Delhi-National Capital Region played a significant role, accounting for 61 percent of the leasing activity, while Chennai, Hyderabad, and Pune each held a nine percent share.

The retail leasing market is expected to gain momentum in tier-2, tier-3, and tier-4 cities in India as business activities in these areas accelerate and the purchasing power of these regions

continues to grow. Several states in India are incentivizing businesses to establish their presence in non-metropolitan areas. With the rise of a hybrid workforce, this trend positively influences the spending capacity and categories of expenditure in these areas.

In another report by CBRE, 'India Retail Figures H2 2022', it was noted that international brands like Tim Hortons, Victoria's Secret, and Uniqlo expanded their operations in July-December 2022, despite global challenges and post-pandemic economic fluctuations. Retailers focused on opening larger establishments in prominent locations to enhance the shopping experience for customers. According to data provided by property consultancy firm Anarock, the proportion of transactions involving retail spaces in India ranging from 2,000 sq ft to 5,000 sq ft rose to 28 percent in 2022 from 24 percent the year prior.

Furthermore, many brands focused on expanding in tier-2 cities. Tim Hortons entered Ludhiana, Uniqlo opened its first store in Chandigarh, and Dehradun welcomed Starbucks, Biba, and Shopper's Stop.

In metro areas, notable brands like Pottery Barn, Adidas, Zara, Nike, and Azorte launched flagship stores and expanded their presence. Apple opened its first two stores in India in Mumbai and New Delhi. Brands like Zara and H&M invested in store revamps as they diversified their product lines. Starbucks recorded its fastest store expansion in FY 2022-23, adding 71 new stores.

Meanwhile, Ikea, the Swedish furniture retailer, has opened large-format stores in Hyderabad, Navi Mumbai, and Bengaluru, along with city stores in Mumbai. The retailer had allocated a significant budget of INR 105 billion (US$1.27 billion) for the Indian market in two investment phases. Its parent company, Ingka Group, recently set aside INR 75 billion to open two shopping centers in the Delhi-NCR region. Ikea also operates e-commerce platforms in select cities across India—Bengaluru, Mumbai, Pune, Ahmedabad, Vadodara, and Surat.

Based on the latest investor data, as of March 31, 2023, a group of companies consisting of Reliance Retail, Aditya Birla Fashion & Retail (ABFRL), DMart, Tata's Trent, Titan Co, and Starbucks collectively operated a staggering 30,520 stores. This was a substantial increase from a total of 25,821 stores in 2021-22. Reliance Retail, ABFRL, and Trent have successfully introduced numerous international brands to the Indian market.

Overall, the retail leasing market in India is witnessing dynamic growth, with both domestic and international brands expanding their footprint and capitalizing on the opportunities presented by different city tiers.

Rising economic power of non-metro cities

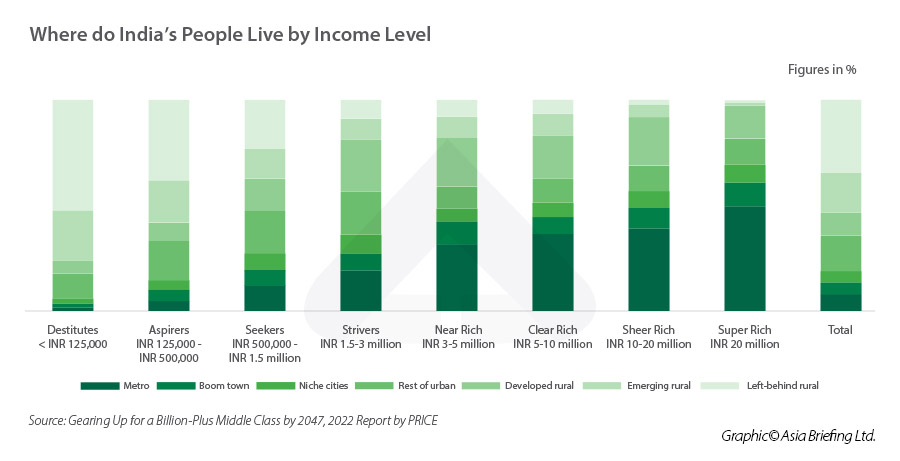

A survey conducted by the think tank People Research on India's Consumer Economy (PRICE) focused on 63 cities in India with a population exceeding one million in 2021. The survey revealed that these cities comprised a significant portion of India's middle class (27 percent) and wealthy population (43 percent). Additionally, these cities contributed 29 percent of the country's household disposable income, 27 percent of total spending, and 38 percent of total savings. The report categorized the surveyed cities into seven groups based on annual household income, considering an average household size of 4.6.

The cities were further classified as metros (nine cities), boomtowns (16 cities), niche cities (38 cities), and a category referred to as "rest of urban." In metros and boomtowns, more than half of the households fell into the middle-class category, defined as having an annual income ranging from INR 500,000 to INR 3 million. The nine metros, namely Mumbai, Delhi, Kolkata, Bengaluru, Chennai, Hyderabad, Surat, Ahmedabad, and Pune, represented the largest markets in terms of household disposable income and total consumption expenditure.

On the other hand, boomtowns, which are emerging large markets, had a young population and exhibited the fastest growth in disposable income. Notable lower-tier cities in this category included Bhopal, Coimbatore, Indore, Jaipur, Kanpur, Kannur, Kochi, Kozhikode, Lucknow, Madurai, Malappuram, Nagpur, Nashik, Thiruvananthapuram, Thrissur, and Tirupur.

Summary

India's thriving retail market, along with its growing middle class, expanding consumer spending, and digital growth, make it a highly attractive destination for businesses seeking growth opportunities. With the right strategy and approach, investing in the Indian retail market can prove to be a highly profitable decision for businesses looking to expand their global footprint.