India’s real estate market is among the fastest growing in the world, driven by the country’s rapid urbanization, economic expansion, and changing demographic trends. The Indian economy expanded 7.6 percent year-on-year in the quarter ending September, further reinforcing its resilience. The International Monetary Fund (IMF) forecasts India to emerge as the world’s third-largest economy by 2027 with GDP expected to exceed US$5 trillion.

India's real estate market is witnessing profound changes due to economic growth and shifting population dynamics. Economic expansion, projected to grow at 6.5 percent in the fiscal year 2024-25, has created an environment conducive to property development, particularly in urban areas. The government’s focus on infrastructure development, coupled with a youthful workforce eager for urban living, drives this momentum.

Urbanization in India is accelerating, with more people migrating to cities in search of employment and better living conditions. This trend is leading to a greater demand for residential properties and commercial real estate, such as office spaces and retail outlets.

Emerging locations for investors in India

India's real estate market in 2024 is characterized by dynamic growth across several key cities. Investors are finding opportunities in established urban hubs, as well as in up-and-coming areas driven by infrastructural development, economic growth, and urban planning. Below are some emerging locations that offer promising prospects for both residential and commercial real estate investments.

Mumbai

Mumbai, as the financial capital of India, remains a focal point for real estate investments. The city boasts an ever-expanding skyline supported by significant infrastructure development, making it attractive for both local and global investors. Upscale residential and commercial properties in areas like Bandra, Worli, and Lower Parel have continued to draw attention, thanks to their prime locations and modern amenities. Additionally, Mumbai’s status as the economic hub of India ensures a strong demand for real estate, with major corporations and banks headquartered here.

Highlights:

- Bandra, Worli, and Lower Parel: These areas offer luxury properties and prime office spaces, ideal for high-net-worth investors.

- Mumbai’s ongoing infrastructure projects, such as the Trans Harbour Link and Metro rail expansion, enhance its connectivity and attractiveness for long-term investments.

Bangalore

Bangalore, often referred to as the "Silicon Valley of India," remains a thriving center for real estate investment due to its booming IT sector and vibrant startup ecosystem. With a growing population of professionals, the demand for both commercial and residential properties has surged in localities such as Whitefield, Electronic City, and Sarjapur.

Highlights:

- Whitefield and Electronic City: These tech-centric areas are witnessing substantial commercial and residential growth, with numerous multinational corporations (MNCs) setting up offices.

- Bangalore’s superior infrastructure, including the Namma Metro and planned road expansions, makes it an ideal investment hub.

Delhi-NCR

The Delhi-NCR (National Capital Region) remains one of the most promising regions for real estate investment. Areas such as Gurgaon, Noida, and Greater Noida are well-connected to the national capital and boast a mix of affordable and luxury real estate options. Improved connectivity via the Delhi Metro and several expressways has also fueled the demand in this region.

Highlights:

- Gurgaon and Noida: Both cities are known for their tech and business parks, offering numerous opportunities for real estate investments.

- The region continues to see growth in both high-end residential projects and more affordable housing options, making it appealing to diverse investor profiles.

Hyderabad

Hyderabad has emerged as a prominent IT and business hub, with rapid growth in real estate development. Areas like HITEC City, Gachibowli, and Nanakramguda are at the forefront of this expansion, thanks to the city's focus on infrastructure and urban planning. Hyderabad offers a balanced mix of affordable housing and upscale properties, making it an attractive option for investors.

Highlights:

- HITEC City and Gachibowli: These areas are rapidly expanding due to the influx of IT and pharmaceutical industries, providing robust opportunities for commercial real estate investments.

- Hyderabad’s real estate market is bolstered by relatively lower property prices compared to other metro cities, making it an appealing investment destination.

Pune

Pune's strategic location, along with its growing IT sector and educational institutions, has made it one of the most promising real estate markets in India. Localities such as Hinjewadi, Kharadi, and Baner are witnessing rapid development, driven by the presence of IT parks and industrial hubs.

Highlights:

- Hinjewadi and Kharadi: Both areas are home to major IT parks and are experiencing a surge in residential developments catering to professionals.

- Pune offers a balanced mix of urban living and natural surroundings, along with a relatively lower cost of living compared to Mumbai, making it a favorable choice for investors.

Chennai

Chennai, a major player in South India’s economy, is also witnessing real estate growth, particularly in industrial and residential segments. Areas like OMR (Old Mahabalipuram Road), Guindy, and Perungudi are key hotspots due to their proximity to tech hubs and industrial zones.

Highlights:

- OMR and Perungudi: Known for IT parks and excellent connectivity, these areas are rapidly evolving into premium real estate destinations.

- Chennai’s industrial growth and infrastructural improvements, such as the Chennai Metro expansion, make it a strong contender for future real estate investments.

Ahmedabad

Ahmedabad, the cultural and business hub of Gujarat, is quickly gaining attention from investors due to its strategic location and robust industrial growth. Areas like Satellite, Bodakdev, and Prahlad Nagar have emerged as real estate hotspots, with the establishment of the Gujarat International Finance Tec-City (GIFT City) further enhancing the city's appeal.

Highlights:

- Satellite and Bodakdev: These localities offer a mix of high-end residential and commercial spaces, supported by Ahmedabad's growing industrial base.

- With its business-friendly environment and rapid infrastructure development, Ahmedabad is becoming an attractive option for real estate investors.

Kolkata

Kolkata, with its rich cultural heritage and relatively affordable property prices, has emerged as an appealing choice for real estate investors. Areas like Rajarhat, New Town, and EM Bypass are experiencing significant growth, driven by infrastructural improvements and the city’s growing economy.

Highlights:

- Rajarhat and New Town: These planned townships are evolving into real estate hotspots with modern amenities and strong connectivity.

- Kolkata’s real estate market offers a wide range of affordable properties, making it an attractive option for first-time investors.

|

City |

Key locations |

Investment highlights |

Development drivers |

|

Mumbai |

Bandra, Worli, Lower Parel |

|

|

|

Bangalore |

Whitefield, Electronic City, Sarjapur |

|

|

|

Delhi-NCR |

Gurgaon, Noida, Greater Noida |

|

|

|

Hyderabad |

HITEC City, Gachibowli, Nanakramguda |

|

|

|

Pune |

Hinjewadi, Kharadi, Baner |

|

|

|

Chennai |

OMR, Guindy, Perungudi |

|

|

|

Ahmedabad |

Satellite, Bodakdev, Prahlad Nagar |

|

|

|

Kolkata |

Rajarhat, New Town, EM Bypass |

|

|

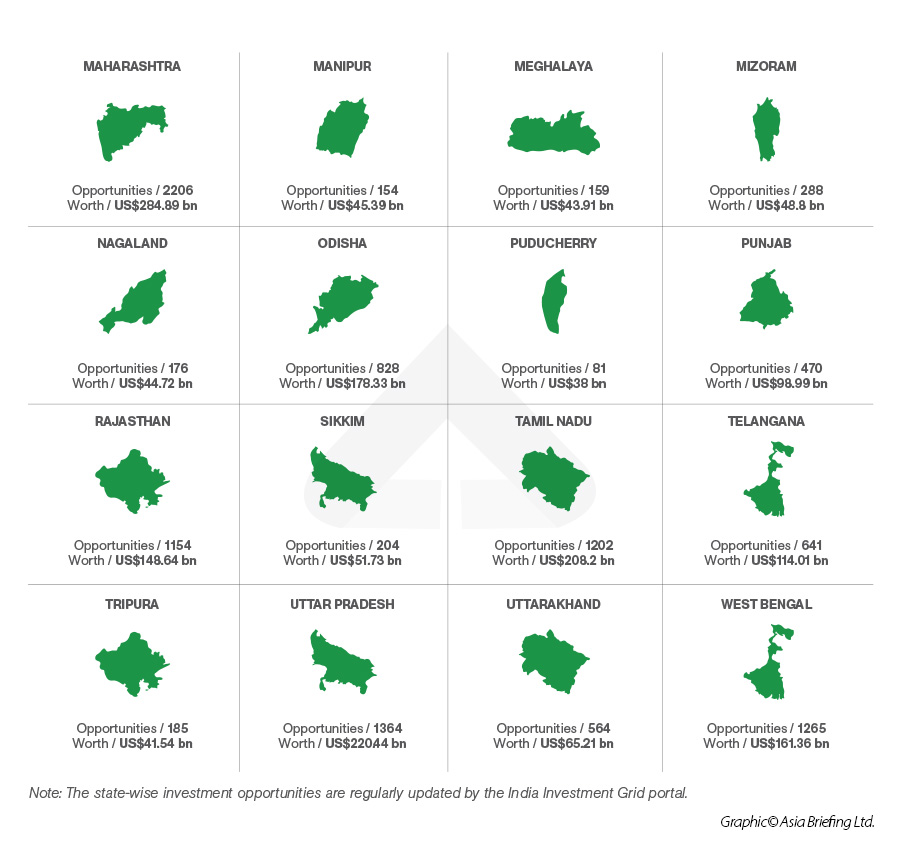

Geographical factors and attractiveness in India

The diverse topography and regional specializations, along with strong state economies and policies that support foreign direct investment (FDI), are key in drawing attention from global and domestic investors alike.

Market size and economic potential

India’s market is vast, supported by a growing middle class and increasing urbanization.

Large states with high per capita income, such as Maharashtra, Tamil Nadu, and Karnataka, attract substantial FDI inflows. These states have robust economies and higher purchasing power, which supports the demand for both residential and commercial real estate. States with larger economies offer more lucrative opportunities due to their capacity for higher-value investments and the development of megacities like Mumbai, Bangalore, and Chennai.

While the country's GDP and large population are significant draws, the complexity of its regional markets can deter some investors unfamiliar with the landscape. Nevertheless, firms that adapt to these cultural and geographical barriers tend to outperform, as the country's economic potential outweighs the challenges.

Infrastructure and connectivity

Investment in real estate is closely linked to a region’s infrastructure and connectivity. States with well-developed transportation networks, including highways, ports, and airports, tend to attract higher levels of investment.

For example, Maharashtra’s robust infrastructure network, including Mumbai’s international airport and its extensive road and rail links, positions the state as an attractive destination for commercial and industrial real estate investments.

Connectivity to global markets through ports like Gujarat’s Mundra Port and Chennai’s Ennore Port also plays a critical role in enhancing investment potential. In addition to ports and airports, the availability of reliable power supply and digital infrastructure, especially in cities driving India’s technology sector like Bangalore and Hyderabad, makes them focal points for both commercial and residential real estate development.

Policy environment and investment promotion

States with investor-friendly policies, streamlined regulatory frameworks, and active investment promotion initiatives enjoy higher FDI inflows.

For instance, Karnataka and Gujarat have introduced simplified processes for land acquisition and approvals, making them more appealing to real estate developers and foreign investors. These states also offer investment incentives such as tax breaks and subsidies, further boosting their attractiveness.

National initiatives like the Make in India program and production-linked incentives (PLI) also enhance the real estate landscape by encouraging the development of industrial and commercial properties.

Industry-specific advantages

Certain states have developed expertise in particular sectors, which shapes their real estate demand. Maharashtra, for instance, has a thriving automotive industry, and its capital, Mumbai, is a financial hub, driving demand for commercial office spaces.

Karnataka, with its concentration of IT firms in Bangalore, attracts both residential and commercial investments catering to a tech-driven workforce.

Similarly, Telangana’s strength in pharmaceuticals has turned Hyderabad into a hotspot for industrial real estate catering to manufacturing facilities. States with these specific advantages are more likely to attract targeted FDI inflows, making them key markets for real estate investors focusing on industry-specific needs.

Human capital and skills

A skilled and educated workforce is a critical factor for FDI, particularly in industries requiring technical expertise such as IT, pharmaceuticals, and engineering. States like Tamil Nadu and Karnataka, with their concentration of higher education institutions and vocational training centers, are well-positioned to attract investment in knowledge-intensive industries. The availability of human capital drives demand for commercial real estate in these regions, as businesses seek to establish headquarters or offices in cities with access to a talented workforce.

The presence of top-tier universities and research institutions also enhances the attractiveness of certain regions, especially for investors focused on real estate developments tied to the education and technology sectors. As India continues to promote education and skill development, states with strong human capital foundations will remain attractive for investors.