The economic relationship between India and ASEAN began in 1992 as both regions recognized each other’s trade capabilities. The relationship has since strengthened with India’s growing manufacturing capacity and the rise of ASEAN’s services sector exports, namely travel, transport, and business services.

The two regions share similarities in their levels of economic development; they are home to rapidly expanding markets and aim to address infrastructure challenges. These similarities offer space for continued and more diversified trade in goods and services as well as business-to-business engagement between India and ASEAN – tapping into the investment requirements of modernizing industries and domestic consumption trends in each other’s markets.

Economic engagement in terms of the free movement of goods, services, and capital, thus, offers mutual benefits for India and ASEAN. This was the rationale that propelled the signing of the ASEAN-India Free Trade Agreement (AIFTA) in 2009. The trade treaty has definitely boosted bilateral trade.

According to a November 2019 report by the Ph.D. Chamber of Commerce and Industry, India’s merchandise exports to ASEAN increased from US$23 billion in 2010 to US$36 billion in 2018 at a compound annual growth rate (CAGR) of about five percent, while its merchandise imports from the 10-member bloc increased from US$30 billion in 2010 to US$57 billion in 2018, at a CAGR of about eight percent. India’s exports to ASEAN in 2019-20 were worth US$31.49 billion while its imports from the bloc reached US$55.37 billion.

In its trade with ASEAN, India has moved to eliminate tariffs on up to 75 percent of 12,000 tariff lines. A report from the National Institution for Transforming India (NITI Aayog) found that this had led to the trade balance worsening in 13 out of 21 sectors, including textiles, leather, and minerals. India’s trade deficit with ASEAN countries is currently around US$24 billion and is why New Delhi remains keen to renegotiate the terms of the ASEAN-India FTA to ensure a more level playing field for Indian exports to ASEAN.

In this article, we break down key export-oriented industries that offer most value in terms of catering to ASEAN’s market needs, trade advantages available to India in the ASEAN region, and finally investment opportunities in India for ASEAN-based businesses.

India’s top export-oriented industries

In 2019, 47.8 percent of India’s exports by value were delivered to fellow Asian countries; 19.3 percent were sold to European importers and 18.8 percent worth of goods were shipped to North America.

Among India’s top 15 trading partners in 2019, Singapore came in fifth (US$10.7 billion or 3.3 percent), Malaysia twelfth (US$6.14 billion or 1.9 percent), and Vietnam fourteenth (US$5.49 billion or 1.7 percent). That year, India’s top 10 exported goods accounted for three-fifths (60.2 percent) of the overall value of its global shipments.

- Mineral fuels including oil: US$44.1 billion (13.7 percent of total exports)

- Gems and precious metals: US$36.7 billion (11.4 percent of total exports)

- Machinery including computers: US$21.2 billion (6.6 percent of total exports)

- Organic chemicals: US$18.3 billion (5.7 percent of total exports)

- Vehicles: US$17.2 billion (5.3 percent of total exports)

- Pharmaceuticals: US$16.1 billion (5 percent of total exports)

- Electrical machinery and equipment: US$14.7 billion (4.5 percent of total exports)

- Iron and steel: US$9.7 billion (3 percent of total exports)

- Clothing and accessories (not knitted or crocheted): US$8.6 billion (2.7 percent of total exports)

- Knitted or crocheted clothing and accessories: US$7.9 billion (2.5 percent of total exports)

Next, we briefly spotlight three industries – the jewelry, pharmaceutical, and agricultural industries – whose exports feature in the top 10 for India.

Gems and jewelry industry

India's gems and jewelry industry contributes about seven percent to the country's GDP and 15 percent to its total merchandise export. India has permitted 100 percent foreign direct investment (FDI) in the sector under the automatic route. Cumulative FDI inflows in diamond and gold ornaments was around US$1.18 billion between April 2000 and September 2020. The industry employs more than 4.64 million people, which is expected to near double by 2022. India's gems and jewelry market size is projected to grow by US$103.06 billion between 2019 and 2023.

The sector is labor intensive and export-oriented. For example, according to the Gem and Jewellery Export Promotion Council (GJEPC), India exports 75 percent of the world’s polished diamonds. Despite the pandemic, in the period between April and October 2020, exports of gems and jewelry was US$11.62 billion. In the same period, India's export of cut and polished diamonds was worth US$18.66 billion, which contributed 52.4 percent to the total gems and jewelry export. Meanwhile, India’s import of gems and jewelry stood at US$24.41 billion in FY20. In FY21 (till September 2020), imports amounted to US$4.23 billion.

Overall, the Indian gems and jewelry industry is one of the world’s largest, supplying 29 percent of the global consumption of jewelry. It is especially valued due to the traditional way Indian jewelers cut and polish diamonds; they also incorporate modern techniques that do not affect the traditional craft. Mandatory hallmarking in the industry is another factor contributing to its growth and reputation.

The size of India's domestic market is also huge. India is the second largest consumer of gold, the demand for which was around 690.4 tons in 2019.

Pharmaceuticals industry

The Indian pharmaceuticals industry has established itself as a globally competitive manufacturing and research hub, supported by the availability of raw materials and a large workforce. The industry is the world’s third largest in terms of the volume of medicines it produces and the 13th largest in terms of value. The Indian pharmaceutical industry was expected to grow at a compound annual growth rate (CAGR) of 22.4 percent to reach US$55 billion in 2020.

The Indian pharmaceuticals market is dominated by generic drugs that constitute nearly 70 percent of the market, whereas over the counter (OTC) medicines and patented drugs make up to 21 percent and 9 percent, respectively. India plans to establish a fund (worth about US$1.3 billion) to boost companies’ capacity to manufacture pharmaceutical ingredients domestically by 2023. India’s total drugs and pharmaceuticals export between April 2020 to November 2020 was US$15.87 billion and for the month of November 2020 – it was US$1.99 billion, according to data published by IBEF.

Even after the COVID-19 pandemic, India’s pharmaceutical sector has continued to be a reliable supplier of necessary drugs and now, vaccine doses, and is forecast to reach a size of about US$130 billion by 2030. FDI inflows to the pharmaceutical sector reached INR 36.5 billion (US$501.99 million) in 2019-20, showing a growth of 98 percent year-on-year.

Agriculture and food processing industry

The Indian food market is the sixth largest in the world. It contributes 32 percent to the global market due to its leadership in the production and export of food products. Every year, India’s export contribution increases.

In 2018-19, the overall export value of:

- Agriculture and allied products stood at US$18.7 billion

- Basmati rice stood at US$4.71 billion

- Non-basmati rice stood at US$3.03 billion

- Spices at US$3.32 billion

- Processed vegetables and fruits at US$1.6 billion

- Tea and coffee at US$1.65 billion

India is the world’s largest processor, producer, consumer, and exporter of cashew nuts, spices, food grains, fruits, and vegetables. On November 11, the government announced that its production-linked incentive scheme would benefit food products, with an outlay worth INR 109 billion (US$14.59 billion), earmarked for a five-year period. Specific product lines showing high growth potential and able to generate medium- to large-scale employment will be supported under this scheme. The product lines are: ready to eat (RTE) and ready to cook (RTC), marine products, fruits and vegetables, honey, desi ghee, mozzarella cheese, organic eggs, and poultry meat. The processed food market is expected to grow to US$543 billion by the end of 2020. Currently, the industry employs 1.85 million people and puts out an aggregate output worth US$158.69 billion. There is ample scope for doing business in this space between India and ASEAN – trade in food products, food processing equipment, investing in processing industries, tapping into regional small and medium enterprises (SMEs) and developing supply chains etc.

One area that has often been overlooked is the halal food industry. A 2018/19 report estimated that the Muslim spend on food and beverages would grow at 6.1 percent to reach US$1.9 trillion by 2023. India has the world’s third largest Muslim population but Southeast Asian exporters, such as Malaysia, dominate the world halal food market. In October 2019, Indonesia’s Halal Product Law came into effect and many consumer products and related services that are traded in the country must now be halal-certified; some products and services will have until 2022 to comply. India can well tap into this fast-growing market – connecting growing indigenous production capacity with its existing networks in the ASEAN region. At US$1.7 billion, India was the fourth largest exporter of food, dominated by meat exports, to Muslim-majority countries in 2018, according to the State of the Global Islamic Economy 2019/20 report from DinarStandard. Presently, the halal food ecosystem is dominated by small and medium enterprises in ASEAN, but global MNCs like Swiss giant Nestle, South Korea’s Samyang Foods, and Thailand’s CP Foods are entering this space.

Advantages of the ASEAN economy

In a report published by the Exim Bank of India in January 2018, commemorating 25 years of India’s partnership with ASEAN, it was found that India’s export offerings are highly diversified given its vast raw material base, large labor market, and an increasing number of manufacturing hubs. ASEAN covering the Southeast Asian region, on the other hand, has its own market appeal – with its population of large youth cohorts, rising disposable incomes, and fast-expanding digital economies.

- The 10 member countries (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam) of ASEAN have a combined population of more than 600 million people, making it the third largest labor force in the world. Widespread labor participation has seen the rapid growth of the manufacturing, retail, transportation, and telecommunications sectors.

- ASEAN is a diverse grouping of countries whose socioeconomic differences offer foreign investors with a range of opportunities to invest in local and varying markets, depending on their capacity. Indonesia represents almost 40 percent of the region’s total economic output, Myanmar’s local market is a lead attraction for exporters, and Singapore’s GDP per capita surpasses that of the more mature and older economies of Canada and US.

- ASEAN is a growing consumer market, expected to become home to 125 households by 2025.

- In 2016, electrical machinery and equipment was ASEAN’s biggest import – an industry that India is actively working to expand through production capacity, tax incentives, and FDI relaxations.

- ASEAN is the fourth largest exporting economy in the world, that contributes seven percent to the total value of global exports.

- Vietnamese export of textiles and apparel stood at US$36.16 billion in 2018

- Malaysia and Singapore took the lead in exporting electronics worth US$373 billion in 2019 and US$9.52 billion, respectively, in October 2020

- Thailand’s automotive sector exported goods worth US$38.39 million in 2018

- Indonesia is the lead in palm oil and coal exports whose combined value stood at US$27 million in 2018 - Myanmar is focusing on cultivating its natural resources of oil, gas, and precious minerals.

- Philippines is turning its attention towards business-focused services.

Performance of the ASEAN-India Free Trade Agreement (AIFTA)

India and ASEAN agreed to the AIFTA as an opportunity to increase their economic interactions by freely trading goods with one another in the Asia-Pacific region. The agreement formally came into effect January 1, 2010. Since then, both regions have made efforts to make trade between them as smooth as possible. Under the FTA, India and ASEAN agreed to progressively eliminate tariffs on 80 percent of the tariff lines, accounting for 75 percent of the trade. India has excluded 489 tariff lines (HS-06 Digit level) from the list of tariff concessions and 590 tariff lines from the list of tariff elimination to address sensitivities in agriculture, textiles, auto, chemicals, petrochemicals, crude and refined palm oil, coffee, tea, pepper, etc.

Benefits for exporters

ASEAN’s decision to lower intra-regional tariffs through the Common Effective Preferential Tariff (CEPT) Scheme on exports under the FTA has benefited Indian exporters in the following ways:

- Free movement of Indian goods throughout the 10 ASEAN countries.

- Elimination of tariffs on Indian goods make them competitive in the ASEAN market, making them more accessible.

- Indian raw material exports more competitive due to reduced tariffs and benefit ASEAN producers.

- Indian export complementarities are higher with ASEAN countries than any other region due to their shared land and maritime boundaries.

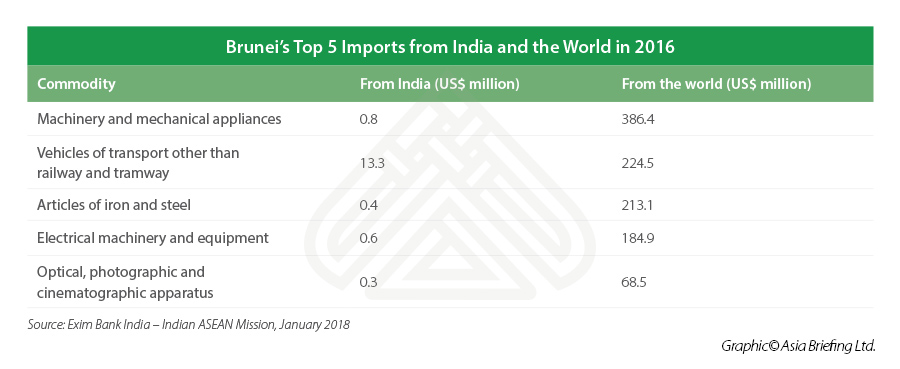

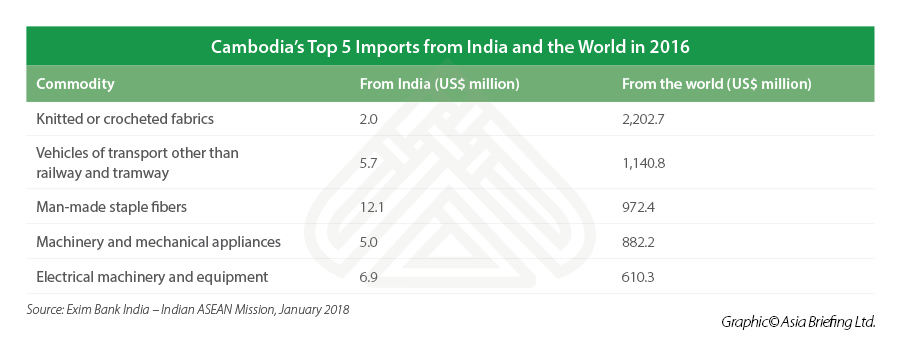

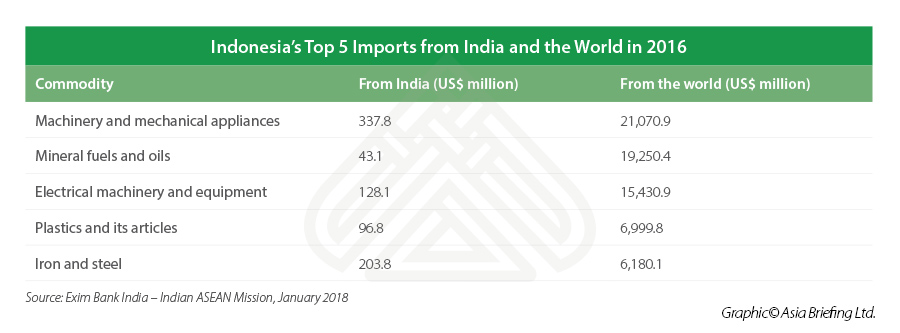

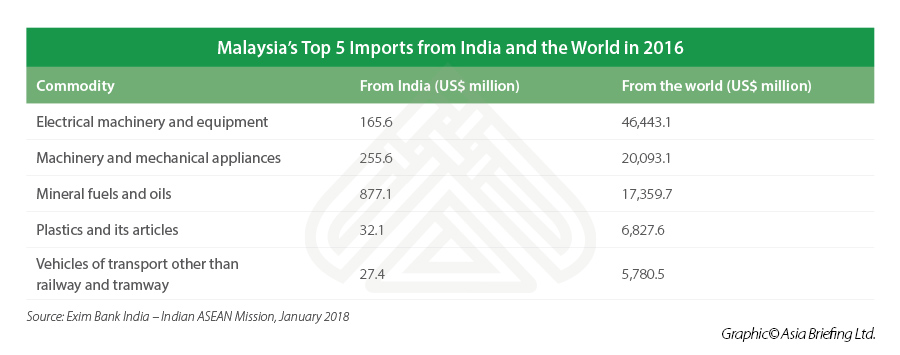

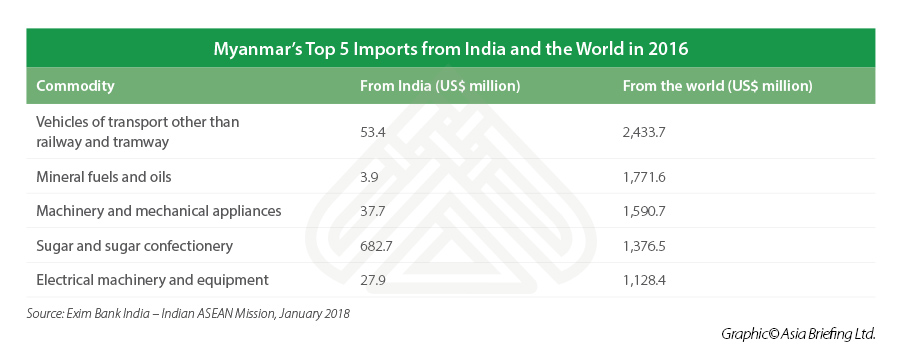

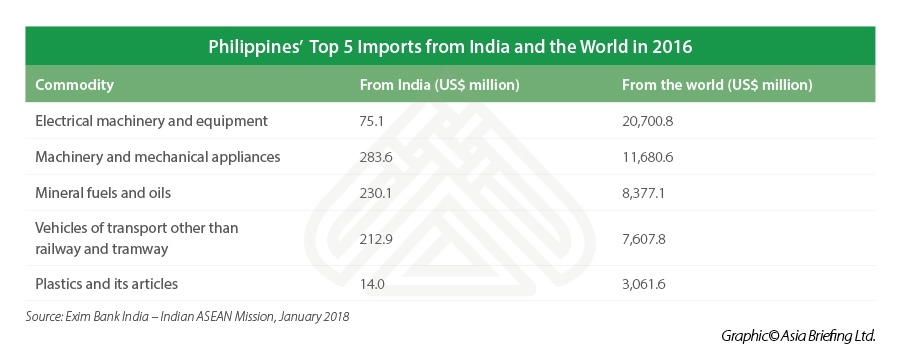

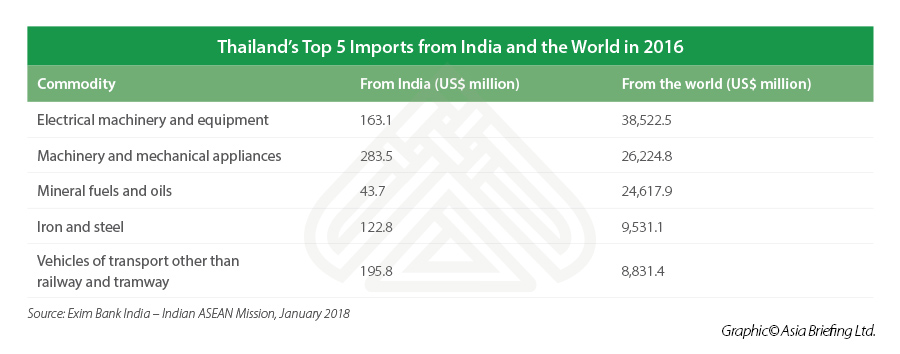

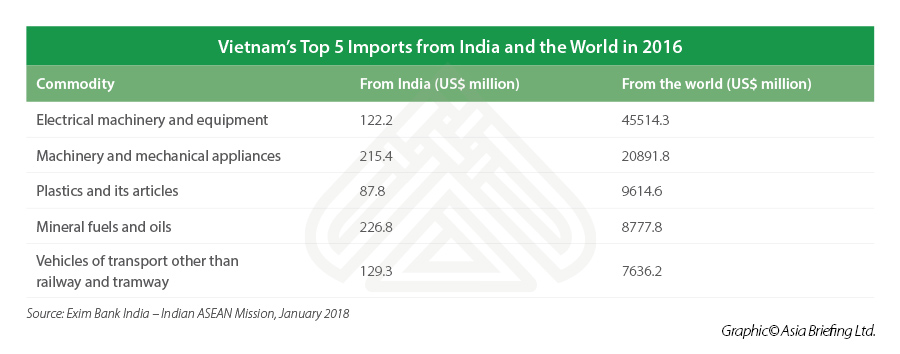

ASEAN top imports from India and the World (2016)

ASEAN-India Trade in Services and Investment Agreement

In 2015, the ASEAN-India Trade in Services and Investment Agreement came into force. Key provisions in the Services Agreement address transparency, domestic regulations, recognition, market access, national treatment, joint committee on services, review, dispute settlement and denial of benefits, among others. The Investment Agreement focuses on the protection of investment to ensure fair and equitable treatment for investors, non-discriminatory treatment in expropriation or nationalization, and fair compensation. The FTA in services and investment could potentially boost Indian-ASEAN trade to more than US$100 billion. The Agreement also facilitate the movement of Indian service professionals in ASEAN countries.

Emerging opportunities for trade and investment

Industrial restructuring through regional value chains

ASEAN is recognized as a leading participant in the global value chain, with strong production networks established across its member countries. However, the regional value chains of Cambodia, Laos, Myanmar, and Vietnam (CLMV countries) lag behind and need capital and know-how to come at par with other ASEAN countries.

India can participate in their progress through investments in building local industrial capacity, creating production linkages between Indian operations and Southeast Asian suppliers, providing training, and opening its own market access in restricted segments. The outcome would be creating regional value chains at different stages of industrial manufacturing, and linked to services, that would facilitate the relocation of production bases across India and ASEAN seamlessly.

Moreover, SMEs form the backbone of the CLMV region. Accounting for 90 percent of the total enterprises in these economies, they are the largest contributors to economic output. India can offer its expertise in developing SME clusters based on skill and resource endowments, institutional strengthening, and export development and export capability creation. India’s own experience could provide insights for partner countries in the region and facilitate their internationalization efforts.

Geographical connectivity and infrastructure linkages

The ongoing Kaladan Multi-Modal Transit is in its final stages according to remarks made by the External Affairs Minister S. Jaishankar on Monday. The 1,360 km India-Myanmar-Thailand Trilateral Highway is also underway, with plans to expand it to Vietnam via Laos. These projects must stay on course and be fast-tracked to capitalize on the proximity between northeast India and Southeast Asia. Once the necessary transit linkages are built, trade and business can flourish through enhanced market access, increased potential for tourism and culture industries, space to mobilize FDI, and setting up export-oriented production bases in special economic zones.

Key growth areas

E-commerce

India’s e-commerce sector is on an upward growth trajectory, projected to be the second largest e-commerce market in the world by 2034. By 2024, the sector will be worth US$99 billion with groceries and apparel serving as key drivers. The Indian government allows 100 percent FDI for B2B e-commerce and 100 percent FDI under the automatic route for the marketplace e-commerce model.

Other growth drivers:

- Rising disposable incomes and increasing internet access in tier 2 cities. E-commerce companies reported sales worth US$4.1 billion across platforms in the festive week of October 2020, driven by the increased demand for smartphones. Tier 2 cities like Dhanbad (Jharkhand), Ludhiana (Punjab), Asansol (West Bengal), and Rajkot (Gujarat) contributed 55 percent to the e-commerce sales.

- Role played by start-ups and technology-driven innovations facilitating digital payments, hyper-local logistics, digital advertisements, and analytics-driven customer engagement. This, in turn, is expected to increase export revenues and create better products and services in the long-term.

On the other hand, COVID-19 has reshaped ASEAN’s digital landscape with many governments and businesses being forced to accelerate towards a digital economy. The region has over 400 million internet users, and so its digital landscape presents a unique opportunity for investors. Sectors such as telemedicine, e-commerce, online education, and telecommuting are examples of such scalable digital opportunities. To learn more, see Investing in ASEAN’s Digital Landscape: New Opportunities After COVID-19.

Education

The size of India’s e-learning segment is only second to that of the United States within the education sector. E-learning platforms provide education and training to a population of 500 million that fall within the age bracket of 5-24 years. Between April 2000 and September 2020, India’s education sector has received FDI worth US$3.849 billion, according to the Department for Promotion of Industry and Internal Trade (DPIIT).

India allows 100 percent FDI under the automatic route in education, and wants globally competitive institutions for higher learning as per the Higher Educational and Foreign Educational Institutions Bill. India’s highly diversified and scalable market should encourage ASEAN education investors.

In December 2020, India launched the following programs to boost employment opportunities for its citizens:

- Gamma Skills Automation Training, which is a unique career-launching program on robotics for engineers.

- SAKSHAM, which is an initiative by Hyundai Motor India to boost employment in diverse sectors.

- IGnITE, which is a high-quality technical education training program to prepare technicians for the industry initiated by Siemens, the Federal Ministry of Economic Cooperation and Development (BMZ), and the Ministry of Skill Development and Entrepreneurship. By 2024, this program aims to upskill 4,000 employees.

- India Empowerment Fund, launched by the IIT Alumni Council, to develop a stronger research ecosystem. The aim is to gain investments in this fund worth US$6.80 billion in the next 10 years.

To know more, see Why India’s Education Market Should Excite Foreign Investors.

Fintech

India is among the fastest growing fintech markets in the world, whose overall value is expected to grow at a CAGR of 20 percent by 2023. According to a May 2020 report, as of March 2020, India and China accounted for the highest fintech adoption rate (87 percent) out of all global emerging markets. On the other hand, the world’s average adoption rate was around 64 percent.

The overall transaction value in the Indian fintech market is projected to grow from approximately US$65 billion in 2019 to US$140 billion in 2023. India overtook China as Asia’s top fintech funding target market with investments of around US$286 million across 29 deals, as compared to China’s US$192.1 million across 29 deals in Q1 2019.

Growth drivers include widespread identity formalization (Aadhaar), high level of banking penetration, high smartphone penetration, and growing disposable income.

Meanwhile, findings from the ASEAN Fintech Ecosystem Report Benchmarking Study 2019 showed that:

- ASEAN’s large population has little access to financial products and services

- Breaches in cyber-security are considered high risks

- Lack of a good digital infrastructure

- Lack of balancing market stimulation and risk management

- Underdevelopment of regulatory harmonization

Healthcare

Healthcare is fast becoming an area of priority for ASEAN. The World Health Organization (WHO) estimates that ASEAN’s average total expenditure per capita on healthcare is US$544. With a rise in the overall aging population of Singapore and Philippines, Singapore’s Healthcare 2020 Masterplan has called for the recruit of more than 20,000 healthcare workers and the addition of 3,700 hospital beds. In Philippines, public private sector partnerships (PPPs) are beginning to gain momentum. In particular, the government is also planning the construction of a special tertiary project, expected to be worth US$135 million.

To expand medical trade to aid these initiatives, ASEAN companies are being encouraged to participate in the India-ASEAN Healthcare Expo to be held virtually between February 22-24, 2021 so that India is able to increase its investments in ASEAN. Besides this, the purpose of the trade fair is to enable ASEAN companies, specifically from Malaysia, to explore business prospects with India in an effort to secure stronger economic and commercial partnerships in the healthcare, medical devices, and pharmaceuticals sectors.

India with its large healthcare market, estimated to be worth around US$200 billion currently, is interested in connecting its top stakeholders, business leaders, and senior government officials with those of ASEAN, especially by way of B2B meetings. While this is also driven by the immediate and mutual goal of combatting the COVID-19 pandemic, over the long-term, such engagement is key to increasing cooperation in the medical and medical-related sectors.

To know more, see India’s Healthcare Investment Outlook: A Brief Profile.

Tourism

The ASEAN region is a top tourist destination accounting for around 38 percent of all tourist travels. In 2011, the number of Indian tourists to ASEAN was 2.71 million. In 2019, the number of tourist arrivals from India rose to 5.32 million.

India can grow its outbound tourism services by tapping into ASEAN’s tourism sector potential. In particular, five of ASEAN’s member countries aim to boost tourism and attract potential investors by undertaking the following initiatives:

- Indonesia – will embark on several infrastructure projects to make it an easily accessible country by expanding the Bali Airport and the Soekarno Hatta International Airport, Jakarta.

- Malaysia – will aim to increase its number of tourists since its record of 25 million in 2011.

- Philippines – will aim to increase activities of leisure and gaming.

- Singapore – will aim to procure investments in order to establish theme parks and resort casinos.

- Thailand – will aim to better connectivity with its neighboring countries in the Mekong region and attract the attention of tourists by improving the 2,000 km R3A Highway that runs from Kunming in China through Laos to Thailand.