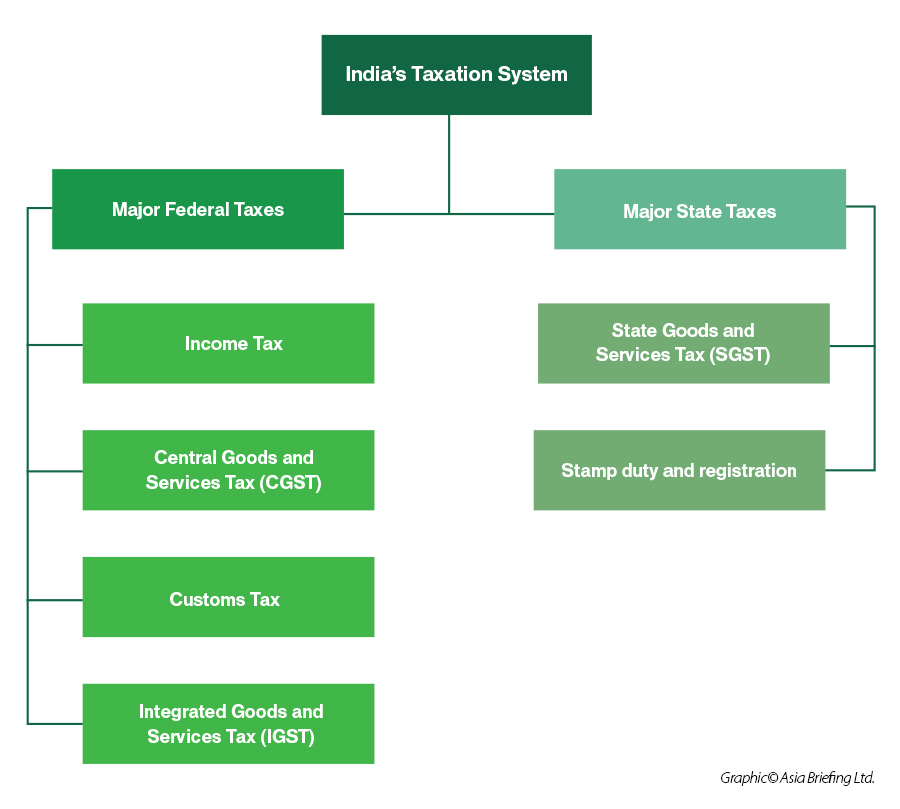

India has taken concerted efforts to streamline, simplify, and automate its taxation regime to increase predictability and fairness. Both the federal and state governments levy takes in India and some minor taxes are also levied by the local authorities such as the municipality and local government.

A resident company is taxed on its worldwide income. A non-resident company is taxed only on income that is received in India, or that accrues or arises, or is deemed to accrue or arise, in India. All companies, whether Indian or foreign, are liable to taxation, under India’s Income Tax Act, 1961.

Summary of tax rates

|

Tax type |

Rate(s) & key details |

Abbreviation |

|

Corporate Income Tax |

|

CIT |

|

Goods and Services Tax |

|

GST |

|

Individual Income Tax |

|

IIT |

|

Minimum Alternate Tax |

|

MAT |

|

Capital Gains Tax |

|

CGT |

|

Cryptocurrency Tax |

|

VDA Tax |

|

Withholding Tax |

|

WHT |

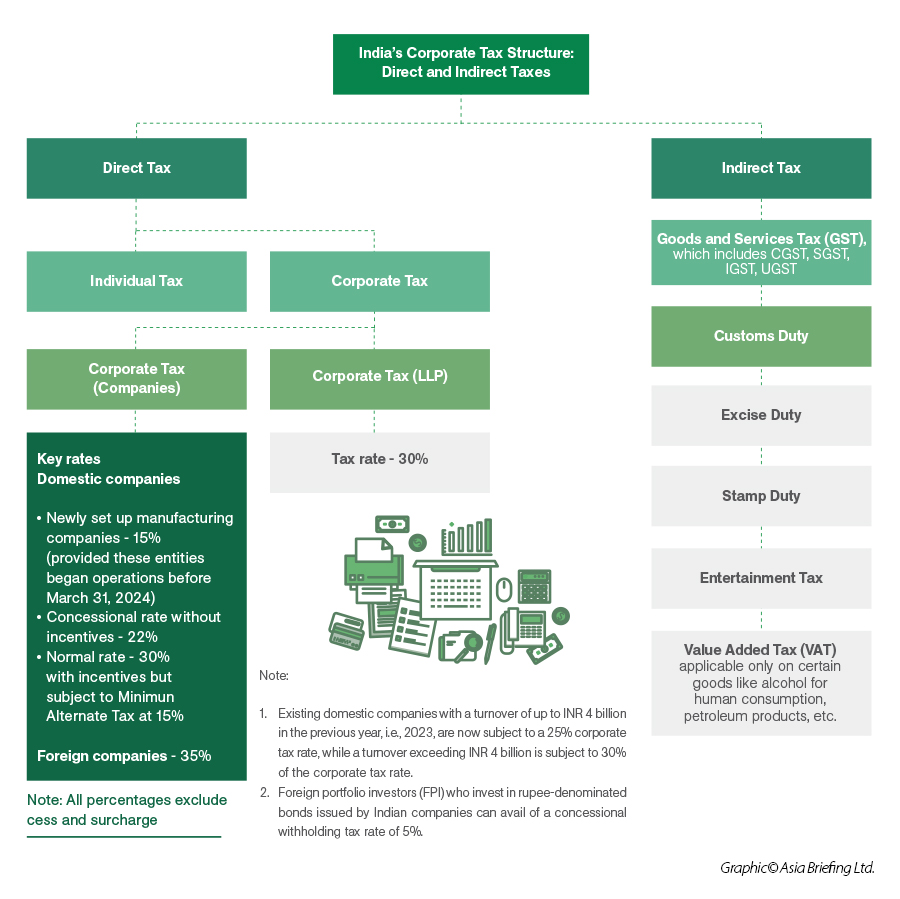

Corporate Income tax

Corporate tax is levied on the income earned by companies at a rate varying between 15-40 percent, depending on the companies’ particulars.

Any company registered under the Companies Act, or any foreign company that has its place of effective management in India is considered a domestic company.

All income earned by a domestic company is taxed under the corporate income tax laws. India has among the highest corporate tax rates in the world, but the effective tax liable differs across industry and sector.

Goods and Services Tax (GST)

India’s biggest tax reform, the goods and services tax (GST), was implemented on July 1, 2017.

GST is a single value-added tax levied on the manufacture, sale, and consumption of goods and services at the national level. The single tax system subsumed all the previously existing federal and state levies with an aim to create a single, uniform market across India.

There are three components to GST in India:

- CGST: Central goods and services tax, levied on an intra-state sale and collected by the central government.

- SGST/UGST: State/union territory goods and services tax, levied on an intra-state sale and collected by the state or union territory government.

- IGST: Integrated goods and services tax, levied on interstate sales and collected by the central government. The IGST is the aggregate of the CGST and SGST; the SGST is appropriated from the state where the supplies are consumed.

Customs duty and import-export taxes

Customs duty is charged by the federal government on import and export of goods to/from India. Duty is payable at the time of import or export of goods.

Exports of goods and services are free from duties and duties paid on exported goods/inputs are refunded.

India follows the HSN classification rules, and the goods are classified under different chapters or tariff headings, primarily according to their description, components and use. The duties or taxes applicable on imports are Basic Custom Duty, Social Welfare Surcharge and IGST at applicable rates.

Withholding tax in India

The withholding tax rate is the rate prescribed in the Income Tax Act, 1961 or relevant Double Taxation Avoidance (DTA) Agreement, whichever is lower.

Non-residents are liable to pay taxes in India on source income, including:

- Interest, royalties, and fees for technical services paid by a resident;

- Salary paid for services rendered in India; and

- Income arising from a business connection or property in India.

Withholding tax (WHT), also called retention tax, is an obligation on the individual (either resident or non-resident) to withhold tax when making payments of a specified nature - such as rent, commission, salary, for professional services, to satisfy contract provisions, etc. – at rates specified in India’s tax regime.

Individual income tax

The Indian income tax system imposes taxes on individual taxpayers based on their taxable income or profits earned. Taxpayers can choose to pay lower taxes by forgoing exemptions and deductions by opting for the new regime.

|

Tax Slabs and Rebate as Announced in the 2025–26 Union Budget |

||||||

|

Income (INR) |

Tax on slabs and rates (INR) |

Benefit (INR) |

Rebate benefits (INR) |

Total benefits (INR) |

Tax after rebate benefits (INR) |

|

|

|

Present (FY 2024-25) |

Proposed (for FY 2025-26) |

Rate/slabs |

Full up to 1.2 million |

|

|

|

800,000 |

30,000 |

20,000 |

10,000 |

20,000 |

30,000 |

0 |

|

900,000 |

40,000 |

30,000 |

10,000 |

30,000 |

40,000 |

0 |

|

1 million |

50,000 |

40,000 |

10,000 |

40,000 |

50,000 |

0 |

|

1.1 million |

65,000 |

50,000 |

15,000 |

50,000 |

65,000 |

0 |

|

1.2 million |

80,000 |

60,000 |

20,000 |

60,000 |

80,000 |

0 |

|

1.6 million |

170,00 |

120,000 |

50,000 |

0 |

50,000 |

120,000 |

|

2 million |

290,000 |

200,000 |

90,000 |

0 |

90,000 |

200,000 |

|

2.4 million |

410,000 |

300,000 |

110,000 |

0 |

110,000 |

300,000 |

|

5 million |

1.19 million |

1.08 million |

110,000 |

0 |

110,000 |

1.08 million |

|

Deductions introduced under new tax regime 2025-26:

|

||||||

|

Income Tax Slab – New Regime |

Tax Rate |

|

INR 400,000 |

No tax |

|

INR 400,001 to INR 800,000 |

5% |

|

INR 800,001 to INR 1.2 million |

10% |

|

INR 1,200,001 to INR 1.6 million |

15% |

|

INR 1,600,001 to INR 2 million |

20% |

|

INR 2,000,001 to INR 2.4 million |

25% |

|

Above INR 2.4 million |

30% |

Despite having higher tax slabs, the old tax system has remained the mainstay for taxpayers in the country since it gives those with greater yearly earnings and more investments more room for tax deductions.

|

Income Tax Slabs under the Old Regime |

|

|

Income tax slabs |

Income tax rate (%) |

|

INR 0 – 250,000 |

0% |

|

INR 250,000 – 500,000 |

5% |

|

INR 500,00 – 1,000,000 |

20% |

|

INR 1,000,000 and above |

30% |

|

*Education cess and surcharges will be applicable. |

|

Transfer pricing

India follows the arm’s length principle for transfer pricing.

India’s transfer pricing laws are enumerated under sections 92 to 92F of the Indian Income Tax Act, 1961 and cover intra-group cross-border transactions.

India’s TP regulations provide a detailed statutory framework for the computation of reasonable, fair, and equitable profits and tax. The goal is to prevent the shifting of profits by manipulating prices charged or paid in international transactions, thereby eroding India’s tax base.

Remitting profits from India

Prior to investing in India, companies must know how to repatriate their profits from the country. Though sending company profits from India is much simpler than remitting personal income, the procedures to remit money to the parent company depend upon an entity’s investment model.

The rules and procedures for remitting profits vary depending on the type of entity set up in India.

Tax incentives for business

Tax incentives are available to businesses in India depending on the economic activity, industry, location, and size of the firm. Investors become eligible for most of India’s tax breaks and incentives after registering with the Ministry of Corporate Affairs. Tax incentives tied to specific targets – such as hiring over 50 Indian employees – often require additional permissions from related ministries.

India offers tax relief at both the central and state level. Further, additional incentives are available to investors in specific sectors, while India’s special economic zones (SEZs) offer their own comprehensive tax relief. However, not all tax benefits offered in India are mutually inclusive.

Availing the benefits of one incentive may disqualify investors from applying to others. Businesses entering the Indian market should review the country’s tax incentives carefully and ensure their entry plan provides them with the greatest tax relief possible. For tax incentives issued by individual states, the related state’s directorate of industries is usually the body in charge of granting benefits.

Audit and compliance

India’s company law prescribes four different kinds of audits for companies - namely internal audit, statutory audit, cost audit, and secretarial audit - and mandates certain classes of companies to appoint an auditor to audit the functions and activities of the company.

|

Overview of Financial Reporting Requirements for Different Entities in India |

|||

|

Types of entities |

Is preparation of financial statements mandatory? |

Relevant statute |

Remarks |

|

Proprietorship |

Yes |

Income Tax Act, 1961 |

Applicable only if the turnover exceeds the limits specified under the relevant statute |

|

Partnership Firm |

Yes |

Income Tax Act, 1961 |

Applicable only if the turnover exceeds the limits specified under the relevant statute |

|

Limited Liability Partnership (LLP) |

Yes |

Limited Liability Partnership Act, 2008 |

Only if the turnover exceeds the limits specified under the relevant statute |

|

Listed Public Limited Company |

Yes |

Companies Act, 2013, Securities and Exchange Board of India (SEBI) Guidelines |

In case the company falls under a special statute, then the requirements of such special statute shall prevail |

|

Unlisted Public Company |

Yes |

Companies Act, 2013 |

In case the company falls under a special statute, then the requirements of such special statute shall prevail |

|

Private Company |

Yes |

Companies Act, 2013 |

In case the company falls under a special statute, then the requirements of such special statute shall prevail |

|

Liaison Office/ Branch Office/ Project Office |

Yes |

Companies Act, 2013 Foreign Exchange Management Act Insurance Regulatory and Development Act 1999 |

Six months from the end of the financial year. |

Here we examine each type of audit, what classes of companies are required to conduct it, and penalty for non-compliance.

|

An Overview of Types of Audits under the Companies Act, 2013 |

||||

|

Type of audit |

Scope of audit |

Standards to comply |

Who conducts the audit? |

Who is the report submitted to? |

|

Statutory audit |

Audit of the financial records and statements of the company |

Auditing standards recommended by Institute of Chartered Accountants of India (ICAI) |

A chartered accountant (CA) (excluding the statutory auditor of the company); or A cost accountant; or A professional decided by the Board. |

Members |

|

Internal audit |

Audit of the functions and activities of the company |

NA |

A CA (excluding the statutory auditor of the company); or A cost accountant; or A professional decided by the Board |

Board of Directors |

|

Secretarial audit |

|

Auditing Standards recommended by the Institute of Company Secretaries of India (ICSI) |

A practicing company secretary (CS |

Members |

|

Cost audit |

Audit of the cost records of the company |

Cost auditing standards issued by the Institute of Cost and Works Accountants of India |

A practicing cost accountant |

Board of Directors |

Accounting standards

India’s accounting standards have been formulated keeping in view the economic and legal environment and to converge with the International Financial Reporting Standards.

Companies in India are obligated to adhere to the Ind AS 115, which lays down the principles to be applied by an entity in order to report useful information to users of financial statements. These principles include the nature, amount, timing, and uncertainty of revenue and cash flows arising from a contract with a customer.

Accounting standards are applicable to each enterprise based on their classification. Enterprises are classified and labeled as Level I, Level II, and Level III companies.