A major investment hub in South Asia and well connected to central, west, southeast, and east Asian countries, India is a prime location for foreign multinationals. The country has doubled down on efforts to diversify its economy resulting in the prominence of its services sectors, boosted by Information and Communication Technologies (ICT) capabilities and wide-spread use of English.

On top of why foreign investors choose India as an investment destination in the first place, i.e.:

- Strong economic track-record: Despite the pandemic blip, and key reforms to liberalize market access and ease doing business make the country an attractive investment destination for foreign investors.

- Marketing liberalization: Most sectors are open to FDI.

- Growing digital economy: Offers some of the brightest prospects with over 300 million internet subscribers.

- Significant and growing middle-class: presenting new opportunities for market penetration in areas like tier-2 and tier-3 cities for goods ranging from consumer durable goods to automobiles to healthcare besides digital services.

- Improving ease of doing business: Business reforms have quickened the set-up process through single-window and electronic platforms. Indian states compete to provide the most efficient turnaround of bureaucratic services, which can be a key market-entry consideration above operating cost.

- Seventh largest country in the world by land area: Land availability across the country is also being made transparent through an online GIS-based industrial land bank, which includes vacant plots and industrial parks.

- Long term vision for foreign trade: India’s Foreign Trade Policy (FTP) 2023 announced new export hubs as well as measures targeting the e-commerce, dairy, and apparel and clothing sectors, among others. The new FTP also seeks the internationalization of domestic currency and will facilitate global trade payments in rupees.

Upgradation of manufacturing capabilities and incentives

For companies interested in or already manufacturing in India, the Production-Linked Incentive (PLI) Schemes provides financial incentives to manufacturers in 14 target sectors based on the value of their committed investment in the country, product innovation and addition to the existing value chain, and incremental sales of finished output.

|

Production-Linked Incentive Schemes in India: Target Sectors and Incentives |

||

|

|

Sectors |

Incentives |

|

1 |

Mobile manufacturing and specified electronic components |

4% to 6% for a period of five years |

|

2 |

Manufacturing of medical devices |

5% for a period of five years |

|

3 |

Critical key starting materials (KSM) / drug intermediaries (DI) and active pharmaceutical ingredients (API) |

5% to 20% for a period of six years |

|

4 |

White goods (ACs and LEDs) |

4% to 6% for a period of five years |

|

5 |

Telecom and networking products |

4% to 7% for a period of five years |

|

6 |

Electronic/technology products |

1% to 4% for a period of four years |

|

7 |

Pharmaceuticals drugs |

3% to 10% for a period of six years |

|

8 |

Food products |

4% to 10% for a period of six years |

|

9 |

Solar PV modules |

Based on sales, performance criteria, and local value addition for a period of five years |

|

10 |

Advanced chemistry cell (ACC) battery |

Based on sales, performance criteria, and local value addition for a period of five years |

|

11 |

Textile products |

Based on sales, performance criteria, and local value addition for a period of five years |

|

12 |

Automotive industry and drone industry |

Based on sales, performance criteria, and local value addition for a period of five years and three years, respectively |

|

13 |

Specialty steel |

4% to 12% for a period of 5 years |

|

14 |

Drones and drone components |

|

Cumulatively, the PLI schemes aim to boost domestic manufacturing, increase exports, and attract more FDI by inviting both foreign and local companies to set up, engage in R&D, or expand their manufacturing units in the country. Companies that are currently beneficiaries of the PLI schemes (both foreign-invested and domestic enterprises) will be important targets for joint ventures, business matchmaking, supply chain partnerships, private equity investment, and other forms of investment. The PLI scheme coverage ranges from a period of four to six years, depending on the sector.

The regional locations of the target sector beneficiaries could prove to be ideal for setting up – based on the nature of the business operation.

Strategic location with superb connectivity

India's location at the head of the Indian oceans is of strategic importance and connects it with the Middle East, Europe, and West Africa from the western coast and Southeast Asia and East Asia from the eastern coast. India’s transit sea routes thus connect Europe with East Asia. India also has the longest coastline in the Indian oceans.

Besides, India’s internal connectivity has also drastically improved. The country has the second largest road network and fourth largest rail network in the world and seventeen international airports according to Airports Authority of India .

China +1 strategy

Businesses adopt the China plus one model to reduce operating costs, diversify workforces and supply chains, as well as access new markets. Businesses that adopt the strategy become less vulnerable to shocks like supply chain disruption, currency fluctuations, and tariff risks. Businesses can quickly scale up in one country if market or operating conditions deteriorate in the other.

India previously represented a more difficult alternative to China in comparison to Southeast Asian countries, but many businesses that are invested in China are now taking a second look at India.

Extensive Double Tax Avoidance Agreements

India has one of the largest networks of tax treaties for the avoidance of double taxation and prevention of tax evasion. The country has Double Tax Avoidance Agreements (DTAAs) with over 94 countries.

The purpose of such tax treaties is to develop a fair and equitable system for the allocation of the right to tax different types of income between the ‘source’ and ‘residence’ countries.

DTAAs provide protection to taxpayers against double taxation and prevent any deterrence in the free flow of international trade, investment, and transfer of technology between two countries.

Foreign companies that are resident in the countries that India has a DTAA with, can claim more beneficial provisions and rates between the IT Act and the DTAA.

Reforms to corporate income tax regime and incentives

India reduced the corporate tax rate for domestic companies, whereby new companies are now subject to a 22 percent rate and new domestic manufacturing companies, 15 percent. The effective tax rate for these domestic companies is around 25.17 percent inclusive of surcharge and cess.

Those companies opting for the concessional corporate tax rate also do not have to pay minimum alternate tax. As a result, India’s current effective tax rate brings it at par, on average, with leading Asian investment destinations and manufacturing hubs like China, Vietnam, Malaysia, Singapore, and South Korea.

Incentives

There are multiple forms of tax and non-tax incentives available to businesses in India, such as tax exemptions, tax reductions, lower tax rates, tax refunds or rebates, tax credits, etc.

These can be primarily categorized as incentives based on:

- Corporate tax incentives for eligible companies;

- Tax incentive for Capital Expenditure on specified businesses;

- Incentives for Special Economic Zones (SEZs); and

- Tax incentives in different Indian states.

Fastest growing economy

According to estimates from the International Monetary Fund (IMF), India’s economy surpassed that of the United Kingdom in terms of size in 2022 and rose to become the fifth largest in the world, with a 7.2 percent growth forecast for FY 2023.

Despite global headwinds, India is well positioned to register impressive growth, backed by robust demand from its large domestic markets. A recent World Bank report titled “Navigating the Storm” underlines that the Indian economy has proved remarkably resilient to the ongoing impacts of the deteriorating external environment, growing faster than most major emerging market economies (EMEs).

With the banking system in good health to support the nation’s economic recovery, it is anticipated that private sector investment will rise in the forthcoming year, making India the bright spot in the Asian business and investment landscape.

Availability of skilled and presence of a large English-speaking workforce

India has the world’s largest adolescent and youth population. It will continue to have one of the youngest populations in the world till 2030. The country has the third-largest group of scientists and technicians in the world. About 10 percent of the country’s population speaks English; it is among the country’s official languages.

India is also an information technology hub, and the IT sector employs 3.9 million, making it the largest private sector jobs creator in the country.

Efficient legal system

India follows the common law system and has a written constitution, which has both federal and unitary features. It provides for the distribution of legislative and executive powers between the central government and state governments while also providing for a unified judiciary. The legislative powers are divided between the central and state legislatures.

Legislatures and regulations are well-defined. Indian companies are governed by the Companies Act, 2013. Limited liability partnerships are governed by a separate legislation, the Limited Liability Partnership Act, 2008. The government has also launched a series of initiatives aimed at enhancing the ease of doing business.

India’s Competition Act, 2002 is the principal legislation dealing with anti-trust issues. The Act prohibits or regulates (a) anti-competitive agreements, (b) abuse of a dominant position, and (c) combinations (mergers, acquisitions, de-mergers).

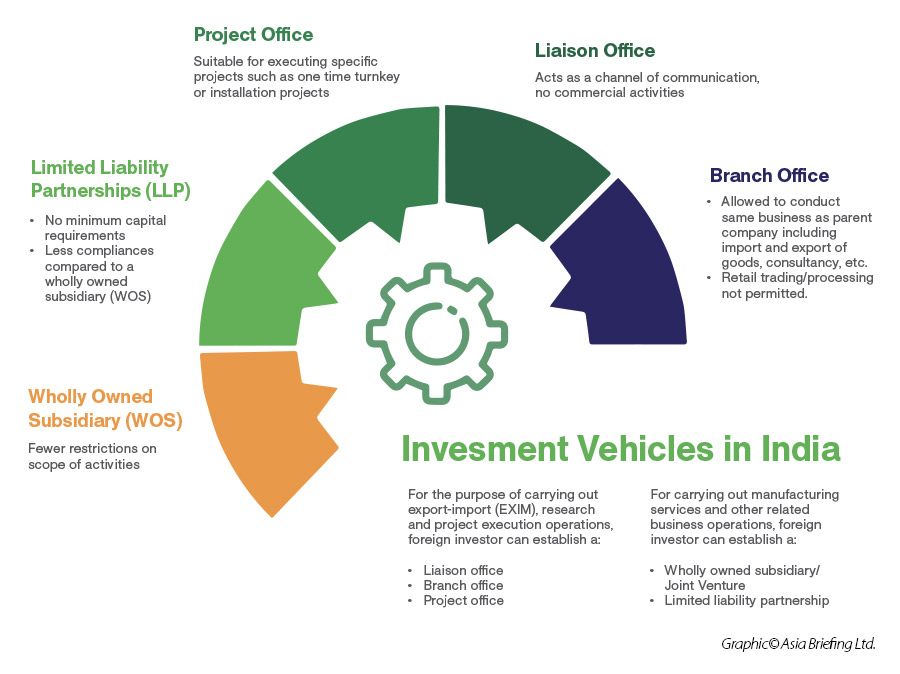

Entry options for foreign companies

Several entry options are available for foreign investors to enter the India market.