India’s individual income tax system is structured around a taxpayer’s residency status and the source of income. The regime uses a slab-based structure—different portions of income are taxed at varying rates based on the India tax bracket they fall into. This guide explains the two available tax regimes, outlines key changes introduced in recent budgets, and provides an overview of filing and payment obligations.

How to choose the right tax regime?

Taxpayers in India have two regimes to choose from:

Old tax regime

- Continues with the existing structure, allowing taxpayers to claim numerous exemptions and deductions (such as contributions to PPF, ELSS, EPF, life insurance premiums, mortgage interest, health insurance premiums, and more).

- Applicable tax bracket for FY 2025–26 offer basic relief with a zero-tax threshold up to INR 250,000 (with higher limits for senior citizens).

New tax regime

- Offers lower tax rates in exchange for forgoing many popular deductions and exemptions.

- Recent proposals under the Union Budget 2025–26 aim to ease the tax burden on the middle class, with additional benefits for incomes up to INR 1.275 million (US$ 14,663).

The choice depends on each taxpayer’s financial profile. Business clients must assess whether the benefit of lower tax rates outweighs the loss of exemptions.

New tax regime updated structure for 2025

Under the revised structure, taxpayers can benefit from lower rates if they opt out of standard deductions and exemptions. The proposed tax slabs are as follows:

|

Income Range (INR) |

Tax Rate |

|

0 – 400,000 |

Nil |

|

400,000 – 800,000 |

5% |

|

800,000 – 1,200,000 |

10% |

|

1,200,000 – 1,600,000 |

15% |

|

1,600,000 – 2,000,000 |

20% |

|

2,000,000 – 2,400,000 |

25% |

|

Above 2,400,000 |

30% |

Notable changes include an increased standard deduction—from INR 50,000 to INR 75,000—and adjusted surcharge rates for higher-income earners.

Old tax regime

The traditional tax system allows taxpayers to structure their finances and reduce taxable income through numerous deductions and exemptions. Key deductible expenses include contributions to PPF, ELSS, EPF, life insurance, mortgage payments, and health insurance premiums. Additional benefits, such as House Rent Allowance (HRA) and Leave Travel Allowance (LTA), remain available under this regime.

The tax slabs under the old system are:

Senior citizens benefit from higher exemption limits, with residents aged 60 to 80 allowed up to INR 300,000 and those above 80 up to INR 500,000.

|

Income Tax Slab for People Between 60 to 80 Years |

|||

|

Tax Slabs |

Rates |

||

|

INR 300,000 |

NIL |

||

|

INR 300,000 - INR 500,000 |

5% |

||

|

INR 500,000 - INR 1,000,000 |

20% |

||

|

INR 1,000,000 and above |

30% |

||

|

Income Tax Slab for People Above 80 Years |

|||

|

Up to INR 500,000 |

NIL |

||

|

INR 500,000 - INR 1,000,000 |

20% |

||

|

INR 1,000,000 and above |

30% |

||

How to determine your tax eligibility?

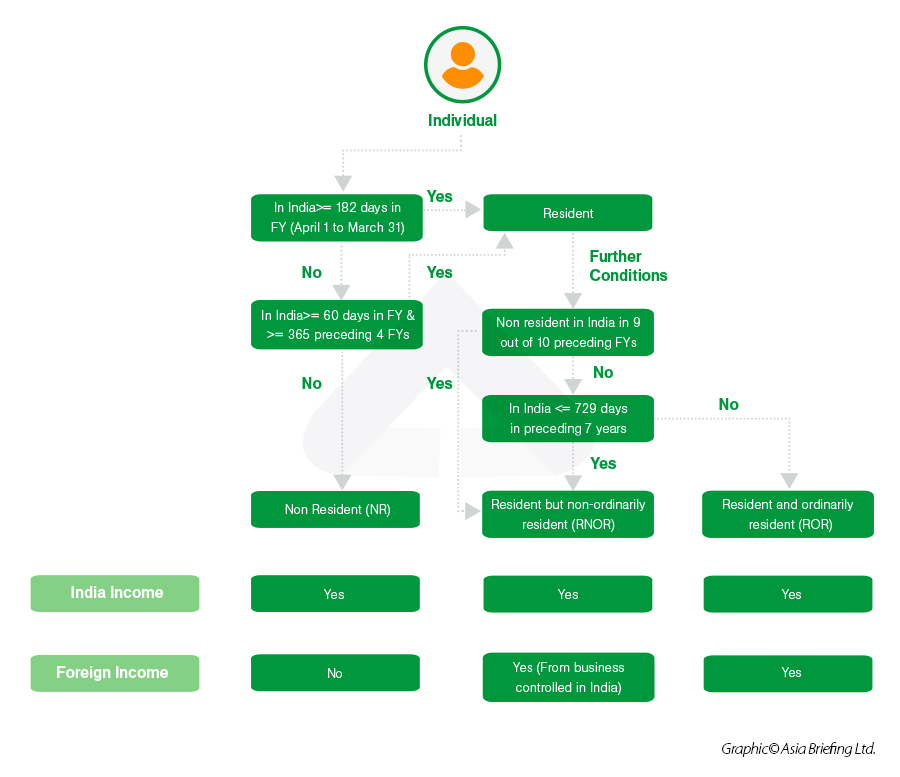

The tax incidence on an individual is influenced by their residential status, which is determined by their actual presence in India according to the regulations outlined in the Income Tax Act.

An individual who is a citizen of India and is not liable to tax in any other country shall be considered a resident of India for tax purposes only if their total income, excluding income from foreign sources, exceeds ₹15 lakh and they do not incur any tax liability in any other country.

How to calculate your individual income tax?

In India, total income tax is determined based on the tax rates and regulations in effect as of April 1 of the relevant assessment year.

When it comes to employment income, it includes not just wages and salaries but also a range of other earnings—such as pensions, bonuses, commissions, and even non-cash benefits like perquisites, sweat equity shares, and employer contributions to superannuation funds. Reimbursements for personal expenses may also be considered part of taxable income.

As for the tax structure, the new income tax regime is the default system. However, individuals who do not have business income still have the flexibility to opt for the old regime on a year-by-year basis.

For taxpayers with business income, the rules are slightly different. They must explicitly choose the old tax regime if they wish to continue with it. However, if they decide to switch to the new tax regime, this choice is permanent—they will not be able to revert to the old system later.

Step-by-step calculation process

- Gather all income from employment (cash or in kind). This includes salaries, pensions, bonuses, commissions, and other benefits.

- Your taxable income is divided into segments corresponding to the tax slabs applicable for the assessment year.

- General formula to calculate income tax and taxable income:

Taxable Income = Gross Salary - Deductions

Income Tax = (Taxable Income x Applicable Tax Rate) - Tax Rebate

- Use the following formula to compute the tax for each slab:

T = Σ [(min(I, Sᵢ) – Sᵢ₋₁) × rᵢ]

Where:

• T is the total tax liability

• I represent your total taxable income

• Sᵢ is the upper limit of the i-th tax slab

• Sᵢ₋₁ is the upper limit of the previous slab (with S₀ = 0)

• rᵢ is the tax rate applicable to that slab

After computing the basic tax, incorporate any applicable surcharges and the health and education cess (typically 4 percent of the combined tax and surcharge).

Sample use case

Let’s assume Mr. K has a total taxable income of INR 1,200,000 under the new tax regime. Based on the India tax bracket, his tax liability would be:

|

Income Range (INR) |

Tax Rate |

|

0 – 400,000 |

Nil |

|

400,000 – 800,000 |

5% |

|

800,000 – 1,200,000 |

10% |

|

1,200,000 – 1,600,000 |

15% |

|

1,600,000 – 2,000,000 |

20% |

|

2,000,000 – 2,400,000 |

25% |

|

Above 2,400,000 |

30% |

For Mr. K, the calculation would be:

- First INR 400,000:

Tax = INR 400,000 × 0 percent = INR 0 - Next INR 400,000 (from INR 400,001 to INR 800,000):

Tax = INR 400,000 × 5 percent = INR 20,000 - Remaining INR 400,000 (from INR 800,001 to INR 1,200,000):

Tax = INR 400,000 × 10 percent = INR 40,000

Thus, his basic tax liability is INR 20,000 + INR 40,000 = INR 60,000. Any applicable surcharges and the 4 percent cess would then be added to this amount, resulting in his final tax obligation.

Tax payment and filing obligations

Advance tax

Taxpayers whose annual tax liability exceeds INR 10,000 must pay advance tax in instalments. The schedule includes:

- 15 percent by June 15

- 45 percent by September 15

- 75 percent by December 15

- 100 percent by March 15

Salaried individuals generally have taxes deducted at source; however, they must account for additional income streams such as rental or interest income.

Senior citizens (60 years or older) who do not earn from business or profession do not have to pay advance tax.

The taxpayers can pay advance tax, self-assessment tax online from the NSDL website. They should also have a net banking facility with an authorized bank.

Annual tax returns

Mandatory documents include:

- PAN and Aadhar numbers.

- Form 26AS.

- Bank account details.

- Challan receipts for advance or self-assessment tax payments.

- Previous return details (if filing a revised return).

For non-residents or expatriates, an Income Tax Clearance Certificate (ITCC) is required before exiting India.

Starting April 1, 2025, taxpayers will have up to 5 years (instead of 3) to file an updated tax return. However, late submissions come with penalties:

- Filing between 3-4 years incurs a 60 percent extra tax.

- Filing between 4-5 years incurs a 70 percent extra tax.

Additionally, updated returns will not be permitted if the tax authority issues a reassessment notice after the 4-year mark—unless that reassessment is later cancelled.

Income tax clearance

Individuals who are not domiciled or residents of India and have earned income in India through business, profession, or employment must obtain an Income Tax Clearance Certificate (ITCC) before leaving the country. This confirms that they have paid all required taxes on their income earned within India.

To apply for an ITCC, they need to submit Form 30A, which must be filed by their employer or the person who paid them. After verification, tax authorities will issue the ITCC through Form 30B.

Additional considerations

- Non-employment income: Special tax rates apply for capital gains, interest, and royalties earned from non-employment sources.

- Health and education cess: An additional cess of 4 percent is levied on the aggregate tax and applicable surcharges.

- Double taxation avoidance: Expatriates can reduce their taxable income through double taxation avoidance agreements, mitigating the risk of being taxed in two jurisdictions.

Double Taxation Avoidance Agreements

Most expatriates worry about “double taxation” – paying taxes to two different countries on the same income. A foreign taxpayer working in India may be able to reduce taxable income in their country of primary residence (and double taxation) under a double taxation avoidance agreement.

FAQ: IIT in India: Commonly Asked Questions

Which allowances in India are tax exempt?

|

Fully taxable |

Partly taxable |

Fully exempt |

|

Entertainment Allowance |

House Rent Allowance [u/s 10(13A)] |

Allowance granted to Government employees outside India. |

|

Dearness Allowance |

Special Allowances [u/s 10(14)] |

Allowance granted to High Court Judges. |

|

Overtime Allowance |

|

Sumptuary allowance granted to High Court or Supreme Court Judges |

|

Fixed Medical Allowance |

|

Allowance paid by the United Nations Organization |

|

City Compensatory Allowance (to meet increased cost of living in cities) |

|

Compensatory Allowance received by a judge |

|

Interim Allowance |

|

|

|

Servant Allowance |

|

|

|

Project Allowance |

|

|

|

Tiffin/Lunch/Dinner Allowance |

|

|

|

Any other cash allowance |

|

|

|

Warden Allowance |

|

|

|

Non-practicing Allowance |

|

|

What are the common deductions from salary and pension income?

|

Section |

Nature of Expenses |

Amount (INR) |

|

80C |

LIC/ PPF/ KVP/ EPF/ SSY/ NSC/ HOME LOAN PRINCIPAL/ SCHOOL FEES/ ELSS/ STAMP DUTY |

1,50,000 |

|

80CCD (1B) |

NPS |

50,000 |

|

80DD |

Expenses of disabled dependent (40%/ 80% disability) |

75,000/ 1,25,000 |

|

80U |

Own physical disability (40%/ 80% disability) |

75,000/ 1,25,000 |

|

80TTA |

Interest on Savings Account. Only available to Persons other than Senior Citizen/ Very Senior Citizen |

10,000 |

|

80TTB |

Interest on Savings Account and Interest on deposits with Post Offices, Banks, Cooperative bank. Only available to Senior Citizen & Very Senior Citizen |

50,000 |

|

80G |

Donation/ Contributions made to certain relief funds and charitable institutions. Contributions made to certain relief funds and charitable institutions (Only if paid by Cheque/ Bank Mode) |

50% of Donation or 10% of Total Income, whichever is higher. |

|

80GG |

Deduction for the rent paid (available to all Individuals except to those who gets HRA from Employment). Eligibility will be least amount of the following: 1) Rent paid minus 10% of the adjusted total income. 2) Rs. 5,000 per month 3) 25% of the adjusted total income |

|

|

80D |

Health Insurance policy contribution for self, spouse and dependent children (only if paid by cheque/ bank Mode). |

25,000/ 50,000 (for senior citizen) |

|

80E |

Interest on loan taken for higher education of Spouse, Children or Student for whom the individual is the legal guardian |

|

|

80EE |

Interest for Home Loan

|

50,000 |

|

80DDB |

Medical treatment of Specified Ailments for Dependents |

40,000/ 1,00,000 (for senior citizen) |

|

80CCD(1)* |

Employee’s contribution to NPS |

10% of salary or 20% of Gross Total Income |

|

80CCD(2) |

Employer’s contribution to an employee’s NPS account Contribution made by employer |

Maximum contribution of employee’s salary (14% in case of Central Government employee is allowed in a financial year) |

*The maximum deduction available for aggregate contributions u/s 80C, 80CCC and 80CCD(1) is Rs. 1.5 lakh.

Tax deduction under Chapter VIA will not be available to a taxpayer opting for the New Tax Regime u/s 115BAC, except for deduction u/s 80CCD(2).

Rebate u/s 87A: The rebate is available to a resident individual if his total income does not exceed Rs. 5,00,000 under the old tax regime and Rs. 7,00,000 under the new tax regime. The amount of rebate shall be 100 percent of income-tax or Rs. 12,500 whichever is less. Under the old tax regime and the amount of rebate shall be 100 percent of income-tax or Rs. 25,000 whichever is less under the new tax regime

Forms for filing income tax return

ITR-1: An individual whose total income is less than Rs. 50 lakh and the sources of income are from salaries or pensioners, single house property, other sources like interest from bank deposit and agricultural income up to Rs. 5000. If there are any capital gains, then the individual cannot file ITR-1.

ITR-2: Individuals having income from capital gains and not having business income and not eligible for ITR-1(Sahaj).

ITR-3: Individuals having business income apart from other heads of income but not eligible for ITR-1, 2 or 4(Sugam).

ITR-4: Individuals having income up to Rs. 50 lakh and includes business income under presumptive taxation scheme. However, not applicable for an Individual who is either a director of a company or has invested in unlisted shares of a company.

Understanding numerous income tax forms and their relevance is crucial to filing a correct and compliant return and avoiding any potential lawsuits (Income Tax Litigation). The three primary parts that regulate the procedure are the Taxpayer Information Summary (TIS), Annual Information System (AIS), and Form 26AS.

- Form 26AS:- Form 26AS is an annual consolidated tax credit statement that taxpayers can access, view or download from the Income Tax Department’s e-filing website. It is one of the most important documents taxpayers should verify before filing their ITR.

- Annual Information System (AIS):- The Income Tax Department provided the Annual Information System (AIS), a powerful instrument for gathering key data on a taxpayer's financial transactions during a financial year. An individual taxpayer receives income from a variety of sources during the course of a fiscal year, including wages, rent, interest income, and so forth. The AIS compiles information about these diverse sources of income, taxes deducted at source (TDS), taxes paid, and other tax-related data. Taxpayers can get a consolidated view of their tax credits and liabilities by utilising Form 26AS to access the AIS. This helps them to find any inconsistencies or missing information by comparing the data with their own records. Accurate reporting of income and taxes is ensured with this statement. Also, taxpayers can avoid potential hassles with the tax authorities by fixing any errors or omissions before completing and filing the ITRs.

- Taxpayer Information Summary (TIS): The Taxpayer Information Summary (TIS) is a statement aggregating the entire tax information on file with the Income Tax Department for a particular taxpayer. It serves as an overview of the taxpayer's tax-related actions and provides significant insights into their tax compliance. The TIS statement contains details on the taxpayer's tax return submission history, taxes paid, refunds received, and any outstanding tax obligations. This useful tool helps taxpayers review and compare their personal tax records with the information maintained by the Income Tax Department. By using the Income Tax Department's e-filing website, they can conveniently view their TIS statement online. Taxpayers can read and download their TIS statements as needed by going into their e-filing accounts.

Who is a foreign national in India? Are foreign nationals liable to pay taxes in India?

- Any individual who is not a citizen of India is considered a foreign national;

- Taxation of Individuals (incl. foreign nationals) is based on source of income and the residential status (irrespective of citizenship);

- Residential status is determined based on number of days of stay in India during previous financial years (financial year April 1 to March 31), regardless of the purpose of stay.

What is the concept of residential status for determining tax liability under the Indian Income Tax Act, 1961?

Income tax for expats in India is determined based on their residency status. Individuals can be divided into following categories based on their residency:

Resident - An individual is said to be a resident in the tax year if he/she is:

- physically present in India for a period of 182 days or more in the tax year (182-day rule), or

- physically present in India for a period of 60 days or more during the relevant tax year and 365 days (or more) in aggregate in four preceding tax years (60-day rule)

If none of the above two conditions are met, the individual is said to be a Non-Resident (NR) in that tax year.

Resident and Ordinarily Resident (ROR) - If a taxpayer qualifies as a resident, the next step is to determine if she or he is a ROR or Resident but not ordinarily resident (RNOR). These individuals are taxed on their worldwide income. An individual would be ROR if both of the following conditions are met:

- Has been a resident of India in at least 2 out of 10 years immediately previous years; and

- Has stayed in India for 730 days or more in 7 immediately preceding year

Resident but Not Ordinarily Resident (RNOR) - If the individual qualifies as a resident only and does not satisfy the above conditions, she or he will be known as a resident but not ordinarily resident (RNOR). These individuals are taxed on their income sourced or received from India, or from an income derived from a business set up or controlled in India. Further, with effect from FY 2020-21, the Finance Act, 2020 has inserted the following two more situations wherein a resident person is deemed to be ‘Not Ordinarily Resident’ in India:

- An Indian Citizen (passport holder) or a person of Indian origin whose total income exceeds INR 15,00,000 (other than income from foreign sources) during the previous year and who has been in India for a period of 120 days or more but less than 182 days;

- Deemed Resident: Effective 01 April 2020, a concept of deemed residency has been introduced. An Indian citizen having India-sourced taxable income exceeding INR 15,00,000 during the relevant tax year will be deemed to be a resident of India if one is not liable to tax in any other country by reason of domicile or residence or any other criteria of similar nature. Further, such an individual will qualify as RNOR in India for the relevant tax year.

Non-resident - If none of the conditions specified for residency are met, then the individual will qualify as a non-resident.

Which categories of income are taxable in India?

All income received or accrued in India is subject to taxation. Below are the types of incomes that are taxable in India:

- Employment income: Salaried income relating to services rendered in India is considered to accrue or arise in India regardless of where it is received or the residential status.

- Business income tax rules for expats: All individuals who are self-employed or involved in business controlled or setup in India are subject to tax in India.

- Expat investment income: Investment income earned by the foreign nationals are taxed in the following manner (all must be declared via expatriate tax returns):

- Dividends earned from Indian companies is taxable in the hands of the individual shareholders

- Dividends received from foreign companies are subject to taxation in the hands of shareholders at the normal tax rates

- Expat Directors' Fees: Directors' fee is taxed at the usual progressive rates. Tax is required to be withheld at source from directors' fees paid to residents.

- Expat rental income: Rental income received by an individual from leasing of the house property is taxable at the value determined in accordance with specific provisions subject to deductions.

What is the concept of Double Taxation and how can it be avoided?

Expatriates often worry about “double taxation”, which means paying taxes in two different countries on the same income.

The Double Tax Avoidance Agreement (DTAA) is a tax treaty signed between two or more countries to help taxpayers avoid paying double taxes on the same income. A DTAA becomes applicable in cases where an individual is a resident of one nation but earns income in another.

Taxpayer can take the help of Double Tax Avoidance Agreement (DTAA) for incomes that can be taxable in both the countries that is India and the other country and avoid paying tax in one of the countries. He or she will then only be liable to pay tax for that income in one country.

What do we need to keep in mind while filing taxes?

Filing of taxes may be challenging for foreign nationals due to the presence of multiple tax regimes and a different tax system from their home country. It is advisable for individuals to not wait for the last minute in order to file their returns, as it might turn out to be a lengthy process depending upon the particulars of a case (sources of income, exemptions types and proofs, correctness of data, among others), and hurrying may lead to unnecessary mistakes leading to possible penalties.

Few points to keep in mind while filing an income tax return:

- Proper calculation and declaration of taxable income is important to avoid any discrepancy

- Correct Income Tax Return form needs to be filled with accurate information

- Timely preparation and filing of all the mandatory documents is vital

Foreign Nationals in India should be aware of the basic provisions affecting their taxation and should plan in advance to reduce their tax burden.

If you are looking for assistance in your India taxation matters, please do not hesitate to contact us.