India's focus on developing a green economy offers foreign companies profitable business opportunities by making strategic investments in natural assets. The government, on its part, has in place various measures to advance sustainable development goals and are keen to attract foreign firms that offer green solutions and know-how.

The green economy offers investment opportunities by aligning profitability with environmental goals. It focuses on sustainable development and poverty eradication, and values natural assets such as forests, water, and soil. Success is defined by improving human well-being, social equity, and reducing environmental risks, thereby challenging the perceived trade-off between economic progress and environmental responsibility.

Green industries can be commercially viable and drive economic growth, innovation, and job opportunities, especially for small and medium-sized enterprises.

However, achieving this requires a shift in financial strategies for both public and private sectors, involving targeted policy reforms to protect

natural capital and promote emerging sectors and technologies as well as investment in knowledge and intellectual property domains.

In the landscape of progress, India’s focus is shifting to the rising stars—emerging sectors like renewable energy, resource-efficient buildings, low-carbon transport, and waste management. These hold the key to steering the country toward a future of robust economic expansion and sustainable success. – Naina Bhardwaj, Dezan Shira & Associates’ International Business Advisory

Government policies enabling the creation of a green economy

India has implemented several significant measures to curb carbon emissions and advance sustainable development goals. One key initiative involves allowing foreign direct investment (FDI) up to 100 percent through the automatic route for renewable energy projects. Additionally, the waiver of Inter State Transmission System (ISTS) charges for inter-state sale of solar and wind power until June 30, 2025, has been instituted. The government has declared a trajectory for Renewable Purchase Obligation (RPO) up to the year 2030 and established Ultra Mega Renewable Energy Parks, facilitating a plug-and-play approach for developers by providing land and transmission.

Various schemes have been launched, including Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM), Solar Rooftop Phase II, and the 12000 MW CPSU Scheme Phase II. To ensure efficient power evacuation, the Green Energy Corridor Scheme involves laying new transmission lines and creating additional sub-station capacity. The Transmission Plan aims to integrate 500 GW of renewable energy capacity by 2030. Moreover, the Green Energy Open Access Rules, 2022, have been notified to promote renewable energy, and a Green Term Ahead Market has been introduced to facilitate the sale of renewable energy power through exchanges.

The government has taken proactive steps to retire inefficient thermal units, with a total of 259 units and a capacity of 18152 MW being phased out from the 10th Plan onwards until November 2022. Indian Railways has set a Net Zero target by 2030, which alone is expected to reduce emissions by 60 million tonnes annually. The widespread adoption of LED bulbs, part of a government campaign, is contributing to an annual reduction of 40 million tonnes in emissions. All thermal power capacity added since 2017 is through supercritical units, leading to a reduction in fossil fuel consumption and CO2 emissions.

Efforts to promote electric vehicles and establish charging infrastructure are underway, alongside the notification of fuel efficiency norms for the transport sector. Thermal power plants are also engaging in co-firing biomass pellets with coal. Various schemes and programs focused on enhancing energy efficiency further contribute to India's comprehensive approach to addressing carbon emissions and promoting sustainable development.

During the 26th session of the United Nations Framework Convention on Climate Change (COP 26) in November 2021, India declared its commitment to achieving net zero emissions by the year 2070. The Ministry of Environment, Forest and Climate Change (MoEF&CC) has set up 11 committees to formulate circular economy (CE) action plans, addressing 10 waste categories. Extended Producer Responsibility (EPR) rules have been officially notified for four waste categories, namely plastic waste, waste tyre, batteries, and e-waste.

Finally, India, alongside several countries, has embraced the 17 Sustainable Development Goals (SDGs) set forth by the United Nations in 2015. These are interconnected goals, with an ambition to achieve them all by 2030, and address global challenges related to poverty, inequality, climate change, environmental degradation, peace, and justice.

Foreign investment scope in India’s green economy

Renewable energy

In India, FDI in the renewable energy sector has seen significant growth, reaching US$2.5 billion in FY23, marking a 56 percent YoY increase. Q1 FY23 alone witnessed US$949.4 million in FDI, with Q4 FY23 showing a remarkable 102 percent YoY increase at US$838 million. As of December 2022, total FDI in the sector amounted to US$12.47 billion, and since 2014, it has surpassed US$78 billion. Key investor countries include Singapore, Mauritius, The Netherlands, and Japan.

India's renewable energy landscape is attractive for investment due to abundant labor, easy access to affordable capital, streamlined regulatory clearances, mandates for green hydrogen use, and various incentive schemes. The Bank of America anticipates India’s renewables domain to draw up to US$800 billion in investments over the next decade. Within this, the renewable energy sector could attract around US$250 billion in investments, batteries US$250 million, and supporting grid infrastructure and other segments like green hydrogen, equipment and system could garner US$300 billion in total investment. The bank expects India, given its scale, to be a preferred destination for strategic investors targeting net-zero goals.

Leading Indian corporates, including Reliance Industries, Tata group, Mahindra Group, and the TVS Group, have already laid out ambitious plans to enter the green energy sector. Reliance Industries, for instance, aims to achieve carbon-neutrality by 2035 and has made substantial acquisitions in solar, battery, and hydrogen, totaling over US$1.5 billion, to offset emissions from its oil and petrochemicals business. RIL has also been focused on manufacturing polysilicon, wafers, cells, modules, electric vehicles, grid storage batteries, electrolyzers and fuel cells, according to an April 2023 note from Goldman Sachs. Information from the Bank of America notes its advisory services on recent deal activity in the green energy and renewables sector has amounted to over US$5 billion. For example, it advised Actis LLP on the US$1.6 billion sale of Sprng Energy to Shell, and TPG Rise on its US$1 billion investment in Tata Motors’ electric vehicle business.

Despite a spurt in activity in block deals and the primary IPO market, the consumer technology segment has seen a valuation reset. Bank of America notes that new private raisings are limited to top-quartile companies, and while absolute valuation levels remain protected, multiples have decreased. Block deals in the listed space continue, but transaction sizes have reduced, indicating sellers choosing to monetize partially while retaining potential upside.

Waste sector

India is a significant contributor to global municipal solid waste (MSW), generating over 62 million tons annually, but only 43 million tons are collected and 12 million tons treated. Inadequate waste management infrastructure poses environmental and health challenges. Hazardous, plastic, e-waste, and biomedical waste are increasing, with projections from the Central Pollution Control Board (CPCB) suggesting India’s annual waste generation will reach 165 million tons by 2030.

The country’s solid waste management market is segmented into collection, transportation, treatment, and disposal. Collection and transportation dominate due to inadequate infrastructure, while treatment and disposal are expected to grow with a focus on sustainable practices. While government initiatives and rule amendments aim to improve waste management, there is significant variation in technology adoption and waste processing capacity across states and union territories (UT). For example, waste-to-energy (W2E) plants are operational in only 10 states/UTs, and biomethanation is found in 22 states/UTs.

As per Mordor Intelligence, the estimated size of the Indian waste management market was US$32.09 billion in 2023, projected to reach US$35.87 billion by 2028, with a compound annual growth rate (CAGR) of 2.25 percent during the forecast period (2023-2028).

The waste management market is characterized by its fragmentation, with various players working towards reducing waste generation and optimizing recycling processes. Numerous startups are, however, spearheading initiatives for environmentally friendly waste disposal. Key market players include A2Z Green Waste Management Ltd, BVG India Ltd, Ecowise Waste Management Pvt. Ltd, Tatva Global Environment Ltd, and Hanjer Biotech Energies Pvt. Ltd.

Foreign enterprises keen to showcase their technologies and meet Indian business partners, can attend the Clean India Expo held in New Delhi from January 17-19, 2024.

Sustainability targets

India is actively seeking to attract foreign corporations that specialize in sustainable technology and are willing to invest in key sectors. These target sectors include:

- Smart cities & industrial corridors

- Affordable housing

- Waste management

- Water

- Transport infrastructure

- Renewable energy (solar, wind, biomass, small hydro)

- Electric mobility

- Medical devices

- Healthcare, pharma & biotech

- Food processing (including agriculture)

- Textiles

The aim is to foster sustainable development and collaboration in these critical areas.

Meanwhile, the national FDI facilitation agency, Invest India, is committed to aligning investor facilitation goals with UNSDG (United Nations Sustainable Development Goals). In pursuit of this, it will furnish target investors with comprehensive information, including details on specific investment opportunities, outreach plans, organized or attended roadshows, roundtables, and sector events. The agency also provides sector collaterals, conducts sector trainings, identifies priority markets, outlines a resource plan, offers a detailed prospect list, and maps key stakeholders.

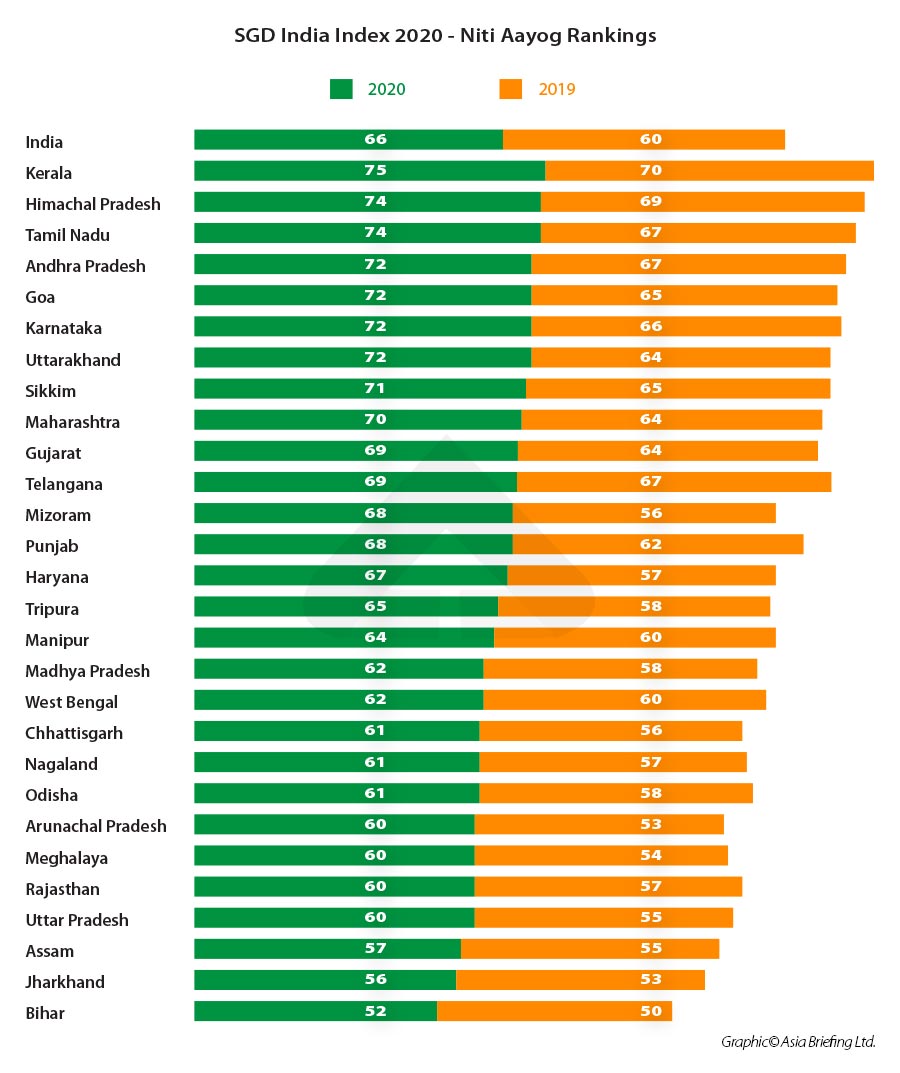

Select Indian states have prepared sustainable development goals (SDG) vision documents and the SDG India index was established in 2018. Per the most recent available data,from the think tank Niti Aayog, published in July 2020, the states/UTs leading in SDG implementation are Kerala, Himachal Pradesh, Chandigarh, Puducherry, and Tamil Nadu. The states of Uttar Pradesh, Assam, Jharkhand, and Bihar ranked the lowest.

Per data from the Sustainability Development Report 2023, which tracks the annual progress of all UN member states towards their achievement of UNSDG goals, India confronts major challenges in nine areas and significant challenges in five areas.

India’s MoUs with Foreign Countries on Matters Of Environmental Sustainability

India has entered into a number of Memoranda of Understanding (MoU) within a wide range of areas related to environment protection and sustainability. The MoUs are of great importance as they facilitate international cooperation in areas of mutual interest. The MoUs are valuable for public authorities as well as for companies and organizations for implementation of activities within prioritized sectors.

2010: India-Sweden MoU

Focus: Renewable energy cooperation

2016: India-European Union Water Partnership MoU

Focus: Enhancing water management capabilities

2018: India-Netherlands MoU

Areas covered: Water management projects, sanitation impact bonds, introduction of Dutch sustainable technology

2019: India-Switzerland Technical Cooperation MoU

Areas covered: Climate change, sustainable water management, air/water/land pollution, resilient urban development

2020: India-Finland MoU

Focus: Air and water pollution prevention, waste management, climate change

2020: India-Denmark Green Strategic Partnership

Areas covered: Exchange of ideas, best practices, knowledge, technology, capacity building for promoting sustainable lifestyles (LiFE), sector-wise opportunities in energy transition, green transport, infrastructure, construction technologies

Notable: Introduction of LiFE concept by India at COP26 summit in Glasgow

2022: India-Denmark MoU

Focus: Smart water resources development

2023: India-France Partnership

Emphasis: Sustainability, commitments to combat climate change, eliminate single-use plastics, sector-wise opportunities in energy transition, green transport, infrastructure, construction technologies

Additional sector cooperation (Post-2020): India-Denmark Energy Partnership (INDEP)

Areas covered: Capacity building and technology transfer in offshore wind, energy modeling, integration of renewable energy

Water Sector Collaboration (Post-2018): Arcadis and Tata Consulting Engineers

Collaboration on water management and ports & waterways projects

Sanitation initiatives (Post-2018): KPMG India, Dutch non-profit WASTE, and Lucknow-based FINISH Society

Establishment of Sanitation Impact Bond to address sanitation challenges

Technology transfer and innovation (Post-2018): Nettenergy and Shrike Energy

Introduction of Dutch technology for biomass utilization in green electricity, bio-chemicals, and bio-fuels in the Indian market

Environmental collaboration (Post-2018): Biosfera Foundation and TERI

Commitment of expertise and capacity to address environmental, health, and social challenges associated with burning agriwaste

Solar rooftop financing (Post-2018): FMO, Netherlands Development Finance Company, and Azure Rooftop (GENCO) Pvt. Ltd

Financing of the solar rooftop portfolio

India’s environmental challenges

Air pollution

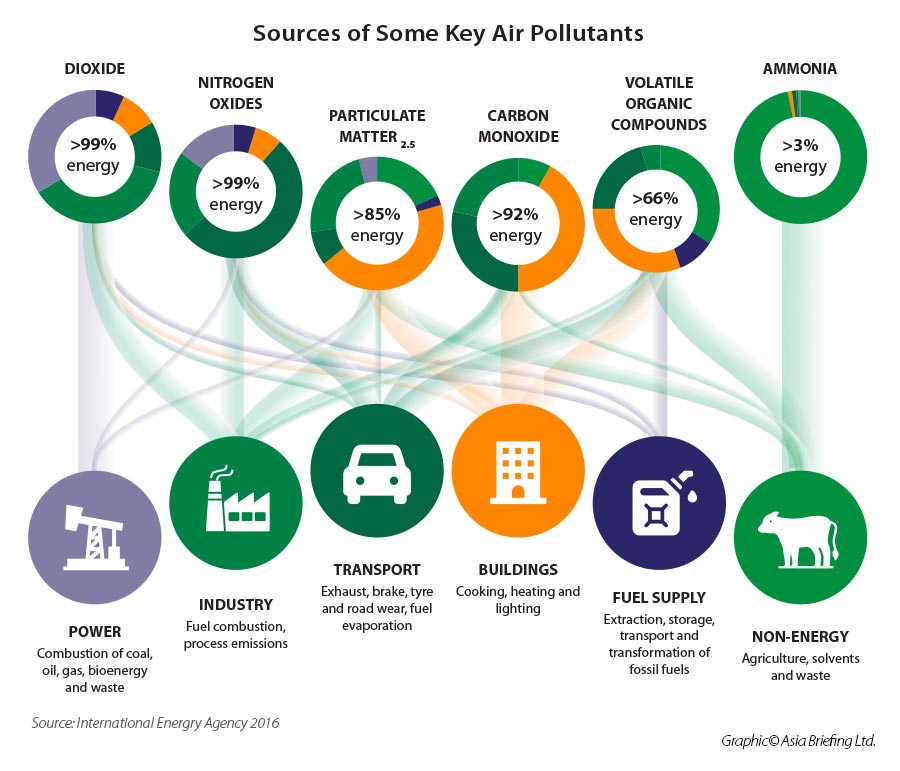

In recent years, anthropogenic air pollution has become a pressing social and environmental challenge in India, affecting lifestyle habits as well as causing deep social concerns and economic disruption. In fact, it is deemed the second biggest factor affecting human health in the country. Simultaneously, India is witnessing indications of a warming climate that could have severe long-term consequences. Both these issues are intricately linked to energy-related fuel combustion, which is a primary source of three significant air pollutants—NOX, SO2, and PM2.5. Moreover, it stands as the leading contributor to India's CO2 emissions. In numerous locations, levels of particulate matter consistently surpass recommended national and international standards, posing serious implications for public health. Addressing these challenges is crucial for mitigating the adverse impacts on both the environment and the well-being of the population.

India is home to 39 out of the world’s 50 most polluted cities, and claimed the eighth position as the most polluted country globally in 2022, in a report from Swiss firm IQAir. For example, according to the Indian Central Pollution Control Board's (CPCB) real-time ranking for the Air Quality Index (AQI) on November 14, 2023, the capital city Delhi recorded an AQI of 397, placing it among the four worst cities for air quality out of 244 cities monitored. The AQI index specifically measures PM 2.5 pollutants, reflecting the severity of air pollution challenges faced by the country. IQAir reported Delhi's AQI as 271 [categorized as 'Very Unhealthy'] on January 17, 2024.

Investment opportunities

Business opportunities in tackling the air pollution challenge are substantial, particularly in the following areas:

- Building sustainability: India’s rising urban population demands increased construction, contributing to air pollution. Investments in innovations for more efficient brick-firing and sustainable construction methods can significantly reduce pollutant emissions. Additionally, the development of energy-efficient filtration systems for buildings addresses both indoor air quality and environmental impact, providing opportunities for growth and cost reduction.

- Clean mobility solutions: As Indian cities aim to "de-carbonize" transportation, there is a growing need for investments in cleaner mobility solutions. State and UT policies supporting the production of electric vehicles (EVs) and establishing charging infrastructure, along with transitioning public transportation fleets to carbon-neutral options, presents a significant business opportunity. Regulations promoting carbon-neutral mobility further drive market growth, aligning with global sustainability goals.

- Environmental impact reduction: Economic losses due to air pollution are substantial, with an estimated cost of US$2.9 trillion to the global economy in 2018 alone. For India, the economic cost was estimated to exceed US$150 billion annually by IQAir in its World Air Quality Report 2022. Businesses focusing on solutions that reduce the environmental impact of air pollution, such as clean energy production and advanced industrial filtration systems, not only contribute to public health but also address the economic burden associated with work absences and reduced productivity.

Investments in these areas align with the urgent need to combat air pollution, offering not only environmental benefits but also substantial economic returns by addressing the significant costs and challenges associated with India’s deteriorating air quality.

Low Performance on Sustainability Parameters

India ranked at the lowest position in the World Economic Forum’s Environmental Performance Index (EPI) 2022 with a score of 18.9. In the 2020 iteration, India had ranked 168, with a score of 27.6. The EPI report assesses 180 countries and uses 40 indicators across 11 categories to evaluate countries' progress in environmental health, ecosystem vitality, and climate change mitigation. It is produced by the Yale Center for Environmental Law and Policy and the Center for International Earth Science Information Network, Columbia University.

In the 2022 report, India's scores significantly dropped under ‘Ecosystem Vitality and Climate Policy’, with major contributors being the species habitat index, loss of ecosystem services, unsustainable fishing, carbon emissions from land cover, and greenhouse gas emissions (GHG) per capita.

Notably, peer countries, such as Pakistan, Bangladesh, Myanmar, Turkey, and Sudan, outperformed India in the EPI 2022 rankings. The top five ranked countries were Denmark, the United Kingdom, Finland, Malta, and Sweden.

Among the urgent challenges identified in the report are deteriorating air quality and rapidly rising GHG emissions. Fast growing emerging markets like India and Vietnam face a challenge as they pursue near term economic growth targets over sustainability measures. It is projected that India and China will be the world’s largest emitters of greenhouse gases by 2050.

Access to clean water

India confronts a severe water crisis encompassing various challenges:

- Water scarcity: Despite comprising 17 percent of the global population, India possesses only 4 percent of the world's water resources, leaving 820 million Indians grappling with high to extreme water stress.

- Groundwater depletion: Rapid depletion of groundwater levels is a pressing concern, posing a threat to sustainable water sources.

- Water pollution: A significant 47 percent of water monitoring stations indicate coliform concentrations exceeding 500mpn/100, highlighting the pervasive issue of water pollution.

- Climate change impact: Climate change has aggravated the crisis, leading to delayed monsoons and the drying up of reservoirs in various regions, compounding water scarcity challenges.

Contributing factors and investment prospects

Several factors contribute to the water crisis in India, including inadequate infrastructure, insufficient government oversight, contaminated surface water, and limited access to piped water supply. This crisis poses multifaceted threats to India's well-being, economy, environment, and food supply. Approximately 200,000 Indians succumb annually to health issues linked to inadequate water, sanitation, and hygiene.

States particularly vulnerable to water scarcity include Uttar Pradesh, Madhya Pradesh, Karnataka, Bihar, Haryana, Gujarat, and Maharashtra. These challenges underscore the urgency for sustainable water management practices and present opportunities for strategic investments in water conservation and infrastructure development. Addressing these issues is crucial not only for mitigating environmental and health risks but also for fostering resilience and sustainability in India's water ecosystem.

Investment opportunities abound for addressing India's water crisis through private sector involvement. From fully privatized water sectors to public–private partnerships, corporate social responsibility, and impact investing, there is a diverse range of roles for private entities. As water scarcity intensifies and existing infrastructures demand upgrades, private initiatives present a viable solution to complement public efforts in meeting the social and environmental challenges.

Conclusion

India presents promising foreign investment opportunities in its sustainability, environmental, and clean energy sectors. The country has actively engaged in MoUs with various nations to foster collaboration in areas such as renewable energy, water management, waste reduction, and climate change mitigation. These partnerships offer avenues for businesses to participate in projects related to air and water pollution prevention, smart water resources development, and sustainable urban development.

Foreign investors can explore collaborations in the rapidly growing Indian market, contributing to the country's sustainable development goals and leveraging the diverse opportunities in cleantech and environmental conservation.